Amalgamated Bank reduced its position in shares of Performance Food Group (NYSE:PFGC - Free Report) by 23.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 74,453 shares of the food distribution company's stock after selling 22,859 shares during the period. Amalgamated Bank's holdings in Performance Food Group were worth $5,835,000 as of its most recent filing with the Securities and Exchange Commission.

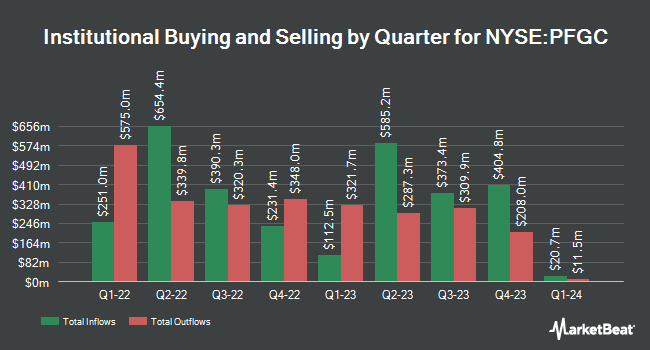

Other hedge funds have also added to or reduced their stakes in the company. Atria Investments Inc raised its holdings in Performance Food Group by 79.3% in the 1st quarter. Atria Investments Inc now owns 29,208 shares of the food distribution company's stock valued at $2,180,000 after acquiring an additional 12,919 shares in the last quarter. Assenagon Asset Management S.A. acquired a new position in Performance Food Group in the 2nd quarter valued at $6,843,000. Magnetar Financial LLC acquired a new position in Performance Food Group in the 1st quarter valued at $1,913,000. Dimensional Fund Advisors LP raised its holdings in Performance Food Group by 27.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,150,291 shares of the food distribution company's stock valued at $142,170,000 after acquiring an additional 469,500 shares in the last quarter. Finally, Point72 Asset Management L.P. raised its holdings in Performance Food Group by 27.8% in the 2nd quarter. Point72 Asset Management L.P. now owns 1,710,679 shares of the food distribution company's stock valued at $113,093,000 after acquiring an additional 372,218 shares in the last quarter. 96.87% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other news, Director Kimberly Grant sold 4,000 shares of the business's stock in a transaction dated Wednesday, August 21st. The stock was sold at an average price of $73.61, for a total value of $294,440.00. Following the transaction, the director now directly owns 10,184 shares of the company's stock, valued at $749,644.24. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. In related news, insider Scott E. Mcpherson sold 25,000 shares of the company's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $74.64, for a total transaction of $1,866,000.00. Following the transaction, the insider now directly owns 149,863 shares of the company's stock, valued at approximately $11,185,774.32. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Kimberly Grant sold 4,000 shares of the company's stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $73.61, for a total value of $294,440.00. Following the transaction, the director now directly owns 10,184 shares in the company, valued at approximately $749,644.24. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 100,500 shares of company stock valued at $7,426,075 in the last ninety days. 2.80% of the stock is owned by company insiders.

Performance Food Group Trading Up 0.7 %

Shares of NYSE PFGC traded up $0.63 during trading on Friday, reaching $85.96. The company had a trading volume of 1,453,407 shares, compared to its average volume of 1,028,922. The stock has a market cap of $13.40 billion, a P/E ratio of 31.72, a PEG ratio of 0.88 and a beta of 1.44. The company has a quick ratio of 0.76, a current ratio of 1.70 and a debt-to-equity ratio of 1.12. The company's fifty day moving average price is $78.82 and its 200-day moving average price is $72.15. Performance Food Group has a 12 month low of $59.35 and a 12 month high of $89.00.

Performance Food Group (NYSE:PFGC - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The food distribution company reported $1.16 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.21 by ($0.05). The business had revenue of $15.42 billion during the quarter, compared to analyst estimates of $15.22 billion. Performance Food Group had a net margin of 0.72% and a return on equity of 16.66%. The firm's revenue for the quarter was up 3.2% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.15 earnings per share. As a group, research analysts expect that Performance Food Group will post 4.84 earnings per share for the current year.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on PFGC shares. Guggenheim lifted their price target on Performance Food Group from $90.00 to $95.00 and gave the company a "buy" rating in a research note on Thursday. Truist Financial boosted their price objective on Performance Food Group from $88.00 to $101.00 and gave the stock a "buy" rating in a research report on Friday. BMO Capital Markets boosted their price objective on Performance Food Group from $87.00 to $95.00 and gave the stock an "outperform" rating in a research report on Thursday. StockNews.com lowered Performance Food Group from a "buy" rating to a "hold" rating in a research report on Thursday. Finally, Morgan Stanley restated an "equal weight" rating and set a $92.00 price objective on shares of Performance Food Group in a research report on Monday, October 28th. Two investment analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $94.50.

View Our Latest Stock Report on PFGC

Performance Food Group Company Profile

(

Free Report)

Performance Food Group Company, through its subsidiaries, markets and distributes food and food-related products in the United States. It operates through three segments: Foodservice, Vistar, and Convenience. The company offers a range of frozen foods, groceries, candy, snacks, beverages, cigarettes, and other tobacco products; beef, pork, poultry, and seafood; and health and beauty care products.

Recommended Stories

Before you consider Performance Food Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Performance Food Group wasn't on the list.

While Performance Food Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.