Allred Capital Management LLC purchased a new position in ASML Holding (NASDAQ:ASML - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor purchased 1,161 shares of the semiconductor company's stock, valued at approximately $805,000.

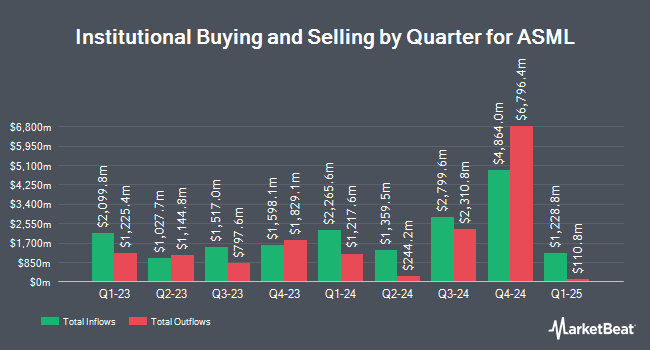

Several other large investors have also made changes to their positions in the business. Edgewood Management LLC lifted its stake in ASML by 43.1% in the fourth quarter. Edgewood Management LLC now owns 3,186,667 shares of the semiconductor company's stock valued at $2,208,615,000 after purchasing an additional 959,696 shares during the last quarter. Amundi raised its holdings in ASML by 4,880.5% during the fourth quarter. Amundi now owns 335,284 shares of the semiconductor company's stock valued at $247,019,000 after acquiring an additional 328,552 shares during the period. Wellington Management Group LLP raised its position in ASML by 53.4% in the 4th quarter. Wellington Management Group LLP now owns 807,257 shares of the semiconductor company's stock worth $559,494,000 after purchasing an additional 281,156 shares during the period. Raymond James Financial Inc. purchased a new position in ASML during the 4th quarter valued at $175,257,000. Finally, Fisher Funds Management LTD acquired a new stake in shares of ASML in the fourth quarter worth $137,386,000. Institutional investors and hedge funds own 26.07% of the company's stock.

Analyst Ratings Changes

ASML has been the topic of a number of recent analyst reports. DZ Bank upgraded shares of ASML from a "hold" rating to a "buy" rating in a research note on Thursday, January 30th. JPMorgan Chase & Co. cut their price target on ASML from $1,148.00 to $1,100.00 and set an "overweight" rating for the company in a report on Thursday, January 30th. Susquehanna cut their price target on shares of ASML from $1,100.00 to $965.00 and set a "positive" rating for the company in a report on Thursday, April 17th. Finally, Wells Fargo & Company cut their price objective on shares of ASML from $860.00 to $840.00 and set an "overweight" rating on the stock in a report on Thursday, April 17th. Two equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $906.00.

View Our Latest Report on ASML

ASML Stock Up 3.0 %

Shares of ASML stock traded up $18.46 on Tuesday, hitting $643.15. The company's stock had a trading volume of 743,607 shares, compared to its average volume of 1,623,810. The stock has a market capitalization of $253.03 billion, a price-to-earnings ratio of 30.93, a P/E/G ratio of 1.62 and a beta of 1.67. The firm's fifty day moving average price is $694.88 and its 200-day moving average price is $710.36. ASML Holding has a fifty-two week low of $578.51 and a fifty-two week high of $1,110.09. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.53 and a quick ratio of 0.99.

ASML (NASDAQ:ASML - Get Free Report) last posted its earnings results on Wednesday, April 16th. The semiconductor company reported $6.31 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $6.12 by $0.19. The business had revenue of $8.77 billion during the quarter, compared to analysts' expectations of $7.90 billion. ASML had a return on equity of 47.73% and a net margin of 26.78%. Research analysts anticipate that ASML Holding will post 25.17 EPS for the current year.

ASML Increases Dividend

The business also recently announced a dividend, which will be paid on Tuesday, May 6th. Shareholders of record on Monday, April 28th will be given a dividend of $1.5855 per share. The ex-dividend date is Monday, April 28th. This is an increase from ASML's previous dividend of $1.08. ASML's dividend payout ratio is currently 27.48%.

ASML Company Profile

(

Free Report)

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers. It offers advanced semiconductor equipment systems, including lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various range of semiconductor nodes and technologies.

See Also

Before you consider ASML, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASML wasn't on the list.

While ASML currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.