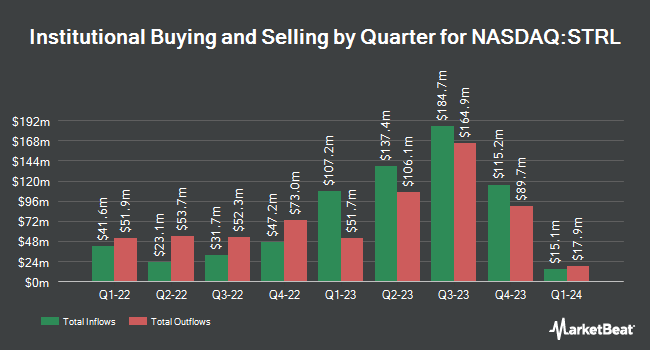

Allspring Global Investments Holdings LLC boosted its holdings in Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) by 7.9% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 666,909 shares of the construction company's stock after purchasing an additional 49,008 shares during the quarter. Allspring Global Investments Holdings LLC owned approximately 2.17% of Sterling Infrastructure worth $111,873,000 at the end of the most recent quarter.

A number of other hedge funds have also recently added to or reduced their stakes in STRL. Geode Capital Management LLC raised its stake in shares of Sterling Infrastructure by 0.5% during the third quarter. Geode Capital Management LLC now owns 719,980 shares of the construction company's stock valued at $104,431,000 after purchasing an additional 3,918 shares in the last quarter. State Street Corp raised its position in Sterling Infrastructure by 0.7% in the third quarter. State Street Corp now owns 713,234 shares of the construction company's stock worth $103,433,000 after acquiring an additional 5,106 shares in the last quarter. Congress Asset Management Co. raised its position in Sterling Infrastructure by 19.1% in the third quarter. Congress Asset Management Co. now owns 647,924 shares of the construction company's stock worth $93,962,000 after acquiring an additional 104,096 shares in the last quarter. Loomis Sayles & Co. L P raised its position in Sterling Infrastructure by 4.9% in the third quarter. Loomis Sayles & Co. L P now owns 380,972 shares of the construction company's stock worth $55,248,000 after acquiring an additional 17,863 shares in the last quarter. Finally, Principal Financial Group Inc. increased its stake in Sterling Infrastructure by 1,088.1% in the 3rd quarter. Principal Financial Group Inc. now owns 355,546 shares of the construction company's stock worth $51,561,000 after purchasing an additional 325,620 shares in the last quarter. Institutional investors and hedge funds own 80.95% of the company's stock.

Insider Buying and Selling

In other news, Director Dana C. O'brien sold 2,000 shares of the company's stock in a transaction that occurred on Wednesday, December 18th. The stock was sold at an average price of $175.89, for a total transaction of $351,780.00. Following the completion of the transaction, the director now directly owns 25,901 shares in the company, valued at $4,555,726.89. The trade was a 7.17 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 3.70% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts recently weighed in on the company. William Blair assumed coverage on Sterling Infrastructure in a research note on Friday, January 17th. They issued an "outperform" rating on the stock. StockNews.com cut Sterling Infrastructure from a "buy" rating to a "hold" rating in a research note on Thursday, February 6th.

View Our Latest Report on Sterling Infrastructure

Sterling Infrastructure Stock Performance

STRL traded up $2.30 on Friday, hitting $132.40. The company had a trading volume of 547,009 shares, compared to its average volume of 506,250. The company's fifty day moving average price is $166.52 and its 200 day moving average price is $154.28. Sterling Infrastructure, Inc. has a 1-year low of $81.25 and a 1-year high of $206.07. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.29 and a quick ratio of 1.29. The stock has a market cap of $4.07 billion, a price-to-earnings ratio of 22.36, a price-to-earnings-growth ratio of 1.53 and a beta of 1.24.

Sterling Infrastructure Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

Further Reading

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.