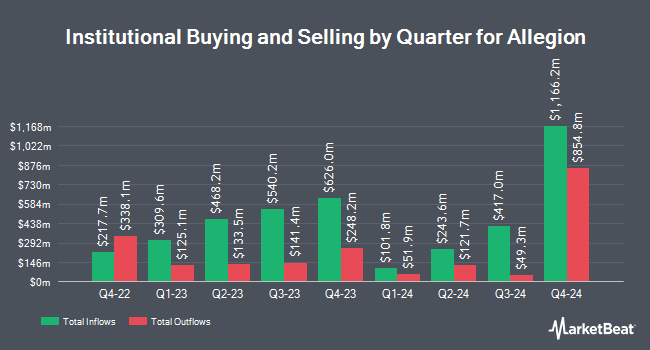

UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in Allegion plc (NYSE:ALLE - Free Report) by 397.8% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 606,901 shares of the scientific and technical instruments company's stock after buying an additional 484,995 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 0.70% of Allegion worth $88,450,000 as of its most recent SEC filing.

A number of other institutional investors have also recently made changes to their positions in the company. Kayne Anderson Rudnick Investment Management LLC boosted its stake in Allegion by 2.5% during the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 3,741,165 shares of the scientific and technical instruments company's stock valued at $442,019,000 after purchasing an additional 91,011 shares during the last quarter. Van ECK Associates Corp raised its position in Allegion by 1.3% in the 3rd quarter. Van ECK Associates Corp now owns 3,178,952 shares of the scientific and technical instruments company's stock worth $479,577,000 after buying an additional 39,905 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its stake in Allegion by 13.9% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 1,904,632 shares of the scientific and technical instruments company's stock valued at $277,581,000 after acquiring an additional 232,395 shares during the period. Millennium Management LLC grew its stake in shares of Allegion by 483.1% in the second quarter. Millennium Management LLC now owns 515,563 shares of the scientific and technical instruments company's stock worth $60,914,000 after acquiring an additional 427,146 shares during the period. Finally, Raymond James & Associates raised its holdings in shares of Allegion by 2.9% during the third quarter. Raymond James & Associates now owns 460,290 shares of the scientific and technical instruments company's stock valued at $67,083,000 after purchasing an additional 13,095 shares during the last quarter. Hedge funds and other institutional investors own 92.21% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts recently commented on ALLE shares. Barclays lifted their price objective on Allegion from $135.00 to $137.00 and gave the stock an "underweight" rating in a report on Monday, October 28th. Robert W. Baird raised their target price on shares of Allegion from $145.00 to $152.00 and gave the stock a "neutral" rating in a research note on Friday, October 25th. Wells Fargo & Company upped their price target on Allegion from $137.00 to $152.00 and gave the stock an "equal weight" rating in a research note on Monday, October 7th. Finally, Mizuho increased their price objective on shares of Allegion from $135.00 to $150.00 and gave the company a "neutral" rating in a report on Thursday, October 17th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and one has given a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $144.60.

Get Our Latest Report on Allegion

Allegion Trading Up 0.1 %

ALLE traded up $0.08 on Tuesday, hitting $140.48. The company had a trading volume of 797,876 shares, compared to its average volume of 773,507. The company has a market cap of $12.21 billion, a PE ratio of 21.58, a PEG ratio of 3.35 and a beta of 1.10. The company has a quick ratio of 1.29, a current ratio of 1.71 and a debt-to-equity ratio of 1.26. The business's fifty day simple moving average is $143.83 and its 200 day simple moving average is $133.00. Allegion plc has a 12-month low of $104.25 and a 12-month high of $156.10.

Allegion (NYSE:ALLE - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The scientific and technical instruments company reported $2.16 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.98 by $0.18. Allegion had a return on equity of 45.64% and a net margin of 15.36%. The company had revenue of $967.10 million during the quarter, compared to the consensus estimate of $970.70 million. During the same period last year, the company earned $1.94 earnings per share. Allegion's revenue was up 5.4% on a year-over-year basis. Equities research analysts expect that Allegion plc will post 7.41 EPS for the current year.

Allegion Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Friday, September 20th were given a $0.48 dividend. This represents a $1.92 dividend on an annualized basis and a yield of 1.37%. The ex-dividend date of this dividend was Friday, September 20th. Allegion's dividend payout ratio (DPR) is currently 29.49%.

Insiders Place Their Bets

In other news, SVP Robert C. Martens sold 8,035 shares of the business's stock in a transaction on Friday, October 25th. The shares were sold at an average price of $144.92, for a total transaction of $1,164,432.20. Following the completion of the sale, the senior vice president now directly owns 7,104 shares of the company's stock, valued at approximately $1,029,511.68. The trade was a 53.07 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 0.33% of the stock is owned by insiders.

About Allegion

(

Free Report)

Allegion plc manufactures and sells mechanical and electronic security products and solutions worldwide. The company offers door controls and systems and exit devices; locks, locksets, portable locks, and key systems and services; electronic security products and access control systems; time, attendance, and workforce productivity systems; doors, accessories, and other.

See Also

Before you consider Allegion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegion wasn't on the list.

While Allegion currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.