AlphaQuest LLC reduced its stake in nLIGHT, Inc. (NASDAQ:LASR - Free Report) by 81.4% during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 13,416 shares of the company's stock after selling 58,563 shares during the period. AlphaQuest LLC's holdings in nLIGHT were worth $141,000 as of its most recent filing with the Securities and Exchange Commission.

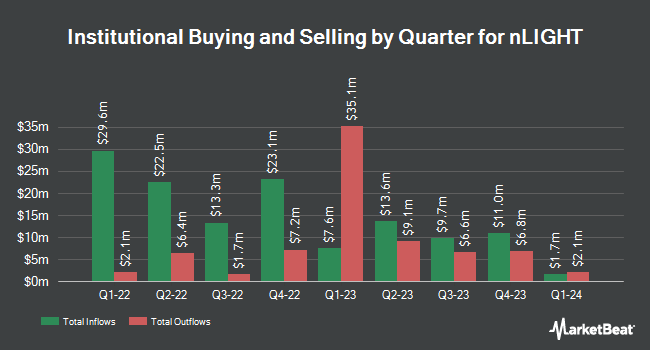

Other hedge funds also recently made changes to their positions in the company. R Squared Ltd acquired a new stake in nLIGHT during the 4th quarter worth approximately $33,000. Point72 DIFC Ltd boosted its position in nLIGHT by 1,637.2% during the 3rd quarter. Point72 DIFC Ltd now owns 4,152 shares of the company's stock worth $44,000 after buying an additional 3,913 shares during the period. Point72 Asia Singapore Pte. Ltd. acquired a new stake in nLIGHT during the 3rd quarter worth approximately $50,000. Quantbot Technologies LP boosted its position in nLIGHT by 25.5% during the 3rd quarter. Quantbot Technologies LP now owns 10,092 shares of the company's stock worth $108,000 after buying an additional 2,052 shares during the period. Finally, Moody National Bank Trust Division acquired a new stake in nLIGHT during the 4th quarter worth approximately $115,000. 83.88% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently commented on the stock. Needham & Company LLC cut their target price on shares of nLIGHT from $16.00 to $14.00 and set a "buy" rating on the stock in a research report on Tuesday, January 21st. Stifel Nicolaus dropped their price target on shares of nLIGHT from $17.00 to $14.00 and set a "buy" rating on the stock in a research report on Wednesday, January 15th.

Get Our Latest Research Report on LASR

nLIGHT Stock Performance

Shares of NASDAQ LASR traded down $0.27 during midday trading on Friday, reaching $8.56. The stock had a trading volume of 460,939 shares, compared to its average volume of 305,074. The company's 50 day moving average price is $10.22 and its 200 day moving average price is $10.74. The firm has a market cap of $419.71 million, a price-to-earnings ratio of -8.31 and a beta of 2.29. nLIGHT, Inc. has a twelve month low of $7.94 and a twelve month high of $14.73.

nLIGHT (NASDAQ:LASR - Get Free Report) last released its quarterly earnings data on Thursday, February 27th. The company reported ($0.42) earnings per share for the quarter, missing the consensus estimate of ($0.21) by ($0.21). The company had revenue of $47.38 million during the quarter, compared to the consensus estimate of $46.62 million. nLIGHT had a negative net margin of 24.16% and a negative return on equity of 19.53%. Equities analysts forecast that nLIGHT, Inc. will post -1.1 earnings per share for the current fiscal year.

Insider Activity

In other news, CEO Scott H. Keeney sold 53,511 shares of nLIGHT stock in a transaction on Tuesday, March 4th. The shares were sold at an average price of $8.17, for a total value of $437,184.87. Following the completion of the sale, the chief executive officer now owns 1,267,927 shares in the company, valued at $10,358,963.59. The trade was a 4.05 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Insiders sold 68,024 shares of company stock worth $579,934 in the last quarter. 6.10% of the stock is owned by corporate insiders.

nLIGHT Company Profile

(

Free Report)

nLIGHT, Inc designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications. The company operates in two segments, Laser Products and Advanced Development. It offers semiconductor lasers with various ranges of power levels, wavelengths, and output fiber sizes; and programmable and serviceable fiber lasers for use in industrial and aerospace and defense applications.

Read More

Before you consider nLIGHT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and nLIGHT wasn't on the list.

While nLIGHT currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.