Algert Global LLC lifted its holdings in shares of Alpha and Omega Semiconductor Limited (NASDAQ:AOSL - Free Report) by 172.8% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm owned 89,920 shares of the semiconductor company's stock after buying an additional 56,962 shares during the period. Algert Global LLC owned approximately 0.31% of Alpha and Omega Semiconductor worth $3,338,000 at the end of the most recent quarter.

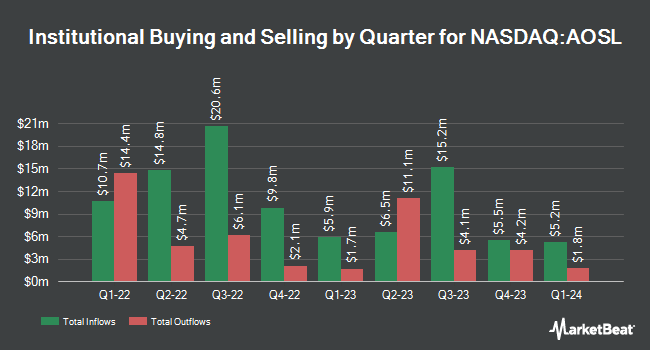

Several other hedge funds have also made changes to their positions in the business. Gladius Capital Management LP acquired a new stake in Alpha and Omega Semiconductor in the second quarter valued at about $36,000. Point72 DIFC Ltd acquired a new stake in Alpha and Omega Semiconductor in the second quarter valued at about $47,000. Hollencrest Capital Management purchased a new position in Alpha and Omega Semiconductor in the third quarter valued at about $56,000. Point72 Asia Singapore Pte. Ltd. purchased a new position in Alpha and Omega Semiconductor in the second quarter valued at about $62,000. Finally, Farther Finance Advisors LLC increased its holdings in Alpha and Omega Semiconductor by 10,937.5% in the third quarter. Farther Finance Advisors LLC now owns 1,766 shares of the semiconductor company's stock valued at $66,000 after buying an additional 1,750 shares in the last quarter. Institutional investors and hedge funds own 78.97% of the company's stock.

Insider Buying and Selling

In other Alpha and Omega Semiconductor news, COO Wenjun Li sold 2,183 shares of Alpha and Omega Semiconductor stock in a transaction on Thursday, October 24th. The shares were sold at an average price of $35.49, for a total value of $77,474.67. Following the transaction, the chief operating officer now owns 61,331 shares in the company, valued at $2,176,637.19. This trade represents a 3.44 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 16.90% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

A number of research analysts have issued reports on the stock. StockNews.com cut shares of Alpha and Omega Semiconductor from a "hold" rating to a "sell" rating in a report on Friday. Stifel Nicolaus dropped their target price on shares of Alpha and Omega Semiconductor from $34.00 to $27.00 and set a "sell" rating for the company in a report on Wednesday, November 6th. B. Riley dropped their target price on shares of Alpha and Omega Semiconductor from $50.00 to $47.00 and set a "buy" rating for the company in a report on Tuesday, November 5th. Finally, Benchmark reaffirmed a "buy" rating and issued a $40.00 target price on shares of Alpha and Omega Semiconductor in a report on Wednesday, November 6th.

Get Our Latest Stock Analysis on AOSL

Alpha and Omega Semiconductor Price Performance

Shares of AOSL traded down $0.68 during mid-day trading on Tuesday, reaching $39.68. 963,365 shares of the company's stock were exchanged, compared to its average volume of 278,950. The company has a quick ratio of 1.44, a current ratio of 2.65 and a debt-to-equity ratio of 0.03. The company has a 50-day simple moving average of $34.41 and a two-hundred day simple moving average of $34.90. Alpha and Omega Semiconductor Limited has a 52-week low of $19.38 and a 52-week high of $47.45. The company has a market cap of $1.15 billion, a price-to-earnings ratio of -60.24 and a beta of 2.42.

Alpha and Omega Semiconductor (NASDAQ:AOSL - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The semiconductor company reported $0.21 earnings per share for the quarter, missing analysts' consensus estimates of $0.22 by ($0.01). Alpha and Omega Semiconductor had a positive return on equity of 0.19% and a negative net margin of 2.94%. The business had revenue of $181.89 million for the quarter, compared to analysts' expectations of $180.07 million. During the same period last year, the business earned $0.30 earnings per share. The company's revenue for the quarter was up .7% on a year-over-year basis. On average, sell-side analysts predict that Alpha and Omega Semiconductor Limited will post -0.67 EPS for the current fiscal year.

Alpha and Omega Semiconductor Company Profile

(

Free Report)

Alpha and Omega Semiconductor Limited designs, develops, and supplies power semiconductor products for computing, consumer electronics, communication, and industrial applications in Hong Kong, China, South Korea, the United States, and internationally. It offers power discrete products, including metal-oxide-semiconductor field-effect transistors (MOSFET), SRFETs, XSFET, electrostatic discharge, protected MOSFETs, high and mid-voltage MOSFETs, and insulated gate bipolar transistors for use in smart phone chargers, battery packs, notebooks, desktop and servers, data centers, base stations, graphics card, game boxes, TVs, AC adapters, power supplies, motor control, power tools, E-vehicles, white goods and industrial motor drives, UPS systems, solar inverters, and industrial welding.

Featured Articles

Before you consider Alpha and Omega Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alpha and Omega Semiconductor wasn't on the list.

While Alpha and Omega Semiconductor currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.