Allegiant Travel (NASDAQ:ALGT - Get Free Report) was upgraded by equities research analysts at StockNews.com from a "sell" rating to a "hold" rating in a report issued on Thursday.

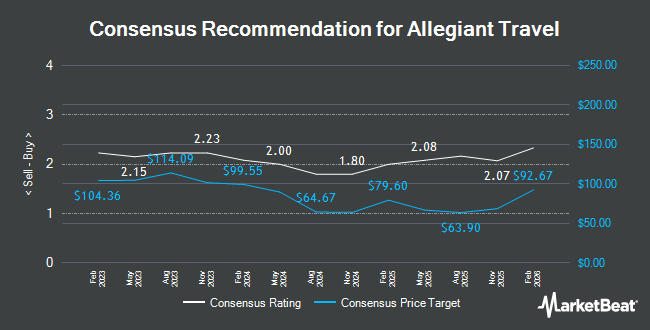

ALGT has been the topic of a number of other research reports. Wolfe Research lowered shares of Allegiant Travel from a "strong-buy" rating to a "hold" rating in a report on Monday, November 4th. Morgan Stanley boosted their target price on shares of Allegiant Travel from $80.00 to $90.00 and gave the company an "equal weight" rating in a research note on Wednesday, December 11th. UBS Group began coverage on Allegiant Travel in a research report on Tuesday, November 26th. They issued a "neutral" rating and a $16.00 target price for the company. Barclays upped their price target on Allegiant Travel from $50.00 to $75.00 and gave the company an "equal weight" rating in a research report on Thursday, November 14th. Finally, Susquehanna raised their price objective on Allegiant Travel from $55.00 to $60.00 and gave the stock a "neutral" rating in a research report on Monday, November 4th. Ten research analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $68.00.

View Our Latest Research Report on ALGT

Allegiant Travel Trading Up 1.6 %

ALGT traded up $1.27 during trading on Thursday, reaching $82.12. The company had a trading volume of 184,009 shares, compared to its average volume of 368,819. The company has a debt-to-equity ratio of 1.36, a quick ratio of 0.72 and a current ratio of 0.75. Allegiant Travel has a 12-month low of $36.08 and a 12-month high of $94.45. The company has a market cap of $1.51 billion, a price-to-earnings ratio of -54.75, a PEG ratio of 7.17 and a beta of 1.67. The firm's 50-day simple moving average is $73.31 and its 200 day simple moving average is $56.55.

Insider Activity

In other Allegiant Travel news, COO Keny Frank Wilper sold 635 shares of the business's stock in a transaction dated Wednesday, October 23rd. The stock was sold at an average price of $62.69, for a total value of $39,808.15. Following the completion of the sale, the chief operating officer now owns 16,353 shares of the company's stock, valued at $1,025,169.57. The trade was a 3.74 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Chairman Maurice J. Gallagher, Jr. sold 28,319 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $84.46, for a total value of $2,391,822.74. Following the completion of the transaction, the chairman now directly owns 2,147,730 shares in the company, valued at $181,397,275.80. The trade was a 1.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 29,600 shares of company stock worth $2,476,465 in the last three months. 15.80% of the stock is owned by insiders.

Hedge Funds Weigh In On Allegiant Travel

A number of institutional investors have recently made changes to their positions in the business. Assenagon Asset Management S.A. acquired a new stake in Allegiant Travel in the 2nd quarter valued at approximately $285,000. JB Capital LLC grew its stake in shares of Allegiant Travel by 48.0% in the second quarter. JB Capital LLC now owns 6,188 shares of the transportation company's stock worth $311,000 after acquiring an additional 2,008 shares during the last quarter. Bank of New York Mellon Corp increased its position in Allegiant Travel by 7.7% during the second quarter. Bank of New York Mellon Corp now owns 215,533 shares of the transportation company's stock worth $10,826,000 after acquiring an additional 15,469 shares during the period. Innealta Capital LLC acquired a new position in Allegiant Travel during the 2nd quarter valued at $34,000. Finally, Versor Investments LP boosted its holdings in Allegiant Travel by 34.5% in the 2nd quarter. Versor Investments LP now owns 5,794 shares of the transportation company's stock valued at $291,000 after purchasing an additional 1,486 shares during the period. 85.81% of the stock is currently owned by institutional investors.

About Allegiant Travel

(

Get Free Report)

Allegiant Travel Company, a leisure travel company, provides travel services and products to residents of under-served cities in the United States. The company offers scheduled air transportation on limited-frequency, nonstop flights between under-served cities and leisure destinations. As of February 1, 2024, it operated a fleet of 126 Airbus A320 series aircraft.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Allegiant Travel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegiant Travel wasn't on the list.

While Allegiant Travel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.