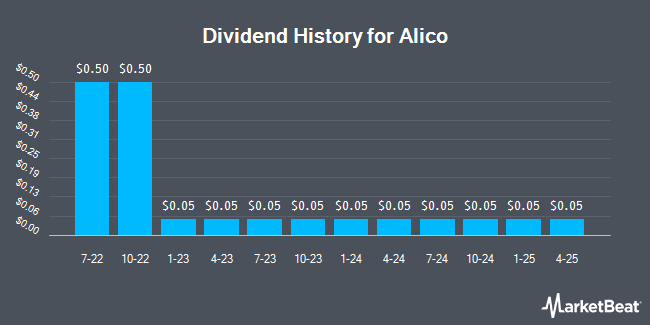

Alico, Inc. (NASDAQ:ALCO - Get Free Report) announced a quarterly dividend on Friday, March 14th, Wall Street Journal reports. Shareholders of record on Friday, March 28th will be given a dividend of 0.05 per share on Friday, April 11th. This represents a $0.20 dividend on an annualized basis and a yield of 0.69%. The ex-dividend date of this dividend is Friday, March 28th.

Alico has decreased its dividend by an average of 50.8% annually over the last three years.

Alico Trading Down 2.1 %

ALCO stock traded down $0.63 during trading on Friday, hitting $28.81. The company had a trading volume of 99,243 shares, compared to its average volume of 35,292. Alico has a 52-week low of $24.14 and a 52-week high of $34.08. The company has a 50 day simple moving average of $29.93 and a 200-day simple moving average of $27.87. The firm has a market capitalization of $220.05 million, a P/E ratio of -4.87 and a beta of 0.81. The company has a quick ratio of 2.37, a current ratio of 4.84 and a debt-to-equity ratio of 0.42.

Alico (NASDAQ:ALCO - Get Free Report) last issued its earnings results on Wednesday, February 12th. The company reported ($1.20) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.93) by ($0.27). Alico had a negative return on equity of 3.01% and a negative net margin of 91.09%. As a group, research analysts forecast that Alico will post -0.37 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, StockNews.com upgraded shares of Alico to a "sell" rating in a research note on Friday, February 14th.

View Our Latest Analysis on ALCO

Alico Company Profile

(

Get Free Report)

Alico, Inc, together with its subsidiaries, operates as an agribusiness and land management company in the United States. The company operates in two segments, Alico Citrus, and Land Management and Other Operations. The Alico Citrus segment engages in planting, owning, cultivating, and/or managing citrus groves to produce fruit for sale to fresh and processed citrus markets, including activities related to the purchase and resale of fruit and value-added services, which include contracting for the harvesting, marketing, and hauling of citrus.

Recommended Stories

Before you consider Alico, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alico wasn't on the list.

While Alico currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.