Sanders Capital LLC boosted its holdings in shares of Alphabet Inc. (NASDAQ:GOOG - Free Report) by 0.2% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 29,257,164 shares of the information services provider's stock after purchasing an additional 46,730 shares during the period. Alphabet comprises approximately 7.1% of Sanders Capital LLC's holdings, making the stock its 4th largest holding. Sanders Capital LLC owned about 0.24% of Alphabet worth $4,891,505,000 at the end of the most recent quarter.

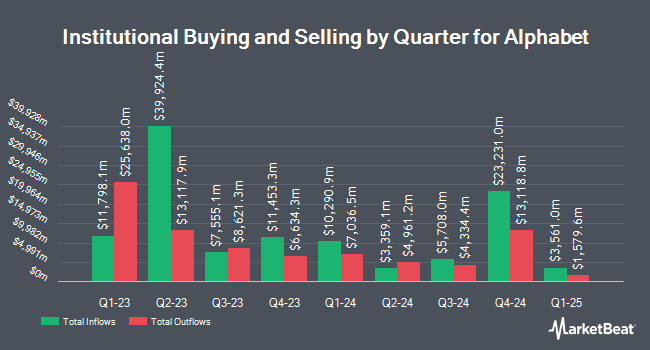

Several other institutional investors and hedge funds have also bought and sold shares of GOOG. FMR LLC raised its stake in Alphabet by 5.2% in the third quarter. FMR LLC now owns 114,802,133 shares of the information services provider's stock worth $19,193,768,000 after buying an additional 5,655,022 shares in the last quarter. Jennison Associates LLC raised its position in shares of Alphabet by 9.1% in the 3rd quarter. Jennison Associates LLC now owns 15,424,324 shares of the information services provider's stock worth $2,578,793,000 after acquiring an additional 1,291,274 shares in the last quarter. Dimensional Fund Advisors LP lifted its stake in shares of Alphabet by 4.5% in the 2nd quarter. Dimensional Fund Advisors LP now owns 14,657,421 shares of the information services provider's stock valued at $2,688,743,000 after purchasing an additional 636,008 shares during the period. American Century Companies Inc. grew its stake in Alphabet by 2.3% in the second quarter. American Century Companies Inc. now owns 12,327,458 shares of the information services provider's stock worth $2,261,103,000 after purchasing an additional 282,121 shares during the period. Finally, Principal Financial Group Inc. raised its holdings in Alphabet by 2.5% in the third quarter. Principal Financial Group Inc. now owns 11,024,276 shares of the information services provider's stock worth $1,843,149,000 after purchasing an additional 264,962 shares in the last quarter. Hedge funds and other institutional investors own 27.26% of the company's stock.

Alphabet Stock Performance

GOOG stock traded up $1.19 during trading on Tuesday, reaching $170.62. The stock had a trading volume of 14,659,379 shares, compared to its average volume of 19,636,730. The stock's 50 day moving average is $169.30 and its two-hundred day moving average is $171.85. The firm has a market cap of $2.09 trillion, a PE ratio of 22.60, a PEG ratio of 1.16 and a beta of 1.04. Alphabet Inc. has a 52 week low of $129.40 and a 52 week high of $193.31. The company has a current ratio of 1.95, a quick ratio of 1.95 and a debt-to-equity ratio of 0.04.

Alphabet (NASDAQ:GOOG - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The information services provider reported $2.12 earnings per share for the quarter, topping the consensus estimate of $1.83 by $0.29. The firm had revenue of $88.27 billion for the quarter, compared to analysts' expectations of $86.39 billion. Alphabet had a net margin of 27.74% and a return on equity of 31.66%. The business's quarterly revenue was up 15.1% on a year-over-year basis. During the same quarter in the prior year, the business earned $1.55 EPS. As a group, equities analysts anticipate that Alphabet Inc. will post 8.02 earnings per share for the current year.

Alphabet Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 9th will be given a dividend of $0.20 per share. This represents a $0.80 dividend on an annualized basis and a dividend yield of 0.47%. The ex-dividend date of this dividend is Monday, December 9th. Alphabet's payout ratio is 10.61%.

Analysts Set New Price Targets

Several research analysts recently issued reports on GOOG shares. Cantor Fitzgerald upgraded shares of Alphabet to a "hold" rating in a research note on Thursday, September 5th. Barclays upped their price target on Alphabet from $200.00 to $220.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 30th. Scotiabank started coverage on Alphabet in a report on Friday, October 11th. They issued a "sector outperform" rating and a $212.00 target price on the stock. Citigroup lifted their price target on Alphabet from $212.00 to $216.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. Finally, Oppenheimer increased their price objective on shares of Alphabet from $185.00 to $215.00 and gave the company an "outperform" rating in a research report on Wednesday, October 30th. Five analysts have rated the stock with a hold rating, thirteen have given a buy rating and three have assigned a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $200.56.

Get Our Latest Stock Report on Alphabet

Insider Transactions at Alphabet

In related news, CEO Sundar Pichai sold 22,500 shares of the business's stock in a transaction that occurred on Wednesday, September 4th. The stock was sold at an average price of $158.68, for a total transaction of $3,570,300.00. Following the completion of the transaction, the chief executive officer now directly owns 2,137,385 shares in the company, valued at approximately $339,160,251.80. The trade was a 1.04 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CAO Amie Thuener O'toole sold 682 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $160.44, for a total transaction of $109,420.08. Following the sale, the chief accounting officer now owns 32,017 shares in the company, valued at approximately $5,136,807.48. The trade was a 2.09 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 206,795 shares of company stock worth $34,673,866 in the last three months. Corporate insiders own 12.99% of the company's stock.

Alphabet Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Further Reading

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report