Amalgamated Bank lessened its holdings in The AES Co. (NYSE:AES - Free Report) by 36.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 139,596 shares of the utilities provider's stock after selling 79,387 shares during the quarter. Amalgamated Bank's holdings in AES were worth $2,800,000 at the end of the most recent reporting period.

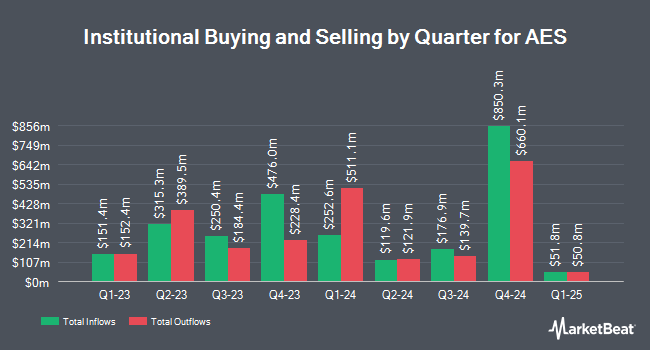

Several other institutional investors have also added to or reduced their stakes in the business. DekaBank Deutsche Girozentrale lifted its holdings in shares of AES by 161.8% during the second quarter. DekaBank Deutsche Girozentrale now owns 107,016 shares of the utilities provider's stock worth $2,035,000 after purchasing an additional 66,145 shares during the period. Empowered Funds LLC lifted its holdings in shares of AES by 1.9% during the first quarter. Empowered Funds LLC now owns 124,745 shares of the utilities provider's stock worth $2,237,000 after purchasing an additional 2,273 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. lifted its holdings in shares of AES by 20.1% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 839,343 shares of the utilities provider's stock worth $15,049,000 after purchasing an additional 140,610 shares during the period. Lazard Asset Management LLC lifted its holdings in shares of AES by 178.5% during the first quarter. Lazard Asset Management LLC now owns 689,879 shares of the utilities provider's stock worth $12,369,000 after purchasing an additional 442,184 shares during the period. Finally, Hudson Valley Investment Advisors Inc. ADV lifted its holdings in shares of AES by 75.9% during the third quarter. Hudson Valley Investment Advisors Inc. ADV now owns 362,651 shares of the utilities provider's stock worth $7,275,000 after purchasing an additional 156,504 shares during the period. Institutional investors and hedge funds own 93.13% of the company's stock.

Analysts Set New Price Targets

AES has been the subject of several recent research reports. Susquehanna reduced their price target on AES from $24.00 to $21.00 and set a "positive" rating for the company in a research report on Tuesday, November 5th. Jefferies Financial Group initiated coverage on AES in a research report on Wednesday, September 11th. They set a "buy" rating and a $20.00 price target for the company. Evercore ISI upgraded AES to a "strong-buy" rating in a research report on Wednesday, September 18th. Finally, Barclays lifted their price target on AES from $22.00 to $23.00 and gave the company an "overweight" rating in a research report on Monday, October 21st. Two research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, AES currently has a consensus rating of "Moderate Buy" and a consensus target price of $22.38.

Read Our Latest Stock Report on AES

AES Price Performance

Shares of NYSE:AES traded up $0.29 during trading on Monday, reaching $13.89. The stock had a trading volume of 21,698,834 shares, compared to its average volume of 12,372,747. The company has a debt-to-equity ratio of 3.21, a quick ratio of 0.80 and a current ratio of 0.85. The business has a fifty day moving average price of $17.49 and a 200-day moving average price of $18.20. The stock has a market cap of $9.88 billion, a PE ratio of 9.65 and a beta of 1.10. The AES Co. has a 1-year low of $13.30 and a 1-year high of $22.21.

AES (NYSE:AES - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The utilities provider reported $0.71 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.60 by $0.11. The firm had revenue of $3.29 billion for the quarter, compared to analyst estimates of $3.46 billion. AES had a return on equity of 27.30% and a net margin of 8.34%. The business's revenue was down 4.2% on a year-over-year basis. During the same period in the previous year, the company posted $0.60 earnings per share. On average, equities analysts forecast that The AES Co. will post 1.93 earnings per share for the current fiscal year.

AES Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 15th. Shareholders of record on Friday, November 1st will be paid a dividend of $0.1725 per share. This represents a $0.69 dividend on an annualized basis and a yield of 4.97%. The ex-dividend date of this dividend is Friday, November 1st. AES's dividend payout ratio (DPR) is currently 47.92%.

AES Profile

(

Free Report)

The AES Corporation, together with its subsidiaries, operates as a diversified power generation and utility company in the United States and internationally. The company owns and/or operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries; owns and/or operates utilities to generate or purchase, distribute, transmit, and sell electricity to end-user customers in the residential, commercial, industrial, and governmental sectors; and generates and sells electricity on the wholesale market.

Featured Stories

Before you consider AES, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AES wasn't on the list.

While AES currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.