Allspring Global Investments Holdings LLC cut its holdings in shares of Ovintiv Inc. (NYSE:OVV - Free Report) by 97.6% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 913 shares of the company's stock after selling 36,710 shares during the period. Allspring Global Investments Holdings LLC's holdings in Ovintiv were worth $35,000 at the end of the most recent quarter.

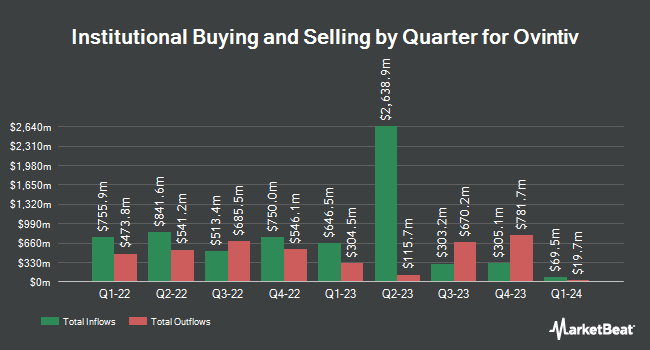

Several other institutional investors also recently modified their holdings of the stock. UMB Bank n.a. increased its holdings in shares of Ovintiv by 27.7% during the third quarter. UMB Bank n.a. now owns 1,317 shares of the company's stock worth $50,000 after buying an additional 286 shares in the last quarter. Covestor Ltd increased its holdings in Ovintiv by 23.1% in the first quarter. Covestor Ltd now owns 1,559 shares of the company's stock valued at $81,000 after purchasing an additional 293 shares during the period. Geneos Wealth Management Inc. increased its holdings in Ovintiv by 53.4% in the first quarter. Geneos Wealth Management Inc. now owns 862 shares of the company's stock valued at $45,000 after purchasing an additional 300 shares during the period. Blue Trust Inc. increased its holdings in Ovintiv by 24.0% in the second quarter. Blue Trust Inc. now owns 1,793 shares of the company's stock valued at $93,000 after purchasing an additional 347 shares during the period. Finally, Cetera Investment Advisers increased its holdings in Ovintiv by 1.0% in the second quarter. Cetera Investment Advisers now owns 37,466 shares of the company's stock valued at $1,756,000 after purchasing an additional 353 shares during the period. 83.81% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have commented on the stock. Evercore ISI cut their price target on shares of Ovintiv from $60.00 to $54.00 and set an "outperform" rating on the stock in a research report on Monday, September 30th. JPMorgan Chase & Co. cut their price objective on shares of Ovintiv from $60.00 to $51.00 and set an "overweight" rating on the stock in a research report on Thursday, September 12th. Morgan Stanley cut their price objective on shares of Ovintiv from $53.00 to $51.00 and set an "equal weight" rating on the stock in a research report on Monday, September 16th. Wolfe Research initiated coverage on shares of Ovintiv in a research report on Thursday, July 18th. They set an "outperform" rating and a $65.00 price objective on the stock. Finally, UBS Group cut their price target on Ovintiv from $61.00 to $57.00 and set a "buy" rating for the company in a research note on Wednesday, September 18th. Five equities research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $57.00.

View Our Latest Research Report on Ovintiv

Ovintiv Stock Performance

OVV traded up $2.04 during midday trading on Wednesday, hitting $41.99. 2,655,613 shares of the company were exchanged, compared to its average volume of 3,053,113. The company's 50 day simple moving average is $40.56 and its 200 day simple moving average is $44.93. The firm has a market capitalization of $11.07 billion, a price-to-earnings ratio of 5.92, a price-to-earnings-growth ratio of 7.60 and a beta of 2.62. The company has a current ratio of 0.44, a quick ratio of 0.44 and a debt-to-equity ratio of 0.47. Ovintiv Inc. has a 1-year low of $36.90 and a 1-year high of $55.95.

Ovintiv Company Profile

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

Read More

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.