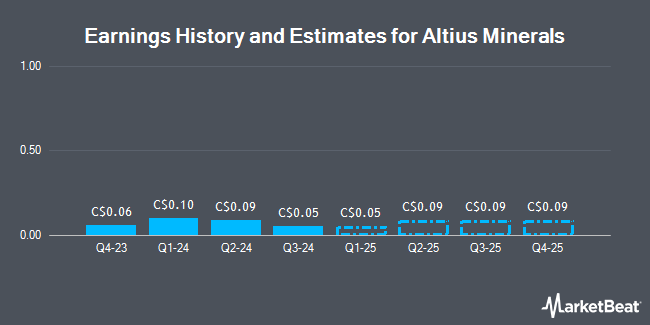

Altius Minerals Co. (TSE:ALS - Free Report) - National Bank Financial dropped their FY2024 earnings estimates for Altius Minerals in a report released on Tuesday, February 4th. National Bank Financial analyst S. Nagle now anticipates that the company will post earnings per share of $0.23 for the year, down from their prior estimate of $0.27. The consensus estimate for Altius Minerals' current full-year earnings is $0.35 per share. National Bank Financial also issued estimates for Altius Minerals' Q4 2024 earnings at $0.02 EPS and FY2025 earnings at $0.16 EPS.

Altius Minerals (TSE:ALS - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported C$0.05 earnings per share for the quarter, missing analysts' consensus estimates of C$0.07 by C($0.02). Altius Minerals had a net margin of 23.34% and a return on equity of 2.32%.

Other analysts also recently issued reports about the stock. National Bankshares upped their price objective on shares of Altius Minerals from C$26.00 to C$32.50 and gave the company an "outperform" rating in a report on Tuesday, October 15th. Scotiabank raised shares of Altius Minerals from a "sector perform" rating to an "outperform" rating and upped their price target for the company from C$27.00 to C$33.00 in a report on Monday, December 23rd. Finally, BMO Capital Markets lifted their price objective on Altius Minerals from C$23.00 to C$24.00 in a research note on Thursday, January 30th.

Get Our Latest Report on Altius Minerals

Altius Minerals Stock Performance

TSE:ALS traded down C$0.09 during midday trading on Thursday, hitting C$27.46. The company's stock had a trading volume of 38,714 shares, compared to its average volume of 80,053. Altius Minerals has a fifty-two week low of C$16.11 and a fifty-two week high of C$29.03. The company has a debt-to-equity ratio of 17.84, a current ratio of 11.30 and a quick ratio of 6.49. The firm has a market cap of C$1.28 billion, a P/E ratio of 88.58 and a beta of 0.94. The firm's 50 day moving average is C$27.05 and its 200-day moving average is C$25.59.

About Altius Minerals

(

Get Free Report)

Altius Minerals Corporation operates as a diversified mining royalty and streaming company in Canada, the United States, and Brazil. The company owns royalty and streaming interests in 11 operating mines covering copper, zinc, nickel, cobalt, potash, iron ore, precious metals, and thermal and metallurgical coal.

Featured Articles

Before you consider Altius Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altius Minerals wasn't on the list.

While Altius Minerals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.