Amalgamated Bank lessened its position in shares of Mohawk Industries, Inc. (NYSE:MHK - Free Report) by 40.1% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 10,323 shares of the company's stock after selling 6,908 shares during the quarter. Amalgamated Bank's holdings in Mohawk Industries were worth $1,659,000 as of its most recent SEC filing.

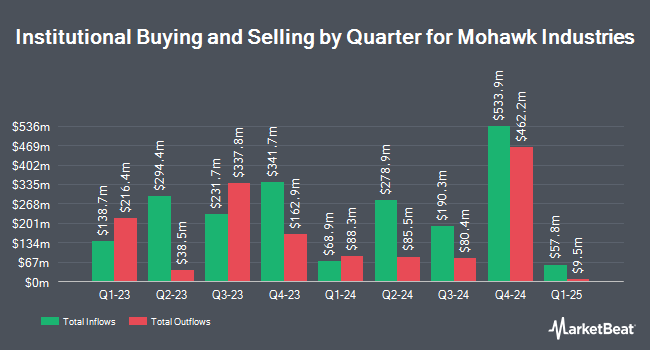

Other institutional investors have also added to or reduced their stakes in the company. O Shaughnessy Asset Management LLC purchased a new position in Mohawk Industries during the 1st quarter valued at approximately $1,450,000. Sei Investments Co. boosted its holdings in shares of Mohawk Industries by 2,040.6% in the 1st quarter. Sei Investments Co. now owns 62,720 shares of the company's stock worth $8,209,000 after purchasing an additional 59,790 shares during the period. State Board of Administration of Florida Retirement System boosted its holdings in shares of Mohawk Industries by 20.1% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 61,447 shares of the company's stock worth $8,043,000 after purchasing an additional 10,274 shares during the period. Vanguard Group Inc. boosted its holdings in shares of Mohawk Industries by 0.3% in the 1st quarter. Vanguard Group Inc. now owns 6,257,677 shares of the company's stock worth $819,067,000 after purchasing an additional 17,541 shares during the period. Finally, Maverick Capital Ltd. purchased a new position in shares of Mohawk Industries in the 2nd quarter worth approximately $1,253,000. Hedge funds and other institutional investors own 78.98% of the company's stock.

Insider Transactions at Mohawk Industries

In related news, insider Suzanne L. Helen sold 660 shares of the business's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $151.46, for a total value of $99,963.60. Following the completion of the transaction, the insider now owns 118,709 shares of the company's stock, valued at $17,979,665.14. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other Mohawk Industries news, insider Suzanne L. Helen sold 2,300 shares of Mohawk Industries stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $151.15, for a total value of $347,645.00. Following the transaction, the insider now owns 119,369 shares in the company, valued at $18,042,624.35. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Suzanne L. Helen sold 660 shares of Mohawk Industries stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $151.46, for a total value of $99,963.60. Following the completion of the transaction, the insider now owns 118,709 shares in the company, valued at $17,979,665.14. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 17.10% of the company's stock.

Mohawk Industries Stock Up 0.2 %

Mohawk Industries stock traded up $0.26 during midday trading on Wednesday, hitting $142.08. 143,174 shares of the company's stock were exchanged, compared to its average volume of 723,175. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.09 and a current ratio of 2.03. The company has a market cap of $8.97 billion, a PE ratio of 16.11, a P/E/G ratio of 1.56 and a beta of 1.38. The firm has a 50-day moving average of $151.29 and a two-hundred day moving average of $136.17. Mohawk Industries, Inc. has a 12 month low of $82.71 and a 12 month high of $164.29.

Analyst Ratings Changes

A number of brokerages have recently commented on MHK. The Goldman Sachs Group lifted their target price on Mohawk Industries from $141.00 to $185.00 and gave the stock a "buy" rating in a report on Monday, July 29th. Royal Bank of Canada dropped their target price on Mohawk Industries from $140.00 to $134.00 and set a "sector perform" rating for the company in a report on Monday, October 28th. Barclays dropped their target price on Mohawk Industries from $161.00 to $146.00 and set an "equal weight" rating for the company in a report on Monday, October 28th. JPMorgan Chase & Co. lifted their target price on Mohawk Industries from $124.00 to $155.00 and gave the stock a "neutral" rating in a report on Friday, August 2nd. Finally, Jefferies Financial Group boosted their price objective on Mohawk Industries from $150.00 to $160.00 and gave the company a "hold" rating in a report on Wednesday, October 9th. Five equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $162.08.

Get Our Latest Research Report on Mohawk Industries

Mohawk Industries Company Profile

(

Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Featured Articles

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.