Ally Financial (NYSE:ALLY - Get Free Report) had its price objective hoisted by Citigroup from $50.00 to $55.00 in a research note issued to investors on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the financial services provider's stock. Citigroup's price objective suggests a potential upside of 52.35% from the company's previous close.

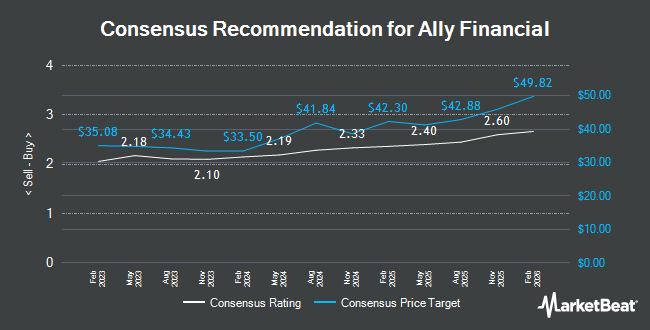

Several other analysts have also weighed in on the company. Royal Bank of Canada restated an "outperform" rating and set a $40.00 price target on shares of Ally Financial in a report on Monday, October 21st. TD Cowen dropped their price objective on Ally Financial from $45.00 to $37.00 and set a "hold" rating for the company in a report on Monday, September 23rd. Morgan Stanley reduced their target price on Ally Financial from $45.00 to $41.00 and set an "overweight" rating on the stock in a research note on Monday, October 21st. Wells Fargo & Company lowered their target price on shares of Ally Financial from $37.00 to $32.00 and set an "underweight" rating for the company in a research note on Thursday, September 26th. Finally, StockNews.com upgraded shares of Ally Financial from a "sell" rating to a "hold" rating in a report on Saturday, October 19th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating and nine have issued a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $40.69.

Check Out Our Latest Report on Ally Financial

Ally Financial Price Performance

ALLY traded down $0.12 on Friday, hitting $36.10. 821,446 shares of the company's stock traded hands, compared to its average volume of 3,478,438. The company's 50 day simple moving average is $35.20 and its 200-day simple moving average is $38.77. The company has a current ratio of 0.92, a quick ratio of 0.92 and a debt-to-equity ratio of 1.36. Ally Financial has a one year low of $26.50 and a one year high of $45.46. The firm has a market cap of $11.00 billion, a price-to-earnings ratio of 14.44, a P/E/G ratio of 0.43 and a beta of 1.40.

Ally Financial (NYSE:ALLY - Get Free Report) last announced its quarterly earnings results on Friday, October 18th. The financial services provider reported $0.95 EPS for the quarter, beating analysts' consensus estimates of $0.57 by $0.38. Ally Financial had a return on equity of 8.39% and a net margin of 10.84%. The company had revenue of $2.10 billion during the quarter, compared to analyst estimates of $2.03 billion. During the same period in the prior year, the company earned $0.83 earnings per share. The firm's revenue was up 6.9% on a year-over-year basis. As a group, research analysts anticipate that Ally Financial will post 3 EPS for the current year.

Institutional Trading of Ally Financial

Hedge funds and other institutional investors have recently made changes to their positions in the business. Oppenheimer & Co. Inc. purchased a new stake in shares of Ally Financial during the first quarter worth about $367,000. US Bancorp DE raised its holdings in shares of Ally Financial by 5.1% in the first quarter. US Bancorp DE now owns 16,297 shares of the financial services provider's stock worth $661,000 after buying an additional 793 shares during the last quarter. State Board of Administration of Florida Retirement System lifted its stake in shares of Ally Financial by 13.3% during the first quarter. State Board of Administration of Florida Retirement System now owns 398,252 shares of the financial services provider's stock worth $16,165,000 after buying an additional 46,880 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. grew its holdings in shares of Ally Financial by 17.6% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 159,405 shares of the financial services provider's stock valued at $6,470,000 after buying an additional 23,803 shares during the last quarter. Finally, Blair William & Co. IL raised its stake in Ally Financial by 107.0% in the 1st quarter. Blair William & Co. IL now owns 20,019 shares of the financial services provider's stock worth $813,000 after acquiring an additional 10,350 shares during the last quarter. Hedge funds and other institutional investors own 88.76% of the company's stock.

Ally Financial Company Profile

(

Get Free Report)

Ally Financial Inc, a digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda. The company operates through Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations segments.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ally Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ally Financial wasn't on the list.

While Ally Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.