Amalgamated Bank lessened its stake in shares of F.N.B. Co. (NYSE:FNB - Free Report) by 23.8% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 171,414 shares of the bank's stock after selling 53,599 shares during the period. Amalgamated Bank's holdings in F.N.B. were worth $2,419,000 at the end of the most recent reporting period.

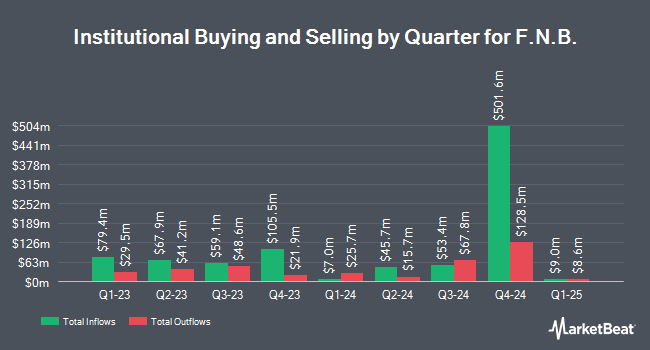

Other institutional investors also recently modified their holdings of the company. Dimensional Fund Advisors LP grew its position in F.N.B. by 3.0% during the second quarter. Dimensional Fund Advisors LP now owns 22,176,107 shares of the bank's stock valued at $303,361,000 after buying an additional 647,335 shares during the period. AQR Capital Management LLC grew its position in F.N.B. by 181.6% during the second quarter. AQR Capital Management LLC now owns 3,047,133 shares of the bank's stock valued at $41,045,000 after buying an additional 1,964,884 shares during the period. Fort Washington Investment Advisors Inc. OH grew its position in F.N.B. by 2.9% during the second quarter. Fort Washington Investment Advisors Inc. OH now owns 1,461,258 shares of the bank's stock valued at $19,990,000 after buying an additional 41,610 shares during the period. Sei Investments Co. grew its position in F.N.B. by 1.8% during the second quarter. Sei Investments Co. now owns 1,365,518 shares of the bank's stock valued at $18,680,000 after buying an additional 24,474 shares during the period. Finally, Stieven Capital Advisors L.P. grew its position in F.N.B. by 8.8% during the second quarter. Stieven Capital Advisors L.P. now owns 1,173,891 shares of the bank's stock valued at $16,059,000 after buying an additional 95,100 shares during the period. Institutional investors and hedge funds own 79.25% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have weighed in on the stock. StockNews.com upgraded shares of F.N.B. from a "sell" rating to a "hold" rating in a research report on Monday, October 21st. Stephens increased their target price on shares of F.N.B. from $16.00 to $18.00 and gave the stock an "overweight" rating in a research report on Monday, October 21st. Finally, Piper Sandler reissued an "overweight" rating on shares of F.N.B. in a report on Friday, October 18th. Two investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $16.33.

Get Our Latest Analysis on FNB

F.N.B. Price Performance

Shares of FNB stock traded down $0.03 during trading hours on Tuesday, hitting $16.74. 431,643 shares of the company's stock were exchanged, compared to its average volume of 2,230,756. The company has a market capitalization of $6.02 billion, a PE ratio of 15.39 and a beta of 0.95. F.N.B. Co. has a 12-month low of $11.01 and a 12-month high of $16.91. The business's 50 day simple moving average is $14.37 and its 200-day simple moving average is $14.09. The company has a current ratio of 0.93, a quick ratio of 0.92 and a debt-to-equity ratio of 0.40.

F.N.B. (NYSE:FNB - Get Free Report) last posted its quarterly earnings results on Thursday, October 17th. The bank reported $0.34 EPS for the quarter, missing the consensus estimate of $0.36 by ($0.02). The business had revenue of $413.02 million for the quarter, compared to analysts' expectations of $409.80 million. F.N.B. had a return on equity of 8.49% and a net margin of 16.29%. On average, equities research analysts anticipate that F.N.B. Co. will post 1.34 earnings per share for the current year.

About F.N.B.

(

Free Report)

F.N.B. Corporation, a bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States. The company operates through three segments: Community Banking, Wealth Management, and Insurance.

Featured Articles

Before you consider F.N.B., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F.N.B. wasn't on the list.

While F.N.B. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.