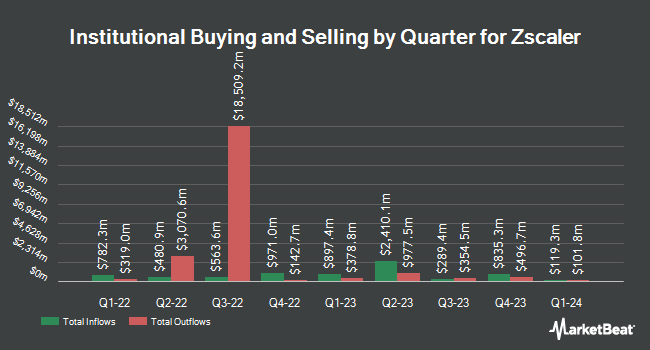

AlphaQuest LLC acquired a new stake in Zscaler, Inc. (NASDAQ:ZS - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 2,618 shares of the company's stock, valued at approximately $472,000.

Other institutional investors have also bought and sold shares of the company. Global X Japan Co. Ltd. raised its holdings in Zscaler by 127.4% during the 4th quarter. Global X Japan Co. Ltd. now owns 141 shares of the company's stock valued at $25,000 after acquiring an additional 79 shares during the period. Stonebridge Financial Group LLC bought a new stake in Zscaler during the 4th quarter valued at $29,000. Prestige Wealth Management Group LLC bought a new stake in Zscaler during the 3rd quarter valued at $31,000. True Wealth Design LLC raised its holdings in Zscaler by 18,500.0% during the 3rd quarter. True Wealth Design LLC now owns 186 shares of the company's stock valued at $32,000 after acquiring an additional 185 shares during the period. Finally, Versant Capital Management Inc raised its holdings in Zscaler by 136.8% during the 4th quarter. Versant Capital Management Inc now owns 180 shares of the company's stock valued at $32,000 after acquiring an additional 104 shares during the period. Hedge funds and other institutional investors own 46.45% of the company's stock.

Insider Activity

In other news, insider Syam Nair sold 3,682 shares of the stock in a transaction that occurred on Tuesday, December 17th. The shares were sold at an average price of $200.32, for a total value of $737,578.24. Following the transaction, the insider now owns 142,866 shares in the company, valued at $28,618,917.12. This represents a 2.51 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Jagtar Singh Chaudhry sold 2,863 shares of the stock in a transaction that occurred on Tuesday, December 17th. The stock was sold at an average price of $200.32, for a total transaction of $573,516.16. Following the completion of the transaction, the chief executive officer now owns 358,569 shares in the company, valued at $71,828,542.08. This trade represents a 0.79 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 10,248 shares of company stock valued at $2,052,879 in the last 90 days. 18.10% of the stock is currently owned by insiders.

Zscaler Stock Down 0.8 %

Shares of NASDAQ ZS opened at $197.79 on Thursday. The firm's 50-day moving average price is $197.74 and its 200-day moving average price is $191.66. The company has a market cap of $30.35 billion, a PE ratio of -791.16 and a beta of 0.88. Zscaler, Inc. has a 52-week low of $153.45 and a 52-week high of $217.84.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on ZS. Stifel Nicolaus upped their price target on shares of Zscaler from $220.00 to $235.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Wedbush upped their price target on shares of Zscaler from $230.00 to $240.00 and gave the stock an "outperform" rating in a report on Thursday, March 6th. Jefferies Financial Group upped their price target on shares of Zscaler from $225.00 to $245.00 and gave the stock a "buy" rating in a report on Tuesday, November 26th. Rosenblatt Securities raised shares of Zscaler from a "neutral" rating to a "buy" rating and upped their price target for the stock from $190.00 to $235.00 in a report on Thursday, March 6th. Finally, Deutsche Bank Aktiengesellschaft upped their price target on shares of Zscaler from $200.00 to $225.00 and gave the stock a "buy" rating in a report on Tuesday, December 3rd. Nine equities research analysts have rated the stock with a hold rating and twenty-five have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $233.88.

Read Our Latest Stock Report on ZS

Zscaler Profile

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

See Also

Want to see what other hedge funds are holding ZS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Zscaler, Inc. (NASDAQ:ZS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.