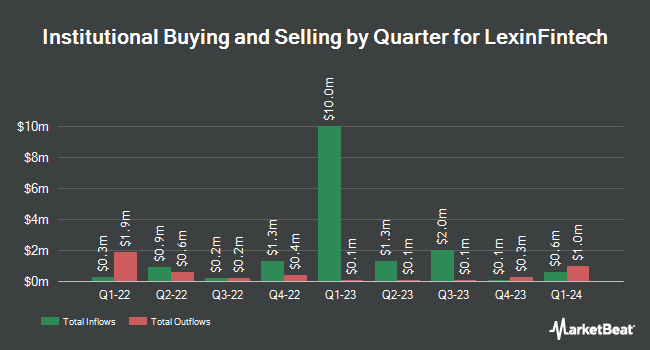

Alliancebernstein L.P. acquired a new stake in LexinFintech Holdings Ltd. (NASDAQ:LX - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 189,280 shares of the company's stock, valued at approximately $1,098,000. Alliancebernstein L.P. owned 0.12% of LexinFintech as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently made changes to their positions in the business. Thurston Springer Miller Herd & Titak Inc. acquired a new stake in shares of LexinFintech in the 4th quarter valued at approximately $29,000. IQ EQ FUND MANAGEMENT IRELAND Ltd acquired a new stake in LexinFintech in the fourth quarter valued at approximately $70,000. Virtu Financial LLC bought a new stake in shares of LexinFintech during the third quarter worth $74,000. Kathmere Capital Management LLC acquired a new position in shares of LexinFintech during the fourth quarter worth $79,000. Finally, Raymond James Financial Inc. bought a new position in shares of LexinFintech in the 4th quarter valued at $157,000.

LexinFintech Trading Up 1.5 %

LX traded up $0.12 during trading on Thursday, reaching $8.11. 729,093 shares of the company's stock were exchanged, compared to its average volume of 2,842,182. The firm has a fifty day moving average price of $8.81 and a two-hundred day moving average price of $6.48. The stock has a market capitalization of $1.33 billion, a PE ratio of 12.87 and a beta of 0.32. LexinFintech Holdings Ltd. has a one year low of $1.57 and a one year high of $11.64. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.10.

LexinFintech (NASDAQ:LX - Get Free Report) last announced its earnings results on Tuesday, March 18th. The company reported $0.28 earnings per share for the quarter. The business had revenue of $501.26 million during the quarter. LexinFintech had a net margin of 5.34% and a return on equity of 7.47%.

LexinFintech Increases Dividend

The business also recently disclosed a semi-annual dividend, which will be paid on Friday, May 16th. Shareholders of record on Thursday, April 17th will be issued a dividend of $0.11 per share. This is a positive change from LexinFintech's previous semi-annual dividend of $0.07. This represents a yield of 1.2%. The ex-dividend date is Thursday, April 17th. LexinFintech's payout ratio is currently 18.89%.

Wall Street Analyst Weigh In

Separately, UBS Group set a $13.60 price objective on LexinFintech and gave the stock a "buy" rating in a research report on Friday, March 21st.

View Our Latest Stock Report on LexinFintech

About LexinFintech

(

Free Report)

LexinFintech Holdings Ltd., through its subsidiaries, provides online consumer finance services in the People's Republic of China. The company operates Fenqile.com, an online consumption and consumer finance platform that offers installment purchase and personal installment loans, as well as online direct sales with installment payment terms; and Le Hua Card, a scenario-based lending.

Further Reading

Before you consider LexinFintech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LexinFintech wasn't on the list.

While LexinFintech currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.