Amalgamated Bank lifted its holdings in Protagonist Therapeutics, Inc. (NASDAQ:PTGX - Free Report) by 756.4% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 17,324 shares of the company's stock after buying an additional 15,301 shares during the period. Amalgamated Bank's holdings in Protagonist Therapeutics were worth $780,000 as of its most recent SEC filing.

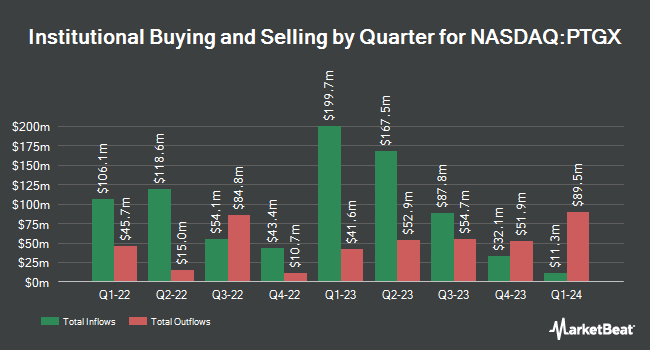

Several other hedge funds and other institutional investors have also modified their holdings of the business. Sei Investments Co. grew its position in Protagonist Therapeutics by 12.2% during the first quarter. Sei Investments Co. now owns 41,758 shares of the company's stock valued at $1,208,000 after purchasing an additional 4,529 shares in the last quarter. Russell Investments Group Ltd. acquired a new position in shares of Protagonist Therapeutics in the first quarter worth $35,000. ProShare Advisors LLC raised its holdings in shares of Protagonist Therapeutics by 9.2% during the first quarter. ProShare Advisors LLC now owns 14,345 shares of the company's stock worth $415,000 after acquiring an additional 1,206 shares in the last quarter. Vanguard Group Inc. boosted its position in Protagonist Therapeutics by 1.2% during the first quarter. Vanguard Group Inc. now owns 3,192,971 shares of the company's stock valued at $92,373,000 after purchasing an additional 39,055 shares during the last quarter. Finally, Seven Eight Capital LP purchased a new position in Protagonist Therapeutics in the first quarter valued at about $202,000. Institutional investors and hedge funds own 98.63% of the company's stock.

Insider Activity

In other news, CFO Asif Ali sold 14,203 shares of the company's stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $44.49, for a total transaction of $631,891.47. Following the completion of the transaction, the chief financial officer now owns 34,960 shares of the company's stock, valued at approximately $1,555,370.40. This represents a 28.89 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director William D. Waddill sold 8,000 shares of Protagonist Therapeutics stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $45.00, for a total value of $360,000.00. Following the sale, the director now directly owns 12,000 shares in the company, valued at approximately $540,000. This trade represents a 40.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 5.40% of the stock is owned by company insiders.

Protagonist Therapeutics Price Performance

Shares of NASDAQ PTGX traded up $0.07 during trading hours on Friday, hitting $41.11. 1,086,776 shares of the company's stock were exchanged, compared to its average volume of 735,177. The stock has a market capitalization of $2.45 billion, a price-to-earnings ratio of 15.45 and a beta of 2.17. The company's 50-day moving average price is $45.63 and its 200-day moving average price is $38.61. Protagonist Therapeutics, Inc. has a 1-year low of $15.58 and a 1-year high of $48.89.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on the company. Truist Financial began coverage on Protagonist Therapeutics in a report on Monday, September 9th. They set a "buy" rating and a $60.00 price target for the company. BTIG Research boosted their target price on shares of Protagonist Therapeutics from $41.00 to $51.00 and gave the stock a "buy" rating in a research report on Wednesday, July 24th. Wedbush reaffirmed an "outperform" rating and issued a $58.00 price objective on shares of Protagonist Therapeutics in a research note on Monday, November 4th. JPMorgan Chase & Co. upped their price objective on shares of Protagonist Therapeutics from $39.00 to $48.00 and gave the stock an "overweight" rating in a report on Thursday, July 25th. Finally, StockNews.com upgraded Protagonist Therapeutics from a "hold" rating to a "buy" rating in a report on Thursday, August 8th. Seven equities research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus target price of $53.57.

Check Out Our Latest Analysis on PTGX

About Protagonist Therapeutics

(

Free Report)

Protagonist Therapeutics, Inc, a biopharmaceutical company, develops peptide-based drugs for hematology and blood disorders, and inflammatory and immunomodulatory diseases. It is developing Rusfertide (PTG-300), an injectable hepcidin mimetic that completed phase 2 clinical trials for the treatment of polycythemia vera and other blood disorders; and JNJ-2113, an orally delivered investigational drug to block biological pathways that completed phase 2b clinical trials for the treatment of moderate-to-severe plaque psoriasis; and PN-943, an orally delivered, gut-restricted alpha 4 beta 7 specific integrin antagonist completed a phase 2 clinical trials in patients with moderate to severe ulcerative colitis.

Read More

Before you consider Protagonist Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Protagonist Therapeutics wasn't on the list.

While Protagonist Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.