Great Lakes Advisors LLC decreased its holdings in Allegion plc (NYSE:ALLE - Free Report) by 2.6% in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 141,792 shares of the scientific and technical instruments company's stock after selling 3,716 shares during the quarter. Great Lakes Advisors LLC owned about 0.16% of Allegion worth $18,529,000 as of its most recent filing with the Securities & Exchange Commission.

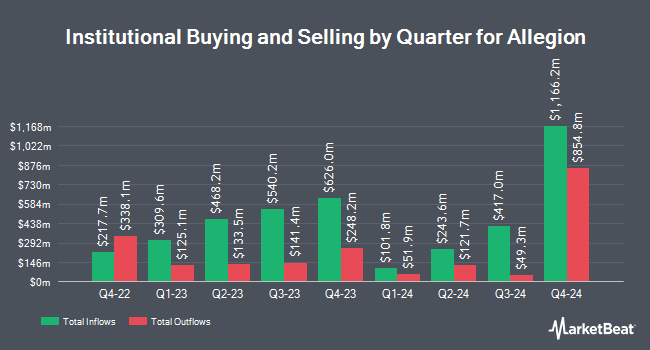

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in ALLE. Public Employees Retirement System of Ohio bought a new position in Allegion in the third quarter worth $4,988,000. Crew Capital Management Ltd. increased its holdings in shares of Allegion by 224.9% during the fourth quarter. Crew Capital Management Ltd. now owns 5,810 shares of the scientific and technical instruments company's stock valued at $759,000 after acquiring an additional 4,022 shares in the last quarter. Qsemble Capital Management LP bought a new position in shares of Allegion during the third quarter valued at $891,000. Sumitomo Mitsui Trust Group Inc. increased its holdings in shares of Allegion by 4.5% during the fourth quarter. Sumitomo Mitsui Trust Group Inc. now owns 204,500 shares of the scientific and technical instruments company's stock valued at $26,724,000 after acquiring an additional 8,806 shares in the last quarter. Finally, Nordea Investment Management AB increased its holdings in shares of Allegion by 4.4% during the fourth quarter. Nordea Investment Management AB now owns 1,175,995 shares of the scientific and technical instruments company's stock valued at $154,643,000 after acquiring an additional 49,176 shares in the last quarter. Hedge funds and other institutional investors own 92.21% of the company's stock.

Insiders Place Their Bets

In related news, Director Gregg C. Sengstack acquired 8,000 shares of the stock in a transaction dated Wednesday, February 19th. The shares were purchased at an average cost of $125.24 per share, with a total value of $1,001,920.00. Following the transaction, the director now directly owns 8,000 shares in the company, valued at approximately $1,001,920. This represents a ∞ increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CAO Nickolas A. Musial sold 403 shares of Allegion stock in a transaction dated Wednesday, February 19th. The shares were sold at an average price of $124.70, for a total value of $50,254.10. Following the transaction, the chief accounting officer now directly owns 4,972 shares in the company, valued at approximately $620,008.40. The trade was a 7.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 3,224 shares of company stock valued at $406,636. Insiders own 0.33% of the company's stock.

Allegion Stock Performance

NYSE:ALLE traded up $1.02 on Thursday, hitting $124.96. The stock had a trading volume of 1,069,366 shares, compared to its average volume of 714,385. The stock has a market cap of $10.78 billion, a price-to-earnings ratio of 18.32, a price-to-earnings-growth ratio of 3.97 and a beta of 1.11. The company has a quick ratio of 1.43, a current ratio of 2.04 and a debt-to-equity ratio of 1.32. The business's 50-day simple moving average is $129.82 and its two-hundred day simple moving average is $136.96. Allegion plc has a 52-week low of $113.27 and a 52-week high of $156.10.

Allegion (NYSE:ALLE - Get Free Report) last announced its earnings results on Tuesday, February 18th. The scientific and technical instruments company reported $1.86 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.75 by $0.11. The business had revenue of $945.60 million for the quarter, compared to analysts' expectations of $938.91 million. Allegion had a return on equity of 45.12% and a net margin of 15.84%. As a group, research analysts predict that Allegion plc will post 7.77 earnings per share for the current year.

Allegion Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Friday, March 14th will be given a $0.51 dividend. This represents a $2.04 annualized dividend and a yield of 1.63%. This is a boost from Allegion's previous quarterly dividend of $0.48. The ex-dividend date is Friday, March 14th. Allegion's dividend payout ratio (DPR) is presently 29.91%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on ALLE shares. Barclays reduced their price target on Allegion from $134.00 to $130.00 and set an "underweight" rating for the company in a report on Wednesday, February 19th. Morgan Stanley lifted their price objective on Allegion from $137.00 to $139.00 and gave the stock an "equal weight" rating in a report on Wednesday, February 19th. Wells Fargo & Company reduced their price objective on Allegion from $140.00 to $135.00 and set an "equal weight" rating for the company in a report on Wednesday, February 19th. Robert W. Baird reduced their price objective on Allegion from $152.00 to $144.00 and set a "neutral" rating for the company in a report on Wednesday, February 19th. Finally, StockNews.com downgraded Allegion from a "buy" rating to a "hold" rating in a report on Friday, March 7th. One research analyst has rated the stock with a sell rating and six have issued a hold rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $138.33.

Get Our Latest Report on Allegion

Allegion Company Profile

(

Free Report)

Allegion plc manufactures and sells mechanical and electronic security products and solutions worldwide. The company offers door controls and systems and exit devices; locks, locksets, portable locks, and key systems and services; electronic security products and access control systems; time, attendance, and workforce productivity systems; doors, accessories, and other.

Featured Stories

Before you consider Allegion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegion wasn't on the list.

While Allegion currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.