AlphaQuest LLC lowered its stake in Murphy Oil Co. (NYSE:MUR - Free Report) by 90.4% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 10,419 shares of the oil and gas producer's stock after selling 98,258 shares during the quarter. AlphaQuest LLC's holdings in Murphy Oil were worth $315,000 at the end of the most recent quarter.

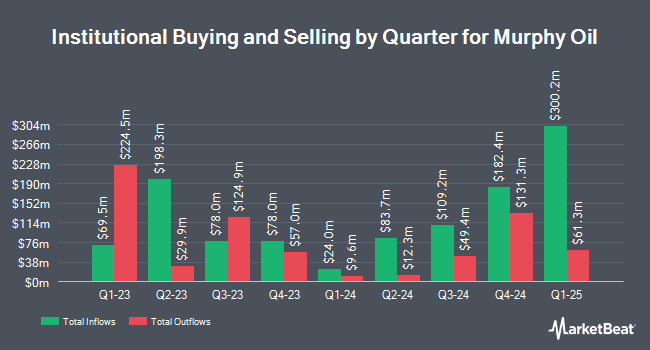

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. Covestor Ltd lifted its stake in shares of Murphy Oil by 266.8% in the 3rd quarter. Covestor Ltd now owns 741 shares of the oil and gas producer's stock worth $25,000 after acquiring an additional 539 shares during the period. Lindbrook Capital LLC lifted its position in Murphy Oil by 60.5% in the fourth quarter. Lindbrook Capital LLC now owns 1,441 shares of the oil and gas producer's stock worth $44,000 after purchasing an additional 543 shares during the period. Jones Financial Companies Lllp boosted its stake in Murphy Oil by 32.9% during the 4th quarter. Jones Financial Companies Lllp now owns 2,284 shares of the oil and gas producer's stock valued at $69,000 after purchasing an additional 565 shares in the last quarter. New Wave Wealth Advisors LLC acquired a new position in shares of Murphy Oil during the 4th quarter valued at $113,000. Finally, KBC Group NV raised its stake in shares of Murphy Oil by 14.5% in the 3rd quarter. KBC Group NV now owns 4,276 shares of the oil and gas producer's stock worth $144,000 after buying an additional 540 shares in the last quarter. Institutional investors own 78.31% of the company's stock.

Insider Transactions at Murphy Oil

In related news, VP Meenambigai Palanivelu purchased 1,573 shares of the firm's stock in a transaction dated Wednesday, February 5th. The stock was bought at an average price of $26.70 per share, for a total transaction of $41,999.10. Following the purchase, the vice president now owns 37,065 shares in the company, valued at $989,635.50. The trade was a 4.43 % increase in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Claiborne P. Deming acquired 50,000 shares of the business's stock in a transaction that occurred on Tuesday, February 4th. The stock was bought at an average cost of $26.47 per share, for a total transaction of $1,323,500.00. Following the completion of the purchase, the director now directly owns 931,651 shares in the company, valued at $24,660,801.97. This represents a 5.67 % increase in their position. The disclosure for this purchase can be found here. 5.92% of the stock is currently owned by company insiders.

Murphy Oil Stock Down 2.0 %

Shares of NYSE:MUR traded down $0.54 during midday trading on Tuesday, hitting $26.12. 2,152,794 shares of the stock were exchanged, compared to its average volume of 1,741,871. The company has a market capitalization of $3.81 billion, a PE ratio of 9.71 and a beta of 2.18. Murphy Oil Co. has a 52-week low of $22.90 and a 52-week high of $49.14. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.77 and a current ratio of 0.83. The business's fifty day simple moving average is $28.36 and its two-hundred day simple moving average is $31.18.

Murphy Oil (NYSE:MUR - Get Free Report) last posted its quarterly earnings results on Thursday, January 30th. The oil and gas producer reported $0.35 earnings per share for the quarter, missing analysts' consensus estimates of $0.62 by ($0.27). Murphy Oil had a return on equity of 7.66% and a net margin of 13.44%. During the same period in the previous year, the company earned $0.90 EPS. As a group, research analysts predict that Murphy Oil Co. will post 2.94 earnings per share for the current fiscal year.

Murphy Oil Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, March 3rd. Shareholders of record on Tuesday, February 18th were given a $0.325 dividend. This represents a $1.30 annualized dividend and a yield of 4.98%. This is an increase from Murphy Oil's previous quarterly dividend of $0.30. The ex-dividend date was Tuesday, February 18th. Murphy Oil's payout ratio is currently 48.33%.

Wall Street Analyst Weigh In

MUR has been the subject of several research reports. Piper Sandler decreased their target price on Murphy Oil from $35.00 to $34.00 and set an "overweight" rating for the company in a research note on Thursday, March 6th. JPMorgan Chase & Co. lowered their price objective on shares of Murphy Oil from $33.00 to $28.00 and set a "neutral" rating on the stock in a research note on Thursday, March 13th. Wells Fargo & Company reiterated an "equal weight" rating on shares of Murphy Oil in a research report on Monday, February 3rd. Mizuho decreased their price target on Murphy Oil from $50.00 to $45.00 and set an "outperform" rating for the company in a research report on Monday, December 16th. Finally, UBS Group reduced their price objective on shares of Murphy Oil from $34.00 to $32.00 and set a "neutral" rating for the company in a research note on Monday, February 3rd. One equities research analyst has rated the stock with a sell rating, ten have assigned a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat, Murphy Oil currently has an average rating of "Hold" and an average target price of $35.31.

Check Out Our Latest Stock Analysis on MUR

Murphy Oil Profile

(

Free Report)

Murphy Oil Corporation, together with its subsidiaries, operates as an oil and gas exploration and production company in the United States, Canada, and internationally. It explores for and produces crude oil, natural gas, and natural gas liquids. The company was formerly known as Murphy Corporation and changed its name to Murphy Oil Corporation in 1964.

Read More

Before you consider Murphy Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Murphy Oil wasn't on the list.

While Murphy Oil currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.