Telemark Asset Management LLC lessened its holdings in Altus Power, Inc. (NYSE:AMPS - Free Report) by 20.0% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 960,000 shares of the company's stock after selling 240,000 shares during the period. Telemark Asset Management LLC owned approximately 0.60% of Altus Power worth $3,053,000 at the end of the most recent quarter.

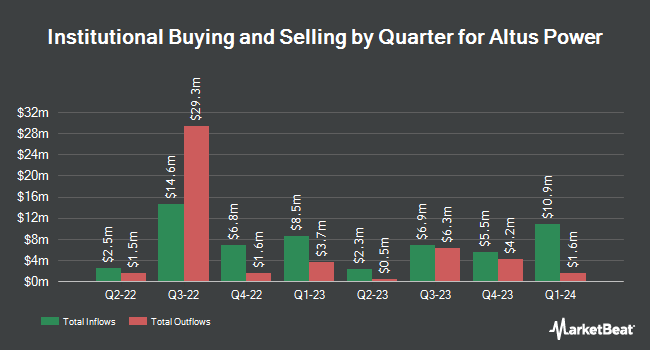

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Price T Rowe Associates Inc. MD grew its holdings in shares of Altus Power by 7.6% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 44,257 shares of the company's stock worth $212,000 after purchasing an additional 3,116 shares during the last quarter. HTG Investment Advisors Inc. increased its holdings in shares of Altus Power by 8.6% during the third quarter. HTG Investment Advisors Inc. now owns 65,148 shares of the company's stock worth $207,000 after buying an additional 5,148 shares in the last quarter. The Manufacturers Life Insurance Company raised its stake in shares of Altus Power by 24.3% in the second quarter. The Manufacturers Life Insurance Company now owns 31,771 shares of the company's stock valued at $125,000 after acquiring an additional 6,209 shares during the last quarter. American Century Companies Inc. boosted its holdings in shares of Altus Power by 14.3% in the 2nd quarter. American Century Companies Inc. now owns 72,322 shares of the company's stock worth $284,000 after acquiring an additional 9,062 shares in the last quarter. Finally, Summit Securities Group LLC acquired a new stake in Altus Power during the 2nd quarter valued at $39,000. Institutional investors own 46.55% of the company's stock.

Altus Power Trading Up 2.7 %

AMPS traded up $0.11 during trading on Friday, reaching $4.17. 592,864 shares of the company's stock were exchanged, compared to its average volume of 1,082,583. The company's fifty day moving average price is $3.41 and its 200-day moving average price is $3.70. The firm has a market capitalization of $670.49 million, a PE ratio of 18.45 and a beta of 0.94. Altus Power, Inc. has a fifty-two week low of $2.71 and a fifty-two week high of $7.28. The company has a debt-to-equity ratio of 2.10, a quick ratio of 0.60 and a current ratio of 0.60.

Analysts Set New Price Targets

AMPS has been the topic of a number of recent analyst reports. Roth Mkm reissued a "buy" rating and issued a $4.50 price objective on shares of Altus Power in a research note on Wednesday, October 16th. Citigroup decreased their price objective on shares of Altus Power from $7.00 to $5.50 and set a "buy" rating on the stock in a report on Tuesday, October 22nd. UBS Group dropped their target price on shares of Altus Power from $5.50 to $5.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Morgan Stanley cut shares of Altus Power from an "overweight" rating to an "equal weight" rating and decreased their price target for the company from $8.00 to $4.00 in a research note on Wednesday, August 21st. Finally, Maxim Group dropped their price objective on shares of Altus Power from $5.50 to $4.50 and set a "buy" rating for the company in a research report on Monday, August 12th. Two analysts have rated the stock with a hold rating, six have given a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Altus Power presently has an average rating of "Buy" and a consensus target price of $5.81.

Read Our Latest Stock Report on Altus Power

Altus Power Company Profile

(

Free Report)

Altus Power, Inc, a clean electrification company, develops, owns, constructs, and operates roof, ground, and carport-based photovoltaic solar energy generation and storage systems. It serves commercial, industrial, public sector, and community solar customers. Altus Power, Inc was founded in 2013 and is headquartered in Stamford, Connecticut.

Featured Articles

Before you consider Altus Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altus Power wasn't on the list.

While Altus Power currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.