Ally Financial (NYSE:ALLY - Free Report) had its price target trimmed by JPMorgan Chase & Co. from $43.00 to $36.00 in a research note released on Tuesday morning,Benzinga reports. The firm currently has an overweight rating on the financial services provider's stock.

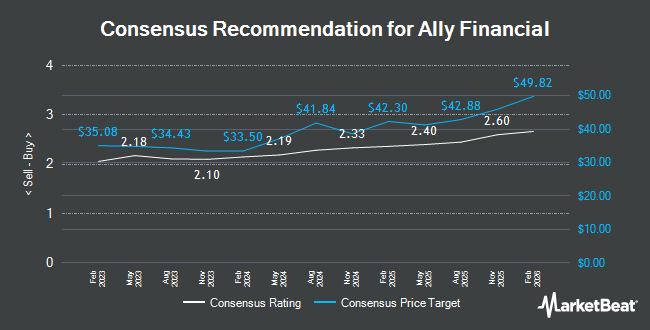

Other research analysts also recently issued reports about the company. Wells Fargo & Company lifted their target price on Ally Financial from $32.00 to $34.00 and gave the stock an "underweight" rating in a report on Thursday, January 23rd. Barclays lifted their price objective on Ally Financial from $36.00 to $44.00 and gave the stock an "equal weight" rating in a research note on Monday, January 6th. Truist Financial decreased their target price on shares of Ally Financial from $47.00 to $45.00 and set a "buy" rating for the company in a research report on Friday, April 4th. Morgan Stanley boosted their price target on shares of Ally Financial from $41.00 to $45.00 and gave the stock an "overweight" rating in a research report on Thursday, January 23rd. Finally, Keefe, Bruyette & Woods increased their price objective on shares of Ally Financial from $44.00 to $56.00 and gave the stock an "outperform" rating in a research report on Monday, December 9th. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating and ten have issued a buy rating to the company. Based on data from MarketBeat.com, Ally Financial currently has a consensus rating of "Hold" and an average price target of $42.41.

Check Out Our Latest Stock Report on ALLY

Ally Financial Price Performance

ALLY stock traded down $0.23 during midday trading on Tuesday, reaching $31.76. 6,337,031 shares of the stock were exchanged, compared to its average volume of 3,524,171. The company has a fifty day moving average price of $35.75 and a 200 day moving average price of $36.29. Ally Financial has a 52 week low of $29.52 and a 52 week high of $45.46. The company has a debt-to-equity ratio of 1.51, a current ratio of 0.93 and a quick ratio of 0.93. The stock has a market capitalization of $9.76 billion, a PE ratio of 12.22, a P/E/G ratio of 0.32 and a beta of 1.12.

Ally Financial (NYSE:ALLY - Get Free Report) last announced its quarterly earnings results on Wednesday, January 22nd. The financial services provider reported $0.78 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.57 by $0.21. The firm had revenue of $2.09 billion during the quarter, compared to analysts' expectations of $2.02 billion. Ally Financial had a net margin of 11.29% and a return on equity of 9.31%. The company's revenue was up 3.6% on a year-over-year basis. During the same period in the prior year, the company posted $0.45 EPS. As a group, analysts expect that Ally Financial will post 3.57 EPS for the current fiscal year.

Ally Financial Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, February 14th. Investors of record on Friday, January 31st were given a $0.30 dividend. This represents a $1.20 annualized dividend and a yield of 3.78%. The ex-dividend date was Friday, January 31st. Ally Financial's payout ratio is currently 46.15%.

Insider Buying and Selling at Ally Financial

In related news, CFO Russell E. Hutchinson bought 19,100 shares of the business's stock in a transaction that occurred on Friday, January 24th. The shares were bought at an average price of $39.45 per share, with a total value of $753,495.00. Following the completion of the transaction, the chief financial officer now directly owns 202,845 shares in the company, valued at approximately $8,002,235.25. This represents a 10.39 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Michael George Rhodes purchased 25,634 shares of the stock in a transaction that occurred on Monday, January 27th. The stock was bought at an average cost of $39.09 per share, with a total value of $1,002,033.06. Following the completion of the transaction, the chief executive officer now directly owns 25,634 shares in the company, valued at $1,002,033.06. The trade was a ∞ increase in their position. The disclosure for this purchase can be found here. 0.56% of the stock is currently owned by company insiders.

Institutional Trading of Ally Financial

Several institutional investors have recently made changes to their positions in the company. Norges Bank purchased a new position in Ally Financial during the fourth quarter worth about $75,483,000. Jacobs Levy Equity Management Inc. lifted its position in shares of Ally Financial by 84.0% during the 4th quarter. Jacobs Levy Equity Management Inc. now owns 4,202,179 shares of the financial services provider's stock worth $151,320,000 after buying an additional 1,918,965 shares in the last quarter. Assenagon Asset Management S.A. boosted its stake in shares of Ally Financial by 233.4% in the 4th quarter. Assenagon Asset Management S.A. now owns 2,430,128 shares of the financial services provider's stock worth $87,509,000 after buying an additional 1,701,264 shares during the last quarter. Phoenix Financial Ltd. grew its holdings in shares of Ally Financial by 86.4% in the fourth quarter. Phoenix Financial Ltd. now owns 3,390,066 shares of the financial services provider's stock valued at $122,077,000 after acquiring an additional 1,571,027 shares in the last quarter. Finally, Janus Henderson Group PLC increased its position in shares of Ally Financial by 6,226.4% during the fourth quarter. Janus Henderson Group PLC now owns 1,368,654 shares of the financial services provider's stock valued at $49,285,000 after acquiring an additional 1,347,020 shares during the last quarter. Institutional investors own 88.76% of the company's stock.

Ally Financial Company Profile

(

Get Free Report)

Ally Financial Inc, a digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda. The company operates through Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations segments.

Further Reading

Before you consider Ally Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ally Financial wasn't on the list.

While Ally Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here