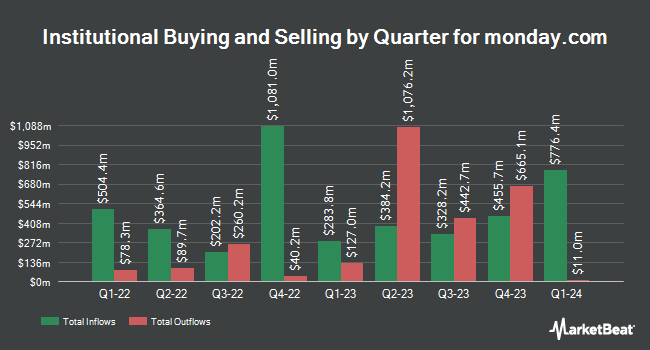

Alliancebernstein L.P. lessened its holdings in monday.com Ltd. (NASDAQ:MNDY - Free Report) by 13.1% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 573,230 shares of the company's stock after selling 86,543 shares during the period. Alliancebernstein L.P. owned 1.19% of monday.com worth $134,961,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of MNDY. Wellington Management Group LLP lifted its stake in monday.com by 49.2% in the 4th quarter. Wellington Management Group LLP now owns 41,959 shares of the company's stock valued at $9,879,000 after buying an additional 13,827 shares in the last quarter. Clearbridge Investments LLC raised its holdings in shares of monday.com by 0.3% in the fourth quarter. Clearbridge Investments LLC now owns 13,501 shares of the company's stock worth $3,179,000 after acquiring an additional 44 shares during the last quarter. CIBC Private Wealth Group LLC lifted its position in shares of monday.com by 264.1% in the fourth quarter. CIBC Private Wealth Group LLC now owns 555,929 shares of the company's stock valued at $126,407,000 after acquiring an additional 403,255 shares in the last quarter. Arrowstreet Capital Limited Partnership boosted its stake in shares of monday.com by 23.8% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 499,950 shares of the company's stock valued at $117,708,000 after acquiring an additional 96,222 shares during the last quarter. Finally, DnB Asset Management AS raised its stake in monday.com by 1.7% in the 4th quarter. DnB Asset Management AS now owns 6,534 shares of the company's stock valued at $1,538,000 after purchasing an additional 109 shares during the last quarter. 73.70% of the stock is currently owned by institutional investors and hedge funds.

monday.com Stock Performance

Shares of NASDAQ:MNDY traded down $15.86 during mid-day trading on Friday, hitting $217.77. 1,708,715 shares of the company traded hands, compared to its average volume of 802,306. The firm's 50 day simple moving average is $272.65 and its 200 day simple moving average is $269.85. The firm has a market cap of $11.06 billion, a P/E ratio of 362.95, a PEG ratio of 16.53 and a beta of 1.34. monday.com Ltd. has a 52-week low of $174.75 and a 52-week high of $342.64.

monday.com (NASDAQ:MNDY - Get Free Report) last posted its quarterly earnings data on Monday, February 10th. The company reported $0.50 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.78 by ($0.28). monday.com had a net margin of 3.33% and a return on equity of 6.22%. Equities research analysts expect that monday.com Ltd. will post 0.46 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities research analysts have recently commented on the stock. The Goldman Sachs Group lifted their price target on shares of monday.com from $350.00 to $400.00 and gave the stock a "buy" rating in a report on Tuesday, February 11th. Canaccord Genuity Group boosted their price target on monday.com from $310.00 to $375.00 and gave the company a "buy" rating in a report on Tuesday, February 11th. Cantor Fitzgerald raised their price objective on monday.com from $292.00 to $380.00 and gave the stock an "overweight" rating in a report on Tuesday, February 11th. Needham & Company LLC upped their target price on monday.com from $350.00 to $400.00 and gave the company a "buy" rating in a research note on Monday, February 10th. Finally, KeyCorp raised monday.com from a "sector weight" rating to an "overweight" rating and set a $420.00 price target on the stock in a research note on Tuesday, February 11th. Three equities research analysts have rated the stock with a hold rating and twenty-one have assigned a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $352.64.

View Our Latest Stock Analysis on MNDY

monday.com Company Profile

(

Free Report)

monday.com Ltd., together with its subsidiaries, develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally. The company provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

Read More

Before you consider monday.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and monday.com wasn't on the list.

While monday.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.