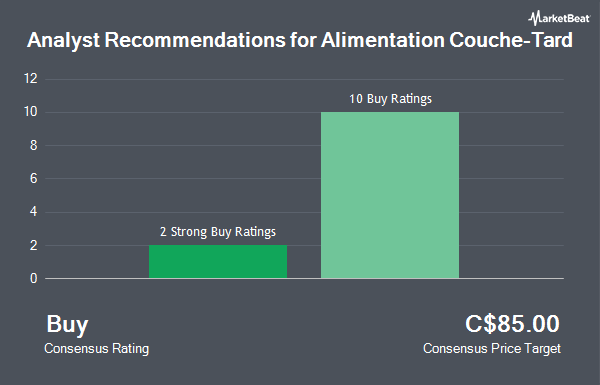

Alimentation Couche-Tard Inc. (TSE:ATD - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the nine brokerages that are currently covering the firm, MarketBeat.com reports. One research analyst has rated the stock with a hold recommendation and eight have issued a buy recommendation on the company. The average 12-month price target among analysts that have issued a report on the stock in the last year is C$87.73.

A number of equities analysts have recently commented on the company. JPMorgan Chase & Co. raised their price target on Alimentation Couche-Tard from C$83.00 to C$87.00 in a report on Thursday, September 19th. Canaccord Genuity Group raised their price objective on shares of Alimentation Couche-Tard from C$83.00 to C$85.00 in a research report on Wednesday, November 20th. Desjardins upped their target price on shares of Alimentation Couche-Tard from C$84.00 to C$85.00 in a report on Wednesday. CIBC increased their target price on shares of Alimentation Couche-Tard from C$88.00 to C$89.00 in a research note on Wednesday. Finally, Stifel Nicolaus boosted their price target on shares of Alimentation Couche-Tard from C$86.00 to C$88.00 in a research report on Friday, September 6th.

Get Our Latest Research Report on Alimentation Couche-Tard

Alimentation Couche-Tard Stock Down 1.1 %

ATD traded down C$0.89 during trading on Friday, hitting C$81.91. 734,676 shares of the company's stock were exchanged, compared to its average volume of 1,480,660. Alimentation Couche-Tard has a fifty-two week low of C$71.31 and a fifty-two week high of C$87.27. The stock has a market cap of C$77.65 billion, a P/E ratio of 21.17, a PEG ratio of 1.35 and a beta of 0.89. The business's 50 day moving average is C$75.61 and its two-hundred day moving average is C$77.84. The company has a quick ratio of 0.88, a current ratio of 1.00 and a debt-to-equity ratio of 102.11.

Alimentation Couche-Tard (TSE:ATD - Get Free Report) last released its earnings results on Wednesday, September 4th. The company reported C$1.13 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of C$1.11 by C$0.02. Alimentation Couche-Tard had a return on equity of 19.72% and a net margin of 3.73%. The business had revenue of C$24.99 billion during the quarter, compared to the consensus estimate of C$24.73 billion. As a group, equities analysts expect that Alimentation Couche-Tard will post 4.0410959 earnings per share for the current fiscal year.

Alimentation Couche-Tard Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Wednesday, December 18th will be given a dividend of $0.195 per share. This represents a $0.78 annualized dividend and a dividend yield of 0.95%. This is a positive change from Alimentation Couche-Tard's previous quarterly dividend of $0.18. The ex-dividend date is Wednesday, December 4th. Alimentation Couche-Tard's dividend payout ratio is presently 18.09%.

Alimentation Couche-Tard Company Profile

(

Get Free ReportAlimentation Couche-Tard Inc operates and licenses convenience stores in North America, Europe, and Asia. Its convenience stores sell tobacco products and alternative tobacco products, grocery items, candies and snacks, beer, wine, beverages, and fresh food offerings; road transportation fuels and electric vehicle charging solutions; and aviation fuels, as well as energy for stationary engines.

Featured Articles

Before you consider Alimentation Couche-Tard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alimentation Couche-Tard wasn't on the list.

While Alimentation Couche-Tard currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.