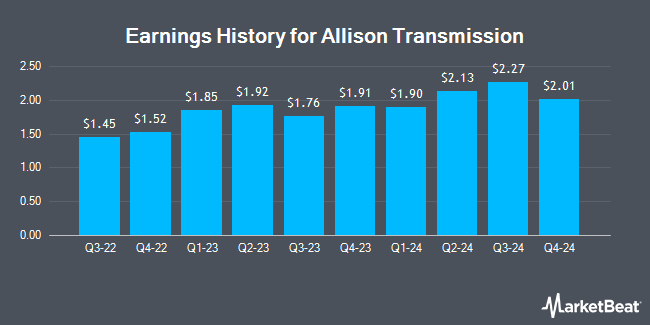

Allison Transmission (NYSE:ALSN - Get Free Report) issued its quarterly earnings results on Tuesday. The auto parts company reported $2.01 earnings per share for the quarter, topping analysts' consensus estimates of $1.90 by $0.11, Zacks reports. Allison Transmission had a return on equity of 51.13% and a net margin of 22.66%. Allison Transmission updated its FY 2025 guidance to EPS.

Allison Transmission Price Performance

ALSN stock traded up $3.28 during mid-day trading on Friday, reaching $104.88. 968,145 shares of the company traded hands, compared to its average volume of 455,052. The company has a debt-to-equity ratio of 1.48, a current ratio of 2.83 and a quick ratio of 2.25. The company has a market capitalization of $9.08 billion, a P/E ratio of 12.77, a P/E/G ratio of 1.82 and a beta of 1.00. Allison Transmission has a 52-week low of $67.61 and a 52-week high of $122.53. The company has a fifty day moving average price of $112.69 and a 200-day moving average price of $103.85.

Analysts Set New Price Targets

A number of equities analysts have issued reports on the company. Robert W. Baird lifted their price target on Allison Transmission from $103.00 to $108.00 and gave the company a "neutral" rating in a research note on Wednesday, October 30th. Morgan Stanley raised their price objective on shares of Allison Transmission from $110.00 to $112.00 and gave the stock an "equal weight" rating in a report on Tuesday, December 17th. Bank of America upped their price objective on Allison Transmission from $67.00 to $77.00 and gave the company an "underperform" rating in a research note on Wednesday, October 30th. Citigroup lowered their target price on Allison Transmission from $120.00 to $115.00 and set a "neutral" rating on the stock in a research note on Wednesday. Finally, The Goldman Sachs Group increased their price target on Allison Transmission from $82.00 to $94.00 and gave the stock a "sell" rating in a research note on Thursday, December 12th. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $100.75.

Get Our Latest Stock Analysis on Allison Transmission

Insider Buying and Selling at Allison Transmission

In other news, SVP John Coll sold 2,000 shares of Allison Transmission stock in a transaction on Tuesday, December 31st. The shares were sold at an average price of $108.40, for a total transaction of $216,800.00. Following the completion of the sale, the senior vice president now directly owns 6,420 shares of the company's stock, valued at approximately $695,928. The trade was a 23.75 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO David S. Graziosi sold 1,723 shares of Allison Transmission stock in a transaction on Wednesday, November 27th. The stock was sold at an average price of $120.26, for a total transaction of $207,207.98. Following the sale, the chief executive officer now directly owns 168,833 shares of the company's stock, valued at $20,303,856.58. This represents a 1.01 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 20,639 shares of company stock valued at $2,448,077 in the last quarter. 1.10% of the stock is currently owned by corporate insiders.

Allison Transmission Company Profile

(

Get Free Report)

Allison Transmission Holdings, Inc, together with its subsidiaries, designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S. defense vehicles, and electrified propulsion systems worldwide. It provides commercial-duty on-highway, off-highway and defense fully automatic transmissions, and electric hybrid and fully electric systems.

Featured Stories

Before you consider Allison Transmission, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allison Transmission wasn't on the list.

While Allison Transmission currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.