Algert Global LLC cut its position in shares of Cousins Properties Incorporated (NYSE:CUZ - Free Report) by 15.2% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 205,792 shares of the real estate investment trust's stock after selling 36,894 shares during the quarter. Algert Global LLC owned 0.14% of Cousins Properties worth $6,067,000 as of its most recent SEC filing.

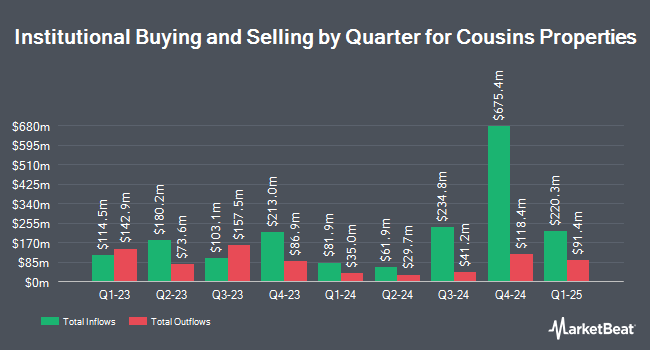

Other hedge funds have also modified their holdings of the company. Massachusetts Financial Services Co. MA grew its stake in Cousins Properties by 3,768.0% in the third quarter. Massachusetts Financial Services Co. MA now owns 2,337,416 shares of the real estate investment trust's stock valued at $68,907,000 after purchasing an additional 2,276,986 shares in the last quarter. Sumitomo Mitsui Trust Group Inc. lifted its holdings in Cousins Properties by 368.7% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 781,947 shares of the real estate investment trust's stock worth $23,052,000 after purchasing an additional 615,118 shares during the last quarter. Swedbank AB acquired a new stake in Cousins Properties during the 1st quarter worth approximately $14,306,000. Principal Financial Group Inc. raised its holdings in Cousins Properties by 3.9% in the 3rd quarter. Principal Financial Group Inc. now owns 12,140,948 shares of the real estate investment trust's stock valued at $357,910,000 after acquiring an additional 458,387 shares in the last quarter. Finally, Vanguard Group Inc. raised its holdings in Cousins Properties by 2.0% in the 1st quarter. Vanguard Group Inc. now owns 23,353,228 shares of the real estate investment trust's stock valued at $561,412,000 after acquiring an additional 456,251 shares in the last quarter. 94.38% of the stock is currently owned by institutional investors.

Cousins Properties Trading Up 0.6 %

Shares of NYSE:CUZ traded up $0.20 during midday trading on Friday, reaching $31.72. The company's stock had a trading volume of 893,415 shares, compared to its average volume of 1,336,858. The firm has a market capitalization of $4.83 billion, a price-to-earnings ratio of 96.12, a PEG ratio of 4.20 and a beta of 1.29. The company has a debt-to-equity ratio of 0.60, a quick ratio of 1.17 and a current ratio of 1.17. The firm has a 50 day moving average price of $30.40 and a two-hundred day moving average price of $26.90. Cousins Properties Incorporated has a fifty-two week low of $19.48 and a fifty-two week high of $32.44.

Cousins Properties (NYSE:CUZ - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The real estate investment trust reported $0.07 earnings per share for the quarter, missing analysts' consensus estimates of $0.67 by ($0.60). Cousins Properties had a return on equity of 1.14% and a net margin of 6.17%. The firm had revenue of $209.21 million for the quarter, compared to analyst estimates of $212.54 million. During the same period last year, the company posted $0.65 earnings per share. The firm's quarterly revenue was up 5.2% compared to the same quarter last year. As a group, analysts forecast that Cousins Properties Incorporated will post 2.68 earnings per share for the current year.

Cousins Properties Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Thursday, October 3rd were paid a dividend of $0.32 per share. This represents a $1.28 dividend on an annualized basis and a yield of 4.04%. The ex-dividend date of this dividend was Thursday, October 3rd. Cousins Properties's dividend payout ratio (DPR) is currently 387.88%.

Wall Street Analysts Forecast Growth

CUZ has been the topic of several recent analyst reports. Wells Fargo & Company lifted their price target on Cousins Properties from $31.00 to $34.00 and gave the company an "overweight" rating in a research note on Monday, November 4th. Truist Financial boosted their price objective on Cousins Properties from $26.00 to $30.00 and gave the stock a "buy" rating in a research report on Friday, August 30th. Robert W. Baird boosted their price objective on Cousins Properties from $31.00 to $33.00 and gave the stock an "outperform" rating in a research report on Monday, November 4th. Evercore ISI upped their price target on Cousins Properties from $29.00 to $30.00 and gave the company an "in-line" rating in a research report on Monday, September 16th. Finally, StockNews.com upgraded Cousins Properties from a "sell" rating to a "hold" rating in a research report on Monday, November 4th. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat, Cousins Properties has an average rating of "Moderate Buy" and an average price target of $31.50.

Get Our Latest Research Report on CUZ

Insider Buying and Selling

In other Cousins Properties news, CAO Jeffrey D. Symes sold 5,997 shares of the business's stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $28.13, for a total transaction of $168,695.61. Following the completion of the sale, the chief accounting officer now directly owns 12,529 shares of the company's stock, valued at approximately $352,440.77. The trade was a 32.37 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 1.40% of the stock is owned by company insiders.

About Cousins Properties

(

Free Report)

Cousins Properties Incorporated ("Cousins") is a fully integrated, self-administered, and self-managed real estate investment trust (REIT). The Company, based in Atlanta and acting through its operating partnership, Cousins Properties LP, primarily invests in Class A office buildings located in high-growth Sun Belt markets.

See Also

Before you consider Cousins Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cousins Properties wasn't on the list.

While Cousins Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.