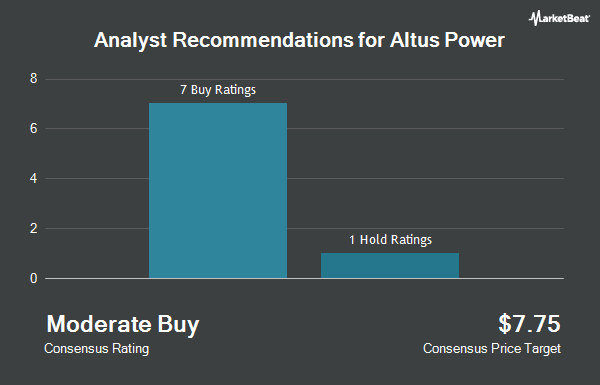

Shares of Altus Power, Inc. (NYSE:AMPS - Get Free Report) have been given an average recommendation of "Buy" by the nine brokerages that are presently covering the firm, MarketBeat reports. Two analysts have rated the stock with a hold rating, five have given a buy rating and two have assigned a strong buy rating to the company. The average 1 year price objective among brokerages that have issued ratings on the stock in the last year is $5.21.

AMPS has been the topic of a number of research analyst reports. Maxim Group reduced their price objective on shares of Altus Power from $5.50 to $4.50 and set a "buy" rating on the stock in a research report on Monday, August 12th. Roth Mkm reiterated a "buy" rating and set a $4.50 target price on shares of Altus Power in a report on Wednesday, October 16th. Citigroup cut their target price on Altus Power from $7.00 to $5.50 and set a "buy" rating on the stock in a research note on Tuesday, October 22nd. Finally, Morgan Stanley downgraded shares of Altus Power from an "overweight" rating to an "equal weight" rating and cut their price objective for the company from $8.00 to $4.00 in a research report on Wednesday, August 21st.

View Our Latest Analysis on AMPS

Institutional Investors Weigh In On Altus Power

A number of hedge funds have recently modified their holdings of AMPS. Summit Securities Group LLC purchased a new stake in shares of Altus Power during the second quarter worth about $39,000. Iridian Asset Management LLC CT bought a new stake in Altus Power in the 3rd quarter worth approximately $40,000. HighTower Advisors LLC purchased a new stake in Altus Power during the third quarter valued at $41,000. Vaughan David Investments LLC IL bought a new stake in shares of Altus Power in the 2nd quarter worth about $55,000. Finally, Susquehanna Fundamental Investments LLC bought a new stake in Altus Power during the second quarter worth approximately $68,000. Institutional investors own 46.55% of the company's stock.

Altus Power Trading Up 4.7 %

Shares of AMPS stock traded up $0.18 during trading hours on Friday, reaching $4.00. The company's stock had a trading volume of 1,422,143 shares, compared to its average volume of 1,057,229. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 2.10. Altus Power has a one year low of $2.71 and a one year high of $7.28. The stock has a market capitalization of $643.20 million, a P/E ratio of 18.18 and a beta of 1.04. The firm's fifty day simple moving average is $3.58 and its 200 day simple moving average is $3.68.

About Altus Power

(

Get Free ReportAltus Power, Inc, a clean electrification company, develops, owns, constructs, and operates roof, ground, and carport-based photovoltaic solar energy generation and storage systems. It serves commercial, industrial, public sector, and community solar customers. Altus Power, Inc was founded in 2013 and is headquartered in Stamford, Connecticut.

Read More

Before you consider Altus Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altus Power wasn't on the list.

While Altus Power currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.