Allogene Therapeutics (NASDAQ:ALLO - Free Report) had its price target trimmed by Piper Sandler from $11.00 to $9.00 in a report released on Thursday,Benzinga reports. The firm currently has an overweight rating on the stock.

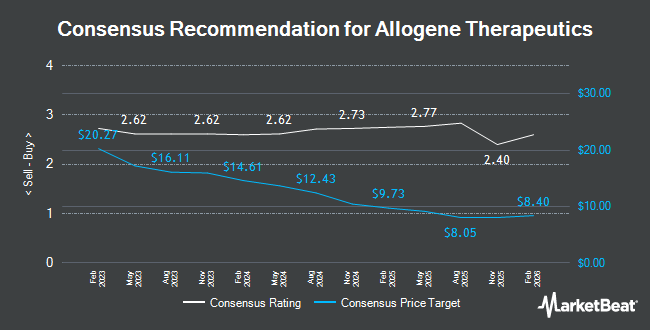

Several other analysts have also issued reports on the company. Canaccord Genuity Group cut their target price on Allogene Therapeutics from $35.00 to $14.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Oppenheimer started coverage on Allogene Therapeutics in a research note on Thursday, August 8th. They issued an "outperform" rating and a $11.00 target price for the company. Citigroup upped their target price on Allogene Therapeutics from $7.00 to $8.00 and gave the stock a "buy" rating in a research note on Friday, August 9th. HC Wainwright reaffirmed a "buy" rating and issued a $9.00 target price on shares of Allogene Therapeutics in a research note on Friday, November 8th. Finally, Truist Financial reissued a "buy" rating and set a $14.00 price objective (down previously from $17.00) on shares of Allogene Therapeutics in a research note on Friday, August 9th. Three research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $9.73.

Check Out Our Latest Research Report on ALLO

Allogene Therapeutics Stock Performance

ALLO traded down $0.26 during midday trading on Thursday, hitting $2.46. The stock had a trading volume of 2,547,498 shares, compared to its average volume of 2,463,793. The company has a market cap of $515.79 million, a P/E ratio of -1.74 and a beta of 0.84. The business has a fifty day moving average of $2.75 and a 200 day moving average of $2.66. Allogene Therapeutics has a 1 year low of $2.01 and a 1 year high of $5.78.

Hedge Funds Weigh In On Allogene Therapeutics

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. The Manufacturers Life Insurance Company raised its holdings in shares of Allogene Therapeutics by 1.2% during the third quarter. The Manufacturers Life Insurance Company now owns 486,023 shares of the company's stock valued at $1,361,000 after acquiring an additional 5,642 shares in the last quarter. CANADA LIFE ASSURANCE Co raised its holdings in shares of Allogene Therapeutics by 85.1% during the first quarter. CANADA LIFE ASSURANCE Co now owns 17,750 shares of the company's stock valued at $79,000 after acquiring an additional 8,162 shares in the last quarter. Nisa Investment Advisors LLC raised its holdings in shares of Allogene Therapeutics by 429.6% during the second quarter. Nisa Investment Advisors LLC now owns 10,767 shares of the company's stock valued at $25,000 after acquiring an additional 8,734 shares in the last quarter. Arizona State Retirement System raised its holdings in shares of Allogene Therapeutics by 36.1% during the second quarter. Arizona State Retirement System now owns 40,915 shares of the company's stock valued at $95,000 after acquiring an additional 10,855 shares in the last quarter. Finally, Private Advisor Group LLC bought a new position in shares of Allogene Therapeutics during the third quarter valued at approximately $34,000. Institutional investors own 83.63% of the company's stock.

Allogene Therapeutics Company Profile

(

Get Free Report)

Allogene Therapeutics, Inc, a clinical stage immuno-oncology company, develops and commercializes genetically engineered allogeneic T cell therapies for the treatment of cancer. It develops, manufactures, and commercializes UCART19, an allogeneic chimeric antigen receptor (CAR) T cell product candidate for the treatment of pediatric and adult patients with R/R CD19 positive B-cell acute lymphoblastic leukemia (ALL).

Read More

Before you consider Allogene Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allogene Therapeutics wasn't on the list.

While Allogene Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.