Alliancebernstein L.P. grew its holdings in shares of Vontier Co. (NYSE:VNT - Free Report) by 5.4% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 224,835 shares of the company's stock after acquiring an additional 11,468 shares during the quarter. Alliancebernstein L.P. owned 0.15% of Vontier worth $8,200,000 at the end of the most recent quarter.

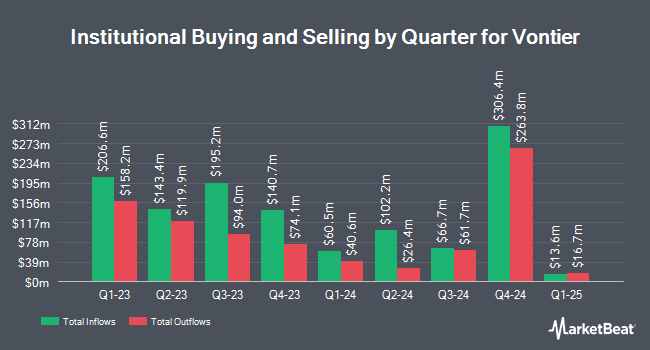

A number of other institutional investors and hedge funds have also recently made changes to their positions in the stock. Bailard Inc. increased its position in Vontier by 0.6% during the 4th quarter. Bailard Inc. now owns 61,207 shares of the company's stock worth $2,232,000 after purchasing an additional 356 shares in the last quarter. TD Private Client Wealth LLC increased its holdings in shares of Vontier by 9.7% during the third quarter. TD Private Client Wealth LLC now owns 4,557 shares of the company's stock worth $154,000 after buying an additional 404 shares in the last quarter. Global X Japan Co. Ltd. lifted its stake in shares of Vontier by 137.7% in the 4th quarter. Global X Japan Co. Ltd. now owns 744 shares of the company's stock valued at $27,000 after acquiring an additional 431 shares during the last quarter. American Century Companies Inc. boosted its holdings in shares of Vontier by 1.1% during the 4th quarter. American Century Companies Inc. now owns 39,342 shares of the company's stock valued at $1,435,000 after acquiring an additional 447 shares in the last quarter. Finally, National Bank of Canada FI grew its position in Vontier by 12.5% during the 3rd quarter. National Bank of Canada FI now owns 4,345 shares of the company's stock worth $147,000 after acquiring an additional 482 shares during the last quarter. Institutional investors own 95.83% of the company's stock.

Analyst Ratings Changes

Several equities analysts have commented on the company. Citigroup dropped their target price on Vontier from $45.00 to $36.00 and set a "buy" rating for the company in a research report on Monday. Robert W. Baird raised their price objective on shares of Vontier from $42.00 to $43.00 and gave the company a "neutral" rating in a report on Tuesday, February 18th. Finally, Barclays reduced their target price on shares of Vontier from $46.00 to $45.00 and set an "overweight" rating on the stock in a report on Wednesday, March 26th. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $43.17.

View Our Latest Stock Report on VNT

Vontier Trading Down 0.1 %

Shares of NYSE:VNT traded down $0.03 during trading on Tuesday, reaching $30.23. The stock had a trading volume of 880,457 shares, compared to its average volume of 865,331. Vontier Co. has a 52 week low of $27.22 and a 52 week high of $42.04. The company has a debt-to-equity ratio of 1.97, a quick ratio of 1.14 and a current ratio of 1.51. The firm's fifty day moving average is $34.47 and its 200 day moving average is $36.14. The stock has a market cap of $4.50 billion, a price-to-earnings ratio of 10.99, a P/E/G ratio of 1.23 and a beta of 1.28.

Vontier (NYSE:VNT - Get Free Report) last issued its quarterly earnings results on Thursday, February 13th. The company reported $0.80 EPS for the quarter, beating analysts' consensus estimates of $0.79 by $0.01. Vontier had a net margin of 14.17% and a return on equity of 43.22%. The business had revenue of $776.80 million for the quarter. As a group, equities analysts forecast that Vontier Co. will post 3.13 EPS for the current fiscal year.

Vontier Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, March 27th. Shareholders of record on Thursday, March 6th were issued a $0.025 dividend. The ex-dividend date was Thursday, March 6th. This represents a $0.10 dividend on an annualized basis and a yield of 0.33%. Vontier's payout ratio is currently 3.64%.

About Vontier

(

Free Report)

Vontier Corporation provides mobility ecosystem solutions worldwide. The company operates through Mobility Technologies, Repair Solutions, and Environmental and Fueling Solutions segments. The Mobility Technologies segment provides digitally equipment solutions for mobility ecosystem, such as point-of-sale and payment systems, workflow automation, telematics, data analytics, software platform, and integrated solutions for alternative fuel dispensing.

Recommended Stories

Before you consider Vontier, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vontier wasn't on the list.

While Vontier currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.