Wolfe Research cut shares of Allegiant Travel (NASDAQ:ALGT - Free Report) from a strong-buy rating to a hold rating in a report published on Monday, Zacks.com reports.

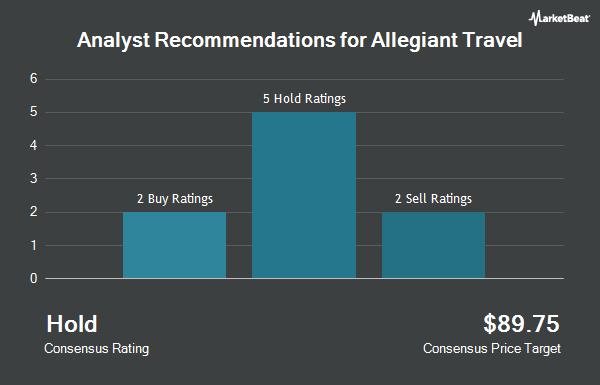

Other research analysts have also issued reports about the stock. Susquehanna raised their price target on shares of Allegiant Travel from $55.00 to $60.00 and gave the company a "neutral" rating in a research note on Monday. Barclays raised their target price on shares of Allegiant Travel from $45.00 to $50.00 and gave the stock an "equal weight" rating in a research note on Monday. Deutsche Bank Aktiengesellschaft lowered shares of Allegiant Travel from a "buy" rating to a "hold" rating and decreased their target price for the stock from $75.00 to $53.00 in a research note on Monday, July 8th. Evercore ISI raised their target price on shares of Allegiant Travel from $60.00 to $65.00 and gave the stock an "in-line" rating in a research note on Thursday, October 3rd. Finally, Morgan Stanley decreased their target price on shares of Allegiant Travel from $95.00 to $87.00 and set an "equal weight" rating on the stock in a research note on Monday, July 8th. Two equities research analysts have rated the stock with a sell rating, seven have given a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $65.38.

Read Our Latest Research Report on ALGT

Allegiant Travel Price Performance

Allegiant Travel stock traded up $7.62 during midday trading on Monday, reaching $73.87. The company had a trading volume of 838,110 shares, compared to its average volume of 370,514. The company has a market capitalization of $1.35 billion, a P/E ratio of -49.01, a P/E/G ratio of 4.61 and a beta of 1.61. Allegiant Travel has a 12-month low of $36.08 and a 12-month high of $85.91. The firm's fifty day simple moving average is $52.65 and its 200-day simple moving average is $50.88. The company has a debt-to-equity ratio of 1.30, a current ratio of 0.74 and a quick ratio of 0.71.

Insider Transactions at Allegiant Travel

In other news, Director Gary Ellmer sold 1,000 shares of the firm's stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $45.00, for a total transaction of $45,000.00. Following the completion of the sale, the director now owns 7,490 shares in the company, valued at $337,050. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, COO Keny Frank Wilper sold 635 shares of Allegiant Travel stock in a transaction that occurred on Wednesday, October 23rd. The shares were sold at an average price of $62.69, for a total value of $39,808.15. Following the completion of the sale, the chief operating officer now owns 16,353 shares in the company, valued at approximately $1,025,169.57. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Gary Ellmer sold 1,000 shares of Allegiant Travel stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $45.00, for a total transaction of $45,000.00. Following the completion of the sale, the director now owns 7,490 shares of the company's stock, valued at $337,050. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 2,334 shares of company stock worth $117,158 in the last 90 days. Insiders own 15.80% of the company's stock.

Institutional Trading of Allegiant Travel

Institutional investors have recently added to or reduced their stakes in the stock. BNP Paribas Financial Markets grew its stake in shares of Allegiant Travel by 369.1% in the first quarter. BNP Paribas Financial Markets now owns 23,874 shares of the transportation company's stock worth $1,796,000 after acquiring an additional 18,785 shares in the last quarter. Janney Montgomery Scott LLC grew its stake in shares of Allegiant Travel by 18.8% in the first quarter. Janney Montgomery Scott LLC now owns 7,799 shares of the transportation company's stock worth $587,000 after acquiring an additional 1,235 shares in the last quarter. Empowered Funds LLC grew its stake in shares of Allegiant Travel by 7.8% in the first quarter. Empowered Funds LLC now owns 71,275 shares of the transportation company's stock worth $5,361,000 after acquiring an additional 5,175 shares in the last quarter. SG Americas Securities LLC acquired a new position in shares of Allegiant Travel in the first quarter worth $141,000. Finally, Susquehanna Fundamental Investments LLC acquired a new position in shares of Allegiant Travel in the first quarter worth $1,306,000. Institutional investors and hedge funds own 85.81% of the company's stock.

About Allegiant Travel

(

Get Free Report)

Allegiant Travel Company, a leisure travel company, provides travel services and products to residents of under-served cities in the United States. The company offers scheduled air transportation on limited-frequency, nonstop flights between under-served cities and leisure destinations. As of February 1, 2024, it operated a fleet of 126 Airbus A320 series aircraft.

Further Reading

Before you consider Allegiant Travel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegiant Travel wasn't on the list.

While Allegiant Travel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.