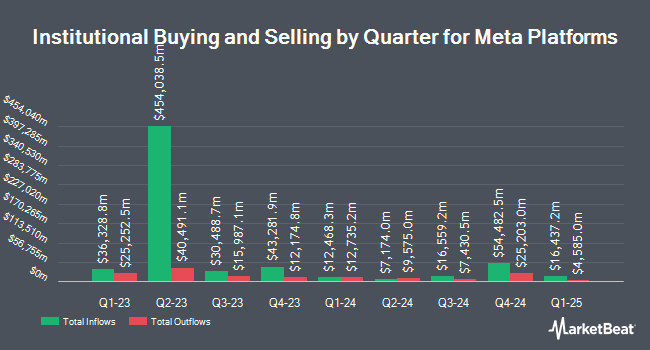

Aljian Capital Management LLC grew its position in Meta Platforms, Inc. (NASDAQ:META - Free Report) by 114.9% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 3,146 shares of the social networking company's stock after buying an additional 1,682 shares during the period. Aljian Capital Management LLC's holdings in Meta Platforms were worth $1,801,000 as of its most recent SEC filing.

Several other large investors have also bought and sold shares of the company. POM Investment Strategies LLC purchased a new stake in Meta Platforms during the second quarter valued at $38,000. Ruedi Wealth Management Inc. grew its holdings in Meta Platforms by 122.2% during the 2nd quarter. Ruedi Wealth Management Inc. now owns 80 shares of the social networking company's stock worth $40,000 after acquiring an additional 44 shares in the last quarter. Halpern Financial Inc. bought a new position in Meta Platforms during the 3rd quarter worth about $46,000. West Financial Advisors LLC purchased a new stake in Meta Platforms during the third quarter valued at approximately $49,000. Finally, NewSquare Capital LLC increased its position in shares of Meta Platforms by 221.9% during the second quarter. NewSquare Capital LLC now owns 103 shares of the social networking company's stock worth $52,000 after purchasing an additional 71 shares in the last quarter. 79.91% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

META has been the topic of a number of research analyst reports. Benchmark reissued a "hold" rating on shares of Meta Platforms in a report on Thursday, July 25th. JPMorgan Chase & Co. upped their price objective on shares of Meta Platforms from $640.00 to $660.00 and gave the stock an "overweight" rating in a research report on Thursday, October 31st. Barclays upped their price target on shares of Meta Platforms from $550.00 to $630.00 and gave the stock an "overweight" rating in a research report on Thursday, October 31st. Wedbush restated an "outperform" rating and set a $600.00 price target on shares of Meta Platforms in a research report on Thursday, September 26th. Finally, Pivotal Research increased their price objective on shares of Meta Platforms from $780.00 to $800.00 and gave the company a "buy" rating in a report on Thursday, October 31st. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating, thirty-five have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $634.10.

Check Out Our Latest Stock Report on Meta Platforms

Meta Platforms Price Performance

NASDAQ META traded down $15.16 during trading on Thursday, reaching $550.36. The company's stock had a trading volume of 3,675,645 shares, compared to its average volume of 14,963,694. The company has a debt-to-equity ratio of 0.18, a current ratio of 2.73 and a quick ratio of 2.73. The stock has a market capitalization of $1.39 trillion, a PE ratio of 25.92, a P/E/G ratio of 1.24 and a beta of 1.22. The firm has a fifty day moving average of $571.30 and a 200 day moving average of $523.03. Meta Platforms, Inc. has a one year low of $313.66 and a one year high of $602.95.

Meta Platforms (NASDAQ:META - Get Free Report) last released its earnings results on Wednesday, October 30th. The social networking company reported $6.03 EPS for the quarter, beating analysts' consensus estimates of $5.19 by $0.84. The company had revenue of $40.59 billion during the quarter, compared to analysts' expectations of $40.21 billion. Meta Platforms had a return on equity of 35.60% and a net margin of 35.55%. Analysts expect that Meta Platforms, Inc. will post 22.53 EPS for the current fiscal year.

Meta Platforms Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, September 26th. Stockholders of record on Monday, September 16th were given a $0.50 dividend. The ex-dividend date of this dividend was Monday, September 16th. This represents a $2.00 annualized dividend and a dividend yield of 0.36%. Meta Platforms's payout ratio is 9.42%.

Insider Buying and Selling

In other Meta Platforms news, COO Javier Olivan sold 620 shares of Meta Platforms stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $557.00, for a total value of $345,340.00. Following the transaction, the chief operating officer now owns 19,992 shares in the company, valued at $11,135,544. The trade was a 3.01 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Aaron Anderson sold 731 shares of the company's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $557.00, for a total transaction of $407,167.00. Following the transaction, the chief accounting officer now owns 3,414 shares in the company, valued at approximately $1,901,598. This trade represents a 17.64 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 185,958 shares of company stock worth $101,181,747. Corporate insiders own 13.71% of the company's stock.

Meta Platforms Profile

(

Free Report)

Meta Platforms, Inc engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately.

Recommended Stories

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report