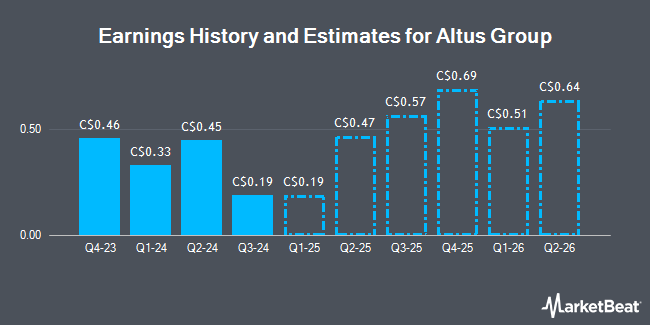

Altus Group Limited (TSE:AIF - Free Report) - Equities research analysts at National Bank Financial reduced their FY2024 earnings per share (EPS) estimates for shares of Altus Group in a report issued on Thursday, November 7th. National Bank Financial analyst R. Tse now forecasts that the company will post earnings per share of $1.24 for the year, down from their prior forecast of $1.36. The consensus estimate for Altus Group's current full-year earnings is $1.73 per share.

Altus Group (TSE:AIF - Get Free Report) last released its earnings results on Thursday, August 8th. The company reported C$0.45 earnings per share for the quarter, topping analysts' consensus estimates of C$0.22 by C$0.23. The firm had revenue of C$206.71 million for the quarter, compared to the consensus estimate of C$132.50 million. Altus Group had a net margin of 0.37% and a return on equity of 0.48%.

A number of other analysts have also recently commented on the company. BMO Capital Markets dropped their price target on Altus Group from C$59.00 to C$55.00 in a research report on Friday, August 9th. Scotiabank cut their target price on Altus Group from C$59.00 to C$51.00 and set a "sector perform" rating on the stock in a research note on Friday, August 9th. CIBC lowered their price target on Altus Group from C$53.00 to C$52.00 in a research report on Friday. TD Securities dropped their price target on shares of Altus Group from C$65.00 to C$63.00 and set a "buy" rating on the stock in a research note on Friday, August 9th. Finally, Cormark reduced their price objective on shares of Altus Group from C$63.00 to C$56.00 and set a "hold" rating for the company in a research note on Friday, August 9th. Five research analysts have rated the stock with a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of C$56.22.

Check Out Our Latest Stock Report on Altus Group

Altus Group Stock Up 1.8 %

TSE AIF traded up C$1.02 during trading hours on Monday, reaching C$57.63. 66,699 shares of the company's stock traded hands, compared to its average volume of 71,548. The firm has a market cap of C$2.65 billion, a PE ratio of 943.50, a PEG ratio of 0.96 and a beta of 0.82. The company has a debt-to-equity ratio of 57.13, a current ratio of 1.41 and a quick ratio of 1.30. Altus Group has a 52-week low of C$36.98 and a 52-week high of C$59.60. The firm has a 50-day simple moving average of C$54.02 and a 200 day simple moving average of C$52.12.

Insider Buying and Selling

In related news, Senior Officer Kimberly Carter sold 1,100 shares of the business's stock in a transaction dated Tuesday, August 20th. The stock was sold at an average price of C$54.00, for a total value of C$59,400.00. In related news, Director William Brennan sold 18,551 shares of the stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of C$55.32, for a total value of C$1,026,241.32. Also, Senior Officer Kimberly Carter sold 1,100 shares of the business's stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of C$54.00, for a total transaction of C$59,400.00. 4.05% of the stock is currently owned by insiders.

Altus Group Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be issued a dividend of $0.15 per share. This represents a $0.60 annualized dividend and a yield of 1.04%. The ex-dividend date is Tuesday, December 31st. Altus Group's dividend payout ratio is currently 1,000.00%.

About Altus Group

(

Get Free Report)

Altus Group Limited provides asset and funds intelligence solutions for commercial real estate (CRE). The company operates through Analytics, Property Tax, and Appraisals and Development Advisory segments. The Analytics segment portfolio includes software, data analytics, market data, and consulting services; CRE asset and fund management services; ARGUS-branded, finance active-branded debt management, and valuation management solutions; technology consulting services, such as strategic advisory for front-to-back-office strategies, processes, and technology; and software services related to education, training, and implementation.

Further Reading

Before you consider Altus Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altus Group wasn't on the list.

While Altus Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.