Alliancebernstein L.P. cut its holdings in SB Financial Group, Inc. (NASDAQ:SBFG - Free Report) by 20.3% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 468,306 shares of the financial services provider's stock after selling 119,608 shares during the period. Alliancebernstein L.P. owned about 7.04% of SB Financial Group worth $9,792,000 at the end of the most recent quarter.

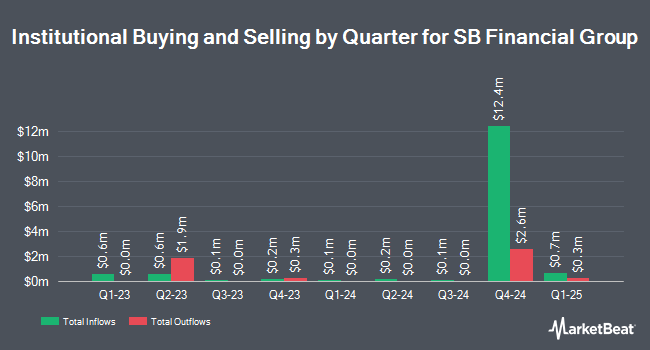

Several other hedge funds and other institutional investors have also bought and sold shares of SBFG. O Shaughnessy Asset Management LLC raised its stake in shares of SB Financial Group by 189.3% in the fourth quarter. O Shaughnessy Asset Management LLC now owns 34,114 shares of the financial services provider's stock valued at $713,000 after buying an additional 22,321 shares during the period. Jones Financial Companies Lllp bought a new position in SB Financial Group during the fourth quarter worth about $62,000. PL Capital Advisors LLC increased its stake in shares of SB Financial Group by 1,991.0% in the fourth quarter. PL Capital Advisors LLC now owns 588,805 shares of the financial services provider's stock worth $12,312,000 after purchasing an additional 560,646 shares in the last quarter. Empowered Funds LLC raised its position in shares of SB Financial Group by 5.0% in the fourth quarter. Empowered Funds LLC now owns 39,637 shares of the financial services provider's stock valued at $829,000 after purchasing an additional 1,875 shares during the period. Finally, Ritholtz Wealth Management bought a new position in SB Financial Group in the 4th quarter worth approximately $408,000. Hedge funds and other institutional investors own 66.67% of the company's stock.

SB Financial Group Stock Performance

Shares of NASDAQ:SBFG traded down $0.02 during trading on Wednesday, hitting $18.18. 806 shares of the company were exchanged, compared to its average volume of 13,516. The company has a market cap of $118.77 million, a PE ratio of 10.57 and a beta of 0.48. SB Financial Group, Inc. has a 52-week low of $13.01 and a 52-week high of $24.48. The company has a debt-to-equity ratio of 0.41, a current ratio of 0.92 and a quick ratio of 0.91. The stock has a 50 day moving average of $20.72 and a 200 day moving average of $20.70.

SB Financial Group (NASDAQ:SBFG - Get Free Report) last issued its earnings results on Thursday, January 23rd. The financial services provider reported $0.52 EPS for the quarter, topping the consensus estimate of $0.41 by $0.11. SB Financial Group had a return on equity of 8.98% and a net margin of 14.10%. As a group, equities research analysts predict that SB Financial Group, Inc. will post 2 EPS for the current year.

About SB Financial Group

(

Free Report)

SB Financial Group, Inc operates as the financial holding company for the State Bank and Trust Company that provides a range of commercial banking and wealth management services to individual and corporate customers primarily in Ohio, Indiana, and Michigan. It offers checking, savings, money market accounts, as well as time certificates of deposit; and commercial, consumer, agricultural, and residential mortgage loans.

Read More

Before you consider SB Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SB Financial Group wasn't on the list.

While SB Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.