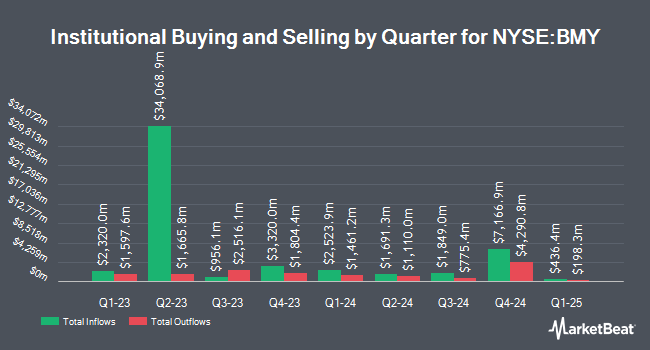

Allianz SE acquired a new position in shares of Bristol-Myers Squibb (NYSE:BMY - Free Report) in the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 101,287 shares of the biopharmaceutical company's stock, valued at approximately $5,679,000.

Several other hedge funds have also modified their holdings of the company. Wealthspire Advisors LLC grew its stake in shares of Bristol-Myers Squibb by 0.6% during the 4th quarter. Wealthspire Advisors LLC now owns 28,679 shares of the biopharmaceutical company's stock worth $1,622,000 after purchasing an additional 170 shares during the period. Edmp Inc. boosted its holdings in Bristol-Myers Squibb by 0.4% during the fourth quarter. Edmp Inc. now owns 41,599 shares of the biopharmaceutical company's stock worth $2,353,000 after buying an additional 171 shares in the last quarter. Trust Point Inc. increased its holdings in Bristol-Myers Squibb by 1.9% in the fourth quarter. Trust Point Inc. now owns 9,423 shares of the biopharmaceutical company's stock valued at $533,000 after buying an additional 172 shares in the last quarter. Bedel Financial Consulting Inc. lifted its position in shares of Bristol-Myers Squibb by 3.2% during the 4th quarter. Bedel Financial Consulting Inc. now owns 5,690 shares of the biopharmaceutical company's stock valued at $340,000 after acquiring an additional 175 shares during the period. Finally, Horst & Graben Wealth Management LLC boosted its stake in shares of Bristol-Myers Squibb by 2.4% during the 4th quarter. Horst & Graben Wealth Management LLC now owns 7,538 shares of the biopharmaceutical company's stock worth $426,000 after acquiring an additional 179 shares in the last quarter. 76.41% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts recently weighed in on BMY shares. Wells Fargo & Company raised their price objective on Bristol-Myers Squibb from $60.00 to $62.00 and gave the company an "equal weight" rating in a research note on Friday, February 7th. Bank of America reaffirmed a "neutral" rating and set a $63.00 price target on shares of Bristol-Myers Squibb in a research note on Tuesday, December 10th. Truist Financial increased their price objective on shares of Bristol-Myers Squibb from $62.00 to $65.00 and gave the company a "buy" rating in a research note on Wednesday, January 8th. Jefferies Financial Group upgraded shares of Bristol-Myers Squibb from a "hold" rating to a "buy" rating and lifted their target price for the stock from $63.00 to $70.00 in a research report on Monday, December 16th. Finally, Citigroup increased their price target on shares of Bristol-Myers Squibb from $60.00 to $65.00 and gave the company a "neutral" rating in a research report on Tuesday, January 28th. Two analysts have rated the stock with a sell rating, eleven have issued a hold rating, four have issued a buy rating and three have issued a strong buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $57.86.

View Our Latest Research Report on BMY

Bristol-Myers Squibb Trading Up 1.7 %

Shares of NYSE:BMY traded up $1.03 during midday trading on Monday, reaching $61.05. The company's stock had a trading volume of 11,614,982 shares, compared to its average volume of 12,744,032. The firm has a market cap of $124.22 billion, a price-to-earnings ratio of -13.81, a price-to-earnings-growth ratio of 2.07 and a beta of 0.43. The business has a 50 day moving average price of $58.64 and a 200 day moving average price of $56.44. Bristol-Myers Squibb has a 1 year low of $39.35 and a 1 year high of $63.33. The company has a quick ratio of 1.15, a current ratio of 1.25 and a debt-to-equity ratio of 2.90.

Bristol-Myers Squibb (NYSE:BMY - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The biopharmaceutical company reported $1.67 EPS for the quarter, beating the consensus estimate of $1.47 by $0.20. Bristol-Myers Squibb had a positive return on equity of 13.93% and a negative net margin of 18.53%. Research analysts forecast that Bristol-Myers Squibb will post 6.74 EPS for the current year.

Bristol-Myers Squibb Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, May 1st. Shareholders of record on Friday, April 4th will be issued a $0.62 dividend. The ex-dividend date of this dividend is Friday, April 4th. This represents a $2.48 dividend on an annualized basis and a dividend yield of 4.06%. Bristol-Myers Squibb's dividend payout ratio (DPR) is presently -56.11%.

Insider Activity

In other news, EVP Samit Hirawat bought 1,823 shares of the firm's stock in a transaction dated Friday, February 14th. The stock was acquired at an average price of $54.84 per share, for a total transaction of $99,973.32. Following the acquisition, the executive vice president now owns 63,932 shares of the company's stock, valued at $3,506,030.88. This trade represents a 2.94 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Corporate insiders own 0.09% of the company's stock.

About Bristol-Myers Squibb

(

Free Report)

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, and neuroscience diseases. The company's products include Eliquis for reduction in risk of stroke/systemic embolism in non-valvular atrial fibrillation, and for the treatment of DVT/PE; Opdivo for various anti-cancer indications, including bladder, blood, CRC, head and neck, RCC, HCC, lung, melanoma, MPM, stomach and esophageal cancer; Pomalyst/Imnovid for multiple myeloma; Orencia for active rheumatoid arthritis and psoriatic arthritis; and Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia.

Read More

Before you consider Bristol-Myers Squibb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bristol-Myers Squibb wasn't on the list.

While Bristol-Myers Squibb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.