Alpine Associates Management Inc. boosted its holdings in VIZIO Holding Corp. (NYSE:VZIO - Free Report) by 10.3% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 3,398,063 shares of the company's stock after purchasing an additional 317,765 shares during the quarter. VIZIO comprises approximately 1.7% of Alpine Associates Management Inc.'s investment portfolio, making the stock its 15th largest holding. Alpine Associates Management Inc. owned about 1.69% of VIZIO worth $37,956,000 at the end of the most recent quarter.

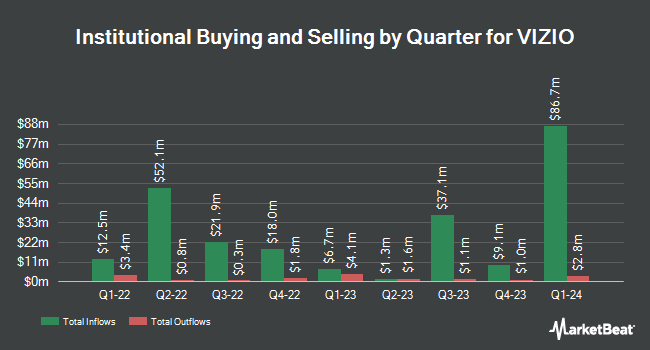

Other hedge funds and other institutional investors have also bought and sold shares of the company. Pentwater Capital Management LP grew its position in shares of VIZIO by 1,294.9% during the 2nd quarter. Pentwater Capital Management LP now owns 6,800,000 shares of the company's stock valued at $73,440,000 after acquiring an additional 6,312,500 shares during the period. Magnetar Financial LLC bought a new position in VIZIO in the 1st quarter worth about $43,318,000. Vanguard Group Inc. grew its holdings in VIZIO by 13.6% during the 1st quarter. Vanguard Group Inc. now owns 7,686,512 shares of the company's stock valued at $84,090,000 after buying an additional 918,300 shares in the last quarter. Gabelli Funds LLC purchased a new position in VIZIO during the first quarter valued at approximately $9,784,000. Finally, Hsbc Holdings PLC increased its holdings in VIZIO by 26.9% during the 2nd quarter. Hsbc Holdings PLC now owns 2,162,523 shares of the company's stock worth $23,290,000 after acquiring an additional 457,893 shares during the period. Institutional investors own 66.24% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on VZIO. Barrington Research cut shares of VIZIO from a "strong-buy" rating to a "hold" rating in a report on Thursday, November 7th. Needham & Company LLC reaffirmed a "hold" rating on shares of VIZIO in a report on Wednesday, October 9th. Nine equities research analysts have rated the stock with a hold rating, Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $11.08.

Get Our Latest Analysis on VZIO

VIZIO Stock Performance

Shares of VZIO remained flat at $11.29 during mid-day trading on Wednesday. 1,063,674 shares of the stock were exchanged, compared to its average volume of 2,439,044. VIZIO Holding Corp. has a 1 year low of $6.63 and a 1 year high of $11.37. The stock's 50 day moving average price is $11.22 and its two-hundred day moving average price is $10.99. The firm has a market capitalization of $2.29 billion, a PE ratio of 1,129.00 and a beta of 2.03.

About VIZIO

(

Free Report)

VIZIO Holding Corp., through its subsidiaries, provides smart televisions, sound bars, and accessories in the United States. It also operates Platform+ that comprises SmartCast, a Smart TV operating system, enabling integrated entertainment solution, and data intelligence and services products through Inscape.

See Also

Before you consider VIZIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VIZIO wasn't on the list.

While VIZIO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.