Alkami Technology (NASDAQ:ALKT - Get Free Report) is expected to issue its Q1 2025 quarterly earnings data after the market closes on Wednesday, April 30th. Analysts expect Alkami Technology to post earnings of $0.09 per share and revenue of $94.38 million for the quarter. Alkami Technology has set its FY 2025 guidance at EPS and its Q1 2025 guidance at EPS.

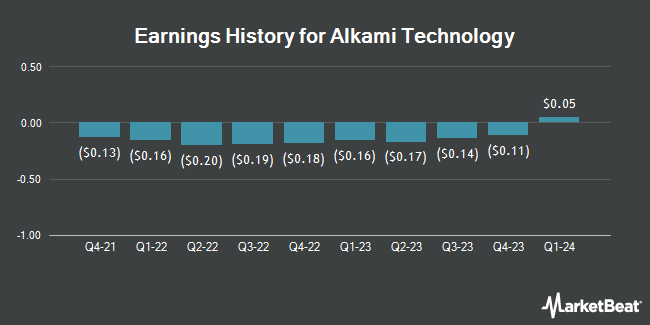

Alkami Technology (NASDAQ:ALKT - Get Free Report) last posted its quarterly earnings results on Thursday, February 27th. The company reported ($0.05) EPS for the quarter, missing analysts' consensus estimates of $0.08 by ($0.13). Alkami Technology had a negative return on equity of 11.31% and a negative net margin of 14.55%. The firm had revenue of $89.66 million during the quarter, compared to analyst estimates of $89.63 million. On average, analysts expect Alkami Technology to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Alkami Technology Stock Performance

Shares of NASDAQ:ALKT traded up $0.34 during trading on Friday, reaching $26.87. 702,491 shares of the company's stock traded hands, compared to its average volume of 807,741. The stock has a market capitalization of $2.77 billion, a P/E ratio of -57.17 and a beta of 0.56. Alkami Technology has a 12 month low of $21.70 and a 12 month high of $42.29. The company has a debt-to-equity ratio of 0.05, a current ratio of 3.52 and a quick ratio of 3.52. The company has a 50 day moving average of $26.46 and a 200-day moving average of $33.29.

Insider Activity at Alkami Technology

In other news, insider Douglas A. Linebarger sold 4,358 shares of the stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $30.41, for a total transaction of $132,526.78. Following the sale, the insider now directly owns 244,404 shares of the company's stock, valued at approximately $7,432,325.64. This represents a 1.75 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO W Bryan Hill sold 17,409 shares of the company's stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $30.41, for a total value of $529,407.69. Following the sale, the chief financial officer now owns 450,620 shares of the company's stock, valued at approximately $13,703,354.20. This represents a 3.72 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 18.10% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on ALKT shares. The Goldman Sachs Group dropped their price target on Alkami Technology from $39.00 to $32.00 and set a "neutral" rating on the stock in a report on Monday, March 3rd. Stephens upgraded shares of Alkami Technology from an "equal weight" rating to an "overweight" rating and set a $40.00 price objective for the company in a report on Thursday, March 13th. Finally, Barclays reduced their price objective on shares of Alkami Technology from $35.00 to $30.00 and set an "equal weight" rating for the company in a research note on Monday, April 14th. Two equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $40.38.

View Our Latest Stock Analysis on Alkami Technology

About Alkami Technology

(

Get Free Report)

Alkami Technology, Inc offers cloud-based digital banking solutions in the United States. The company's Alkami Platform allows financial institutions to onboard and engage new users, accelerate revenues, and enhance operational efficiency, with the support of a proprietary, cloud-based, and multi-tenant architecture.

See Also

Before you consider Alkami Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkami Technology wasn't on the list.

While Alkami Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.