Altman Advisors Inc. acquired a new stake in shares of Eli Lilly and Company (NYSE:LLY - Free Report) in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund acquired 1,608 shares of the company's stock, valued at approximately $1,425,000.

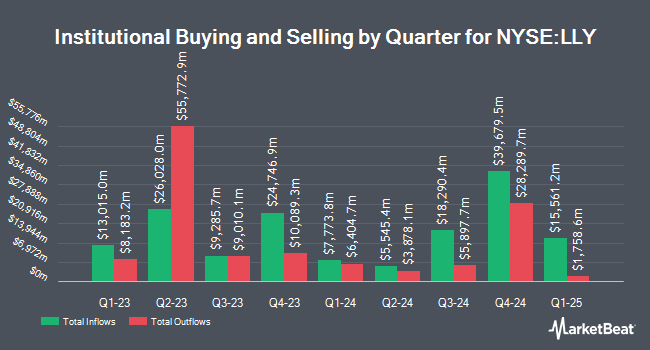

A number of other large investors also recently added to or reduced their stakes in the stock. International Assets Investment Management LLC lifted its position in shares of Eli Lilly and Company by 87,091.7% during the third quarter. International Assets Investment Management LLC now owns 12,463,182 shares of the company's stock worth $11,041,631,000 after purchasing an additional 12,448,888 shares in the last quarter. Capital Research Global Investors raised its stake in shares of Eli Lilly and Company by 6.0% during the 1st quarter. Capital Research Global Investors now owns 8,031,531 shares of the company's stock worth $6,248,210,000 after buying an additional 453,939 shares during the last quarter. Capital International Investors increased its position in Eli Lilly and Company by 5.1% during the 1st quarter. Capital International Investors now owns 6,972,393 shares of the company's stock worth $5,424,243,000 after purchasing an additional 335,560 shares in the last quarter. Dimensional Fund Advisors LP increased its position in Eli Lilly and Company by 5.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 3,581,075 shares of the company's stock worth $3,242,296,000 after purchasing an additional 171,595 shares in the last quarter. Finally, Janus Henderson Group PLC grew its holdings in Eli Lilly and Company by 7.3% in the 1st quarter. Janus Henderson Group PLC now owns 3,575,684 shares of the company's stock valued at $2,781,613,000 after buying an additional 243,729 shares during the period. 82.53% of the stock is currently owned by institutional investors and hedge funds.

Eli Lilly and Company Stock Up 3.2 %

Shares of Eli Lilly and Company stock traded up $23.68 during trading on Wednesday, hitting $753.41. 5,116,185 shares of the stock traded hands, compared to its average volume of 3,185,802. The stock has a market cap of $715.23 billion, a P/E ratio of 80.40, a PEG ratio of 2.82 and a beta of 0.43. The company has a debt-to-equity ratio of 2.03, a quick ratio of 0.97 and a current ratio of 1.27. Eli Lilly and Company has a twelve month low of $561.65 and a twelve month high of $972.53. The company has a fifty day moving average price of $875.60 and a two-hundred day moving average price of $870.81.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The company reported $1.18 EPS for the quarter, missing the consensus estimate of $1.52 by ($0.34). The business had revenue of $11.44 billion during the quarter, compared to the consensus estimate of $12.09 billion. Eli Lilly and Company had a return on equity of 71.08% and a net margin of 20.48%. The business's quarterly revenue was up 20.4% on a year-over-year basis. During the same period in the prior year, the firm earned $0.10 earnings per share. Equities research analysts predict that Eli Lilly and Company will post 13.21 EPS for the current fiscal year.

Eli Lilly and Company Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Investors of record on Friday, November 15th will be issued a $1.30 dividend. The ex-dividend date is Friday, November 15th. This represents a $5.20 dividend on an annualized basis and a yield of 0.69%. Eli Lilly and Company's dividend payout ratio is presently 56.22%.

Wall Street Analysts Forecast Growth

Several research firms have commented on LLY. Evercore ISI upgraded Eli Lilly and Company to a "hold" rating in a report on Thursday, September 5th. Berenberg Bank increased their price objective on shares of Eli Lilly and Company from $1,000.00 to $1,050.00 and gave the company a "buy" rating in a research report on Wednesday, August 14th. Redburn Atlantic upgraded Eli Lilly and Company to a "hold" rating in a research note on Monday, November 4th. Guggenheim increased their target price on Eli Lilly and Company from $884.00 to $1,030.00 and gave the stock a "buy" rating in a research report on Friday, August 16th. Finally, Barclays lowered their price target on Eli Lilly and Company from $1,025.00 to $975.00 and set an "overweight" rating on the stock in a report on Thursday, October 31st. Four investment analysts have rated the stock with a hold rating and seventeen have given a buy rating to the company's stock. Based on data from MarketBeat.com, Eli Lilly and Company presently has a consensus rating of "Moderate Buy" and a consensus price target of $1,007.94.

View Our Latest Stock Report on LLY

Insiders Place Their Bets

In other Eli Lilly and Company news, CAO Donald A. Zakrowski sold 900 shares of the stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $803.38, for a total value of $723,042.00. Following the completion of the sale, the chief accounting officer now directly owns 5,480 shares in the company, valued at $4,402,522.40. This represents a 14.11 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 0.13% of the company's stock.

Eli Lilly and Company Company Profile

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

Further Reading

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.