Align Technology (NASDAQ:ALGN - Get Free Report) is anticipated to announce its Q1 2025 earnings results after the market closes on Wednesday, April 30th. Analysts expect the company to announce earnings of $2.00 per share and revenue of $977.90 million for the quarter. Align Technology has set its Q1 2025 guidance at EPS.

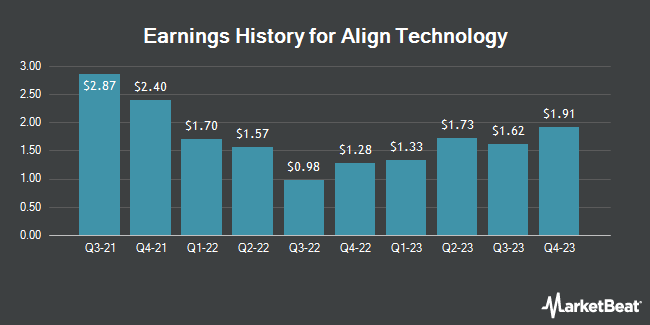

Align Technology (NASDAQ:ALGN - Get Free Report) last announced its quarterly earnings results on Wednesday, February 5th. The medical equipment provider reported $1.96 EPS for the quarter, missing analysts' consensus estimates of $2.43 by ($0.47). Align Technology had a return on equity of 13.84% and a net margin of 10.54%. On average, analysts expect Align Technology to post $8 EPS for the current fiscal year and $9 EPS for the next fiscal year.

Align Technology Stock Up 1.0 %

Shares of NASDAQ ALGN opened at $173.87 on Wednesday. The firm's fifty day moving average is $171.42 and its 200 day moving average is $203.63. Align Technology has a 52 week low of $141.74 and a 52 week high of $327.49. The company has a market cap of $12.73 billion, a price-to-earnings ratio of 30.99, a PEG ratio of 2.24 and a beta of 1.73.

Analyst Ratings Changes

A number of research firms have issued reports on ALGN. Mizuho decreased their price objective on shares of Align Technology from $295.00 to $250.00 and set an "outperform" rating on the stock in a research report on Tuesday, March 25th. Wells Fargo & Company started coverage on Align Technology in a report on Friday, February 14th. They issued an "overweight" rating and a $255.00 price objective for the company. Jefferies Financial Group cut their price objective on Align Technology from $285.00 to $260.00 and set a "buy" rating on the stock in a research report on Thursday, January 23rd. Evercore ISI lifted their price target on shares of Align Technology from $240.00 to $260.00 and gave the company an "outperform" rating in a report on Thursday, February 6th. Finally, Morgan Stanley dropped their target price on shares of Align Technology from $280.00 to $272.00 and set an "overweight" rating for the company in a research report on Thursday, February 6th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, ten have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, Align Technology has an average rating of "Moderate Buy" and an average price target of $256.90.

View Our Latest Research Report on Align Technology

About Align Technology

(

Get Free Report)

Align Technology, Inc designs, manufactures, and markets Invisalign clear aligners, and iTero intraoral scanners and services for orthodontists and general practitioner dentists in the United States, Switzerland, and internationally. The company's Clear Aligner segment offers comprehensive products, including Invisalign comprehensive package that addresses the orthodontic needs of younger patients, such as mandibular advancement, compliance indicators, and compensation for tooth eruption; and Invisalign First Phase I and Invisalign First Comprehensive Phase 2 package for younger patients generally between the ages of six and ten years, which is a mixture of primary/baby and permanent teeth.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Align Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Align Technology wasn't on the list.

While Align Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.