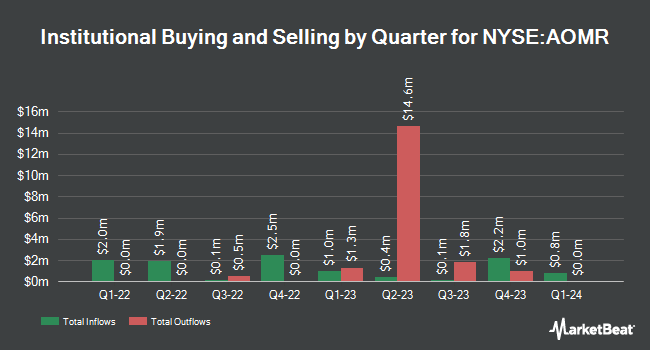

Alpine Global Management LLC acquired a new position in shares of Angel Oak Mortgage REIT, Inc. (NYSE:AOMR - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 102,971 shares of the company's stock, valued at approximately $956,000. Alpine Global Management LLC owned 0.44% of Angel Oak Mortgage REIT at the end of the most recent reporting period.

A number of other hedge funds have also modified their holdings of AOMR. State Street Corp lifted its stake in Angel Oak Mortgage REIT by 3.4% in the 3rd quarter. State Street Corp now owns 333,989 shares of the company's stock valued at $3,484,000 after acquiring an additional 10,909 shares in the last quarter. Jane Street Group LLC lifted its position in shares of Angel Oak Mortgage REIT by 256.2% in the third quarter. Jane Street Group LLC now owns 46,293 shares of the company's stock worth $483,000 after purchasing an additional 33,297 shares in the last quarter. Public Employees Retirement System of Ohio acquired a new position in Angel Oak Mortgage REIT during the third quarter worth $43,000. Barclays PLC grew its position in Angel Oak Mortgage REIT by 294.4% in the third quarter. Barclays PLC now owns 15,813 shares of the company's stock valued at $165,000 after purchasing an additional 11,804 shares in the last quarter. Finally, JPMorgan Chase & Co. increased its stake in Angel Oak Mortgage REIT by 285.3% in the 3rd quarter. JPMorgan Chase & Co. now owns 27,201 shares of the company's stock valued at $284,000 after buying an additional 20,142 shares during the last quarter. 80.15% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the company. Janney Montgomery Scott initiated coverage on Angel Oak Mortgage REIT in a report on Thursday, January 2nd. They issued a "buy" rating and a $13.00 price objective for the company. Wells Fargo & Company dropped their price objective on Angel Oak Mortgage REIT from $12.00 to $11.00 and set an "overweight" rating on the stock in a research note on Wednesday, March 5th. B. Riley raised shares of Angel Oak Mortgage REIT from a "neutral" rating to a "buy" rating and set a $12.00 target price for the company in a research note on Monday. Finally, Jones Trading dropped their price target on shares of Angel Oak Mortgage REIT from $12.50 to $10.50 and set a "buy" rating on the stock in a research report on Thursday, April 17th. One analyst has rated the stock with a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $11.75.

View Our Latest Analysis on Angel Oak Mortgage REIT

Angel Oak Mortgage REIT Stock Performance

Angel Oak Mortgage REIT stock traded down $0.07 during mid-day trading on Friday, hitting $8.45. 138,555 shares of the company's stock traded hands, compared to its average volume of 115,471. The company has a debt-to-equity ratio of 5.29, a current ratio of 5.76 and a quick ratio of 5.76. The firm has a 50 day simple moving average of $9.14 and a two-hundred day simple moving average of $9.51. Angel Oak Mortgage REIT, Inc. has a fifty-two week low of $7.36 and a fifty-two week high of $13.32. The stock has a market cap of $198.58 million, a price-to-earnings ratio of 2.87 and a beta of 1.44.

Angel Oak Mortgage REIT Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Friday, February 21st were paid a dividend of $0.32 per share. This represents a $1.28 dividend on an annualized basis and a dividend yield of 15.15%. The ex-dividend date of this dividend was Friday, February 21st. Angel Oak Mortgage REIT's dividend payout ratio is presently 112.28%.

Angel Oak Mortgage REIT Profile

(

Free Report)

Angel Oak Mortgage REIT, Inc, a real estate finance company, focuses on acquiring and investing in first lien non- qualified mortgage loans and other mortgage-related assets in the United States mortgage market. It offers investment securities; residential mortgage loans; and commercial mortgage loans.

Featured Articles

Before you consider Angel Oak Mortgage REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Angel Oak Mortgage REIT wasn't on the list.

While Angel Oak Mortgage REIT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.