Amalgamated Bank lowered its position in Ovintiv Inc. (NYSE:OVV - Free Report) by 21.0% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 125,726 shares of the company's stock after selling 33,496 shares during the quarter. Amalgamated Bank's holdings in Ovintiv were worth $4,817,000 as of its most recent SEC filing.

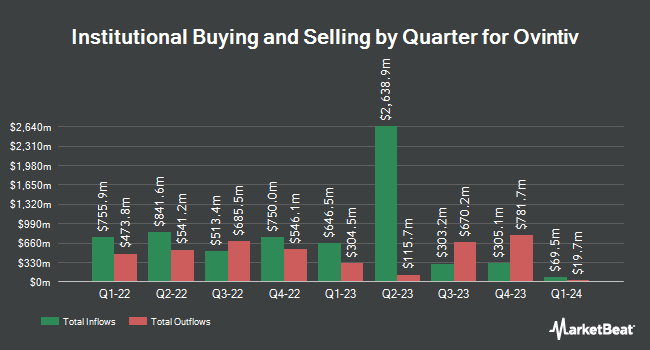

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Innealta Capital LLC bought a new position in Ovintiv in the second quarter worth approximately $39,000. Geneos Wealth Management Inc. lifted its holdings in Ovintiv by 53.4% during the first quarter. Geneos Wealth Management Inc. now owns 862 shares of the company's stock worth $45,000 after buying an additional 300 shares during the period. UMB Bank n.a. lifted its holdings in Ovintiv by 27.7% during the third quarter. UMB Bank n.a. now owns 1,317 shares of the company's stock worth $50,000 after buying an additional 286 shares during the period. International Assets Investment Management LLC purchased a new stake in Ovintiv during the second quarter worth $69,000. Finally, Covestor Ltd lifted its holdings in Ovintiv by 23.1% during the first quarter. Covestor Ltd now owns 1,559 shares of the company's stock worth $81,000 after buying an additional 293 shares during the period. Institutional investors own 83.81% of the company's stock.

Analysts Set New Price Targets

A number of analysts have weighed in on the company. Evercore ISI lowered their target price on Ovintiv from $60.00 to $54.00 and set an "outperform" rating for the company in a report on Monday, September 30th. Mizuho lowered their target price on Ovintiv from $60.00 to $58.00 and set an "outperform" rating for the company in a report on Wednesday, October 9th. UBS Group decreased their price objective on Ovintiv from $61.00 to $57.00 and set a "buy" rating for the company in a report on Wednesday, September 18th. Royal Bank of Canada decreased their price objective on Ovintiv from $62.00 to $61.00 and set a "sector perform" rating for the company in a report on Thursday, August 1st. Finally, Wolfe Research initiated coverage on Ovintiv in a report on Thursday, July 18th. They set an "outperform" rating and a $65.00 price objective for the company. Five equities research analysts have rated the stock with a hold rating, twelve have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, Ovintiv has an average rating of "Moderate Buy" and an average target price of $57.00.

View Our Latest Stock Report on OVV

Ovintiv Price Performance

Shares of NYSE:OVV traded up $1.62 during trading on Friday, reaching $43.17. 4,205,673 shares of the company's stock traded hands, compared to its average volume of 3,058,182. Ovintiv Inc. has a fifty-two week low of $36.90 and a fifty-two week high of $55.95. The company has a quick ratio of 0.44, a current ratio of 0.44 and a debt-to-equity ratio of 0.47. The firm has a market cap of $11.38 billion, a PE ratio of 6.09, a P/E/G ratio of 7.99 and a beta of 2.62. The company has a 50-day simple moving average of $40.51 and a 200-day simple moving average of $44.91.

About Ovintiv

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

Featured Articles

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.