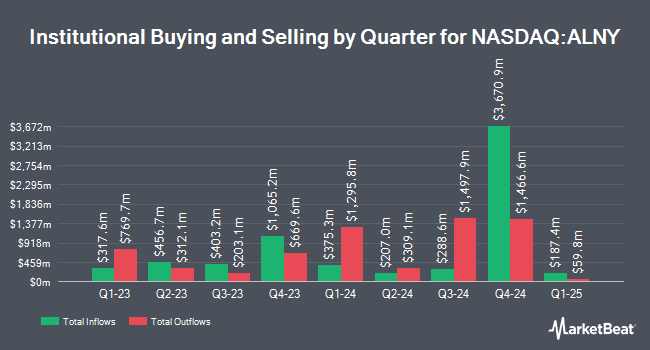

Groupama Asset Managment grew its stake in shares of Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY - Free Report) by 0.5% in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 1,528,450 shares of the biopharmaceutical company's stock after buying an additional 7,065 shares during the period. Alnylam Pharmaceuticals accounts for approximately 2.6% of Groupama Asset Managment's holdings, making the stock its 7th biggest holding. Groupama Asset Managment owned approximately 1.19% of Alnylam Pharmaceuticals worth $359,660,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also made changes to their positions in the company. Quantbot Technologies LP increased its position in Alnylam Pharmaceuticals by 1,754.5% during the 3rd quarter. Quantbot Technologies LP now owns 204 shares of the biopharmaceutical company's stock worth $56,000 after purchasing an additional 193 shares in the last quarter. Bridgewater Associates LP acquired a new stake in shares of Alnylam Pharmaceuticals in the third quarter worth $551,000. Captrust Financial Advisors raised its stake in shares of Alnylam Pharmaceuticals by 34.4% in the 3rd quarter. Captrust Financial Advisors now owns 4,833 shares of the biopharmaceutical company's stock valued at $1,329,000 after acquiring an additional 1,237 shares during the period. True Wealth Design LLC lifted its holdings in shares of Alnylam Pharmaceuticals by 15,300.0% during the 3rd quarter. True Wealth Design LLC now owns 154 shares of the biopharmaceutical company's stock valued at $42,000 after acquiring an additional 153 shares in the last quarter. Finally, Erste Asset Management GmbH purchased a new stake in Alnylam Pharmaceuticals during the 3rd quarter worth $4,539,000. 92.97% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

ALNY has been the topic of a number of recent research reports. JPMorgan Chase & Co. upgraded Alnylam Pharmaceuticals from a "neutral" rating to an "overweight" rating and boosted their price objective for the stock from $280.00 to $328.00 in a research note on Monday, March 24th. Stifel Nicolaus boosted their price target on Alnylam Pharmaceuticals from $300.00 to $345.00 and gave the stock a "buy" rating in a research report on Monday, March 31st. Scotiabank increased their price objective on shares of Alnylam Pharmaceuticals from $338.00 to $342.00 and gave the company a "sector outperform" rating in a research report on Monday, March 31st. Citigroup boosted their target price on shares of Alnylam Pharmaceuticals from $338.00 to $351.00 and gave the stock a "buy" rating in a research report on Friday, March 21st. Finally, Needham & Company LLC reaffirmed a "buy" rating and set a $320.00 price target on shares of Alnylam Pharmaceuticals in a report on Friday, March 21st. One research analyst has rated the stock with a sell rating, five have issued a hold rating and twenty-one have issued a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $316.25.

Check Out Our Latest Analysis on Alnylam Pharmaceuticals

Alnylam Pharmaceuticals Stock Performance

NASDAQ ALNY traded down $26.42 during trading hours on Friday, reaching $235.74. The company's stock had a trading volume of 1,881,579 shares, compared to its average volume of 844,661. The company has a current ratio of 2.78, a quick ratio of 2.71 and a debt-to-equity ratio of 15.27. The business has a 50-day simple moving average of $259.03 and a 200 day simple moving average of $260.23. Alnylam Pharmaceuticals, Inc. has a 52 week low of $141.98 and a 52 week high of $304.39. The stock has a market cap of $30.67 billion, a PE ratio of -108.64 and a beta of 0.30.

Alnylam Pharmaceuticals (NASDAQ:ALNY - Get Free Report) last announced its quarterly earnings results on Thursday, February 13th. The biopharmaceutical company reported ($0.65) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.62) by ($0.03). Equities research analysts predict that Alnylam Pharmaceuticals, Inc. will post -1.7 earnings per share for the current fiscal year.

Insider Transactions at Alnylam Pharmaceuticals

In related news, Director Phillip A. Sharp sold 11,250 shares of the stock in a transaction that occurred on Thursday, January 23rd. The stock was sold at an average price of $275.00, for a total value of $3,093,750.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CMO Pushkal Garg sold 1,548 shares of Alnylam Pharmaceuticals stock in a transaction on Tuesday, February 18th. The shares were sold at an average price of $251.67, for a total value of $389,585.16. Following the sale, the chief marketing officer now directly owns 11,989 shares in the company, valued at $3,017,271.63. The trade was a 11.44 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 71,234 shares of company stock worth $19,958,097. Insiders own 1.50% of the company's stock.

About Alnylam Pharmaceuticals

(

Free Report)

Alnylam Pharmaceuticals, Inc, a biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference. Its marketed products include ONPATTRO (patisiran) for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults; AMVUTTRA for the treatment of hATTR amyloidosis with polyneuropathy in adults; GIVLAARI for the treatment of adults with acute hepatic porphyria; and OXLUMO for the treatment of primary hyperoxaluria type 1.

Recommended Stories

Before you consider Alnylam Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alnylam Pharmaceuticals wasn't on the list.

While Alnylam Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.