Amalgamated Bank increased its holdings in shares of Western Alliance Bancorporation (NYSE:WAL - Free Report) by 333.8% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 51,920 shares of the financial services provider's stock after purchasing an additional 39,951 shares during the quarter. Amalgamated Bank's holdings in Western Alliance Bancorporation were worth $4,491,000 at the end of the most recent reporting period.

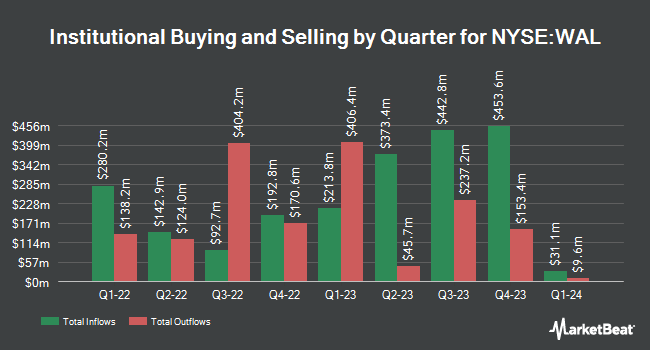

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Russell Investments Group Ltd. grew its position in Western Alliance Bancorporation by 0.6% in the 1st quarter. Russell Investments Group Ltd. now owns 29,768 shares of the financial services provider's stock valued at $1,911,000 after acquiring an additional 164 shares in the last quarter. Blue Trust Inc. grew its position in shares of Western Alliance Bancorporation by 58.4% during the third quarter. Blue Trust Inc. now owns 507 shares of the financial services provider's stock worth $44,000 after buying an additional 187 shares in the last quarter. Versant Capital Management Inc grew its position in shares of Western Alliance Bancorporation by 26.5% during the second quarter. Versant Capital Management Inc now owns 1,165 shares of the financial services provider's stock worth $73,000 after buying an additional 244 shares in the last quarter. UMB Bank n.a. grew its position in shares of Western Alliance Bancorporation by 136.8% during the third quarter. UMB Bank n.a. now owns 431 shares of the financial services provider's stock worth $37,000 after buying an additional 249 shares in the last quarter. Finally, Signaturefd LLC grew its position in shares of Western Alliance Bancorporation by 18.7% during the third quarter. Signaturefd LLC now owns 1,598 shares of the financial services provider's stock worth $138,000 after buying an additional 252 shares in the last quarter. 79.15% of the stock is owned by institutional investors and hedge funds.

Western Alliance Bancorporation Stock Performance

Shares of NYSE:WAL traded down $0.48 during trading on Friday, reaching $89.87. The company had a trading volume of 1,049,806 shares, compared to its average volume of 1,320,843. The firm has a market capitalization of $9.89 billion, a price-to-earnings ratio of 13.87, a price-to-earnings-growth ratio of 1.51 and a beta of 1.44. The company has a debt-to-equity ratio of 0.61, a current ratio of 0.85 and a quick ratio of 0.82. The stock's fifty day moving average price is $84.55 and its 200 day moving average price is $73.29. Western Alliance Bancorporation has a fifty-two week low of $43.20 and a fifty-two week high of $96.45.

Western Alliance Bancorporation (NYSE:WAL - Get Free Report) last released its earnings results on Thursday, October 17th. The financial services provider reported $1.80 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.90 by ($0.10). The company had revenue of $833.10 million during the quarter, compared to analyst estimates of $811.40 million. Western Alliance Bancorporation had a net margin of 14.66% and a return on equity of 13.16%. As a group, equities research analysts predict that Western Alliance Bancorporation will post 7.13 EPS for the current year.

Western Alliance Bancorporation Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Investors of record on Friday, November 15th will be issued a dividend of $0.38 per share. This represents a $1.52 dividend on an annualized basis and a yield of 1.69%. The ex-dividend date of this dividend is Friday, November 15th. This is a positive change from Western Alliance Bancorporation's previous quarterly dividend of $0.37. Western Alliance Bancorporation's dividend payout ratio is currently 23.46%.

Insider Buying and Selling

In related news, Director Robert P. Latta sold 2,996 shares of the company's stock in a transaction on Monday, September 9th. The stock was sold at an average price of $82.75, for a total transaction of $247,919.00. Following the transaction, the director now owns 4,056 shares of the company's stock, valued at $335,634. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. In other Western Alliance Bancorporation news, insider Barbara Kennedy sold 11,083 shares of the company's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $81.59, for a total value of $904,261.97. Following the sale, the insider now owns 7,977 shares of the company's stock, valued at approximately $650,843.43. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Robert P. Latta sold 2,996 shares of the company's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $82.75, for a total value of $247,919.00. Following the completion of the sale, the director now owns 4,056 shares in the company, valued at $335,634. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.75% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on the company. Barclays boosted their price objective on Western Alliance Bancorporation from $105.00 to $107.00 and gave the stock an "overweight" rating in a research report on Friday. Wells Fargo & Company boosted their price objective on Western Alliance Bancorporation from $85.00 to $92.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 1st. Truist Financial decreased their target price on Western Alliance Bancorporation from $100.00 to $95.00 and set a "buy" rating for the company in a research note on Monday, October 21st. JPMorgan Chase & Co. decreased their target price on Western Alliance Bancorporation from $107.00 to $105.00 and set an "overweight" rating for the company in a research note on Monday, October 21st. Finally, Stephens restated an "overweight" rating and set a $102.00 target price on shares of Western Alliance Bancorporation in a research note on Friday, October 18th. One equities research analyst has rated the stock with a sell rating, one has given a hold rating and fourteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, Western Alliance Bancorporation presently has an average rating of "Moderate Buy" and an average price target of $92.73.

Get Our Latest Stock Report on WAL

Western Alliance Bancorporation Profile

(

Free Report)

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates through Commercial and Consumer Related segments. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; demand deposits; and treasury management and residential mortgage products and services.

Featured Stories

Before you consider Western Alliance Bancorporation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Alliance Bancorporation wasn't on the list.

While Western Alliance Bancorporation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.