UBS Group set a C$97.00 price target on Alimentation Couche-Tard (TSE:ATD - Free Report) in a research report sent to investors on Friday,BayStreet.CA reports. The firm currently has a buy rating on the stock.

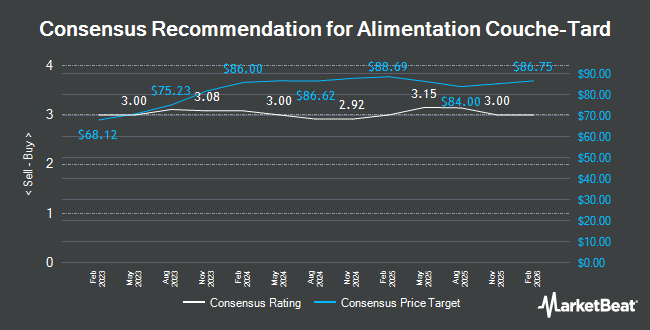

A number of other equities analysts also recently issued reports on the company. JPMorgan Chase & Co. upped their price target on Alimentation Couche-Tard from C$83.00 to C$87.00 in a research report on Thursday, September 19th. CIBC upped their target price on Alimentation Couche-Tard from C$88.00 to C$89.00 in a research report on Wednesday, November 27th. Royal Bank of Canada lowered their price target on Alimentation Couche-Tard from C$96.00 to C$94.00 in a report on Thursday, September 5th. Desjardins boosted their price target on Alimentation Couche-Tard from C$84.00 to C$85.00 in a research note on Wednesday, November 27th. Finally, National Bankshares increased their price objective on shares of Alimentation Couche-Tard from C$85.00 to C$87.00 in a research report on Wednesday, November 27th. One research analyst has rated the stock with a hold rating and nine have issued a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of C$88.50.

Read Our Latest Report on Alimentation Couche-Tard

Alimentation Couche-Tard Stock Up 0.5 %

Shares of TSE:ATD traded up C$0.41 on Friday, reaching C$80.90. The company had a trading volume of 1,087,559 shares, compared to its average volume of 1,468,416. The company has a current ratio of 1.00, a quick ratio of 0.88 and a debt-to-equity ratio of 102.11. The firm has a market capitalization of C$76.69 billion, a PE ratio of 20.90, a PEG ratio of 1.35 and a beta of 0.89. Alimentation Couche-Tard has a 52-week low of C$71.31 and a 52-week high of C$87.27. The firm's 50 day simple moving average is C$76.86 and its 200-day simple moving average is C$78.12.

Alimentation Couche-Tard Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Wednesday, December 18th will be issued a $0.195 dividend. This represents a $0.78 annualized dividend and a yield of 0.96%. This is a positive change from Alimentation Couche-Tard's previous quarterly dividend of $0.18. The ex-dividend date is Wednesday, December 4th. Alimentation Couche-Tard's dividend payout ratio is presently 18.09%.

About Alimentation Couche-Tard

(

Get Free Report)

Alimentation Couche-Tard Inc operates and licenses convenience stores in North America, Europe, and Asia. Its convenience stores sell tobacco products and alternative tobacco products, grocery items, candies and snacks, beer, wine, beverages, and fresh food offerings; road transportation fuels and electric vehicle charging solutions; and aviation fuels, as well as energy for stationary engines.

Further Reading

Before you consider Alimentation Couche-Tard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alimentation Couche-Tard wasn't on the list.

While Alimentation Couche-Tard currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.