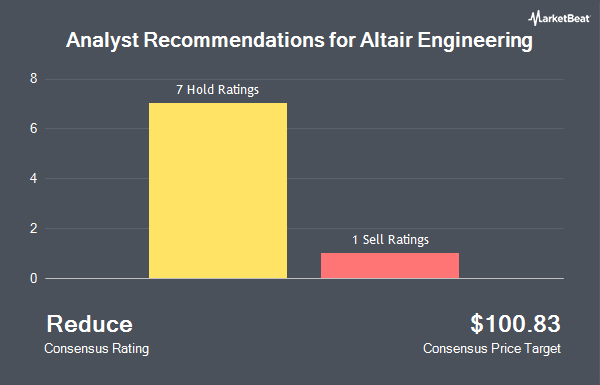

Altair Engineering Inc. (NASDAQ:ALTR - Get Free Report) has been given an average rating of "Hold" by the nine ratings firms that are presently covering the firm, MarketBeat Ratings reports. One analyst has rated the stock with a sell recommendation, seven have issued a hold recommendation and one has issued a buy recommendation on the company. The average 1 year target price among analysts that have issued ratings on the stock in the last year is $100.71.

A number of equities analysts have commented on the stock. Rosenblatt Securities lifted their price objective on shares of Altair Engineering from $88.00 to $113.00 and gave the stock a "neutral" rating in a report on Thursday, October 31st. JPMorgan Chase & Co. lowered shares of Altair Engineering from an "overweight" rating to a "neutral" rating and set a $95.00 price target for the company. in a report on Monday, July 15th. Loop Capital reiterated a "hold" rating and set a $113.00 price objective on shares of Altair Engineering in a research note on Thursday, October 31st. William Blair reissued a "market perform" rating on shares of Altair Engineering in a report on Thursday, October 31st. Finally, Needham & Company LLC reaffirmed a "hold" rating and set a $100.00 target price on shares of Altair Engineering in a report on Thursday, October 31st.

Read Our Latest Stock Analysis on Altair Engineering

Altair Engineering Stock Down 0.3 %

NASDAQ ALTR traded down $0.31 during trading hours on Friday, reaching $103.65. 2,246,368 shares of the company traded hands, compared to its average volume of 1,379,219. The stock has a market capitalization of $8.82 billion, a PE ratio of 272.77, a PEG ratio of 11.95 and a beta of 1.44. The company has a current ratio of 3.27, a quick ratio of 3.27 and a debt-to-equity ratio of 0.27. Altair Engineering has a 12 month low of $68.25 and a 12 month high of $113.12. The company has a 50 day moving average of $95.72 and a two-hundred day moving average of $92.45.

Insiders Place Their Bets

In other Altair Engineering news, major shareholder Jrs Investments Llc sold 6,500 shares of the business's stock in a transaction dated Wednesday, August 28th. The shares were sold at an average price of $89.04, for a total transaction of $578,760.00. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. In related news, insider Jeffrey Marraccini sold 1,824 shares of the firm's stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $104.10, for a total transaction of $189,878.40. Following the completion of the transaction, the insider now owns 4,680 shares of the company's stock, valued at $487,188. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, major shareholder Jrs Investments Llc sold 6,500 shares of Altair Engineering stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $89.04, for a total value of $578,760.00. The disclosure for this sale can be found here. In the last quarter, insiders sold 362,184 shares of company stock worth $35,679,887. 21.75% of the stock is owned by company insiders.

Hedge Funds Weigh In On Altair Engineering

Large investors have recently made changes to their positions in the business. SG Americas Securities LLC acquired a new stake in Altair Engineering during the first quarter valued at approximately $177,000. Swiss National Bank raised its position in shares of Altair Engineering by 1.2% during the first quarter. Swiss National Bank now owns 107,800 shares of the software's stock worth $9,287,000 after purchasing an additional 1,300 shares during the period. Sei Investments Co. lifted its holdings in shares of Altair Engineering by 40.6% during the first quarter. Sei Investments Co. now owns 30,813 shares of the software's stock valued at $2,655,000 after purchasing an additional 8,905 shares during the last quarter. QRG Capital Management Inc. boosted its position in shares of Altair Engineering by 9.5% in the 1st quarter. QRG Capital Management Inc. now owns 20,532 shares of the software's stock valued at $1,769,000 after purchasing an additional 1,781 shares during the period. Finally, Russell Investments Group Ltd. boosted its position in shares of Altair Engineering by 5,564.8% in the 1st quarter. Russell Investments Group Ltd. now owns 31,043 shares of the software's stock valued at $2,676,000 after purchasing an additional 30,495 shares during the period. Institutional investors own 63.38% of the company's stock.

Altair Engineering Company Profile

(

Get Free ReportAltair Engineering Inc, together with its subsidiaries, provides software and cloud solutions in the areas of simulation and design, high-performance computing, data analytics, and artificial intelligence in the United States and internationally. It operates in two segments, Software and Client Engineering Services.

Further Reading

Before you consider Altair Engineering, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altair Engineering wasn't on the list.

While Altair Engineering currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.