Alnylam Pharmaceuticals (NASDAQ:ALNY - Get Free Report) was upgraded by analysts at StockNews.com from a "hold" rating to a "buy" rating in a note issued to investors on Wednesday.

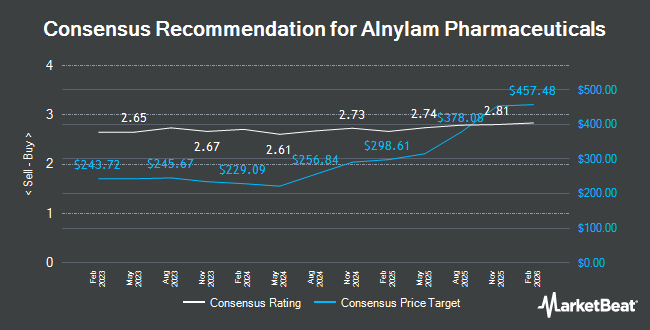

Several other brokerages have also recently commented on ALNY. Wolfe Research cut shares of Alnylam Pharmaceuticals from a "peer perform" rating to an "underperform" rating in a report on Tuesday, November 12th. Barclays raised their price objective on Alnylam Pharmaceuticals from $295.00 to $329.00 and gave the stock an "overweight" rating in a research note on Friday, November 1st. TD Cowen upped their target price on Alnylam Pharmaceuticals from $282.00 to $371.00 and gave the company a "buy" rating in a research report on Monday, October 21st. Piper Sandler reissued an "overweight" rating and set a $296.00 target price on shares of Alnylam Pharmaceuticals in a report on Monday, November 18th. Finally, Canaccord Genuity Group boosted their price target on Alnylam Pharmaceuticals from $366.00 to $384.00 and gave the company a "buy" rating in a research note on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and nineteen have issued a buy rating to the company's stock. According to MarketBeat, Alnylam Pharmaceuticals currently has a consensus rating of "Moderate Buy" and an average target price of $298.09.

Get Our Latest Stock Analysis on ALNY

Alnylam Pharmaceuticals Stock Performance

ALNY stock traded down $8.66 during midday trading on Wednesday, reaching $237.92. 543,101 shares of the company were exchanged, compared to its average volume of 857,668. Alnylam Pharmaceuticals has a one year low of $141.98 and a one year high of $304.39. The firm has a market capitalization of $30.69 billion, a price-to-earnings ratio of -90.81 and a beta of 0.32. The business has a 50-day moving average price of $266.06 and a two-hundred day moving average price of $250.92. The company has a debt-to-equity ratio of 31.64, a current ratio of 2.75 and a quick ratio of 2.69.

Alnylam Pharmaceuticals (NASDAQ:ALNY - Get Free Report) last announced its earnings results on Thursday, October 31st. The biopharmaceutical company reported ($0.87) earnings per share for the quarter, missing analysts' consensus estimates of ($0.51) by ($0.36). The firm had revenue of $500.90 million during the quarter, compared to the consensus estimate of $532.91 million. During the same quarter in the prior year, the business posted $1.15 EPS. The company's revenue for the quarter was down 33.3% compared to the same quarter last year. Equities research analysts forecast that Alnylam Pharmaceuticals will post -2.21 EPS for the current year.

Insider Transactions at Alnylam Pharmaceuticals

In other Alnylam Pharmaceuticals news, EVP Tolga Tanguler sold 1,469 shares of the firm's stock in a transaction that occurred on Tuesday, November 26th. The stock was sold at an average price of $250.98, for a total value of $368,689.62. Following the completion of the sale, the executive vice president now owns 13,191 shares of the company's stock, valued at approximately $3,310,677.18. This trade represents a 10.02 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CEO Yvonne Greenstreet sold 5,219 shares of the business's stock in a transaction that occurred on Tuesday, November 26th. The shares were sold at an average price of $250.98, for a total value of $1,309,864.62. Following the sale, the chief executive officer now owns 78,880 shares of the company's stock, valued at approximately $19,797,302.40. This represents a 6.21 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 10,122 shares of company stock valued at $2,540,455 in the last quarter. 1.50% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Alnylam Pharmaceuticals

A number of hedge funds have recently added to or reduced their stakes in the stock. Souders Financial Advisors grew its stake in shares of Alnylam Pharmaceuticals by 1.0% in the 2nd quarter. Souders Financial Advisors now owns 3,512 shares of the biopharmaceutical company's stock worth $853,000 after acquiring an additional 36 shares in the last quarter. Huntington National Bank boosted its holdings in Alnylam Pharmaceuticals by 91.8% during the third quarter. Huntington National Bank now owns 94 shares of the biopharmaceutical company's stock worth $26,000 after purchasing an additional 45 shares during the last quarter. SYM FINANCIAL Corp grew its position in Alnylam Pharmaceuticals by 6.2% in the 3rd quarter. SYM FINANCIAL Corp now owns 947 shares of the biopharmaceutical company's stock worth $260,000 after purchasing an additional 55 shares in the last quarter. Lindbrook Capital LLC grew its position in Alnylam Pharmaceuticals by 11.1% in the 3rd quarter. Lindbrook Capital LLC now owns 570 shares of the biopharmaceutical company's stock worth $157,000 after purchasing an additional 57 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC increased its stake in Alnylam Pharmaceuticals by 54.2% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 259 shares of the biopharmaceutical company's stock valued at $63,000 after buying an additional 91 shares during the last quarter. Institutional investors and hedge funds own 92.97% of the company's stock.

About Alnylam Pharmaceuticals

(

Get Free Report)

Alnylam Pharmaceuticals, Inc, a biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference. Its marketed products include ONPATTRO (patisiran) for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults; AMVUTTRA for the treatment of hATTR amyloidosis with polyneuropathy in adults; GIVLAARI for the treatment of adults with acute hepatic porphyria; and OXLUMO for the treatment of primary hyperoxaluria type 1.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alnylam Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alnylam Pharmaceuticals wasn't on the list.

While Alnylam Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.