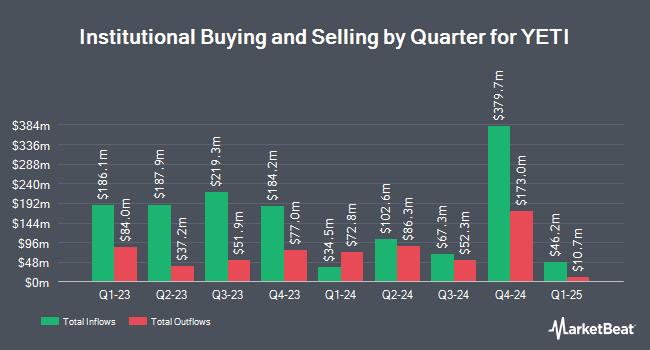

Amalgamated Bank lowered its stake in shares of YETI Holdings, Inc. (NYSE:YETI - Free Report) by 25.9% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 39,908 shares of the company's stock after selling 13,926 shares during the quarter. Amalgamated Bank's holdings in YETI were worth $1,637,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in YETI. V Square Quantitative Management LLC acquired a new stake in YETI during the third quarter worth approximately $26,000. Crewe Advisors LLC acquired a new position in shares of YETI in the 1st quarter valued at $27,000. Versant Capital Management Inc increased its holdings in shares of YETI by 571.8% in the 2nd quarter. Versant Capital Management Inc now owns 833 shares of the company's stock valued at $32,000 after acquiring an additional 709 shares during the period. Blue Trust Inc. increased its holdings in shares of YETI by 265.8% in the 3rd quarter. Blue Trust Inc. now owns 867 shares of the company's stock valued at $33,000 after acquiring an additional 630 shares during the period. Finally, Ashton Thomas Private Wealth LLC acquired a new position in shares of YETI in the 2nd quarter valued at $42,000.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on the stock. Piper Sandler reaffirmed an "overweight" rating and issued a $54.00 target price (down from $55.00) on shares of YETI in a report on Friday, November 8th. Citigroup cut their target price on shares of YETI from $49.00 to $47.00 and set a "buy" rating on the stock in a report on Monday, August 5th. Canaccord Genuity Group reaffirmed a "hold" rating and issued a $44.00 target price on shares of YETI in a report on Monday, September 30th. Bank of America lowered shares of YETI from a "buy" rating to a "neutral" rating and lowered their price objective for the company from $55.00 to $40.00 in a research report on Wednesday, November 6th. Finally, Jefferies Financial Group lifted their price objective on shares of YETI from $54.00 to $55.00 and gave the company a "buy" rating in a research report on Thursday, July 18th. One research analyst has rated the stock with a sell rating, eight have issued a hold rating and five have given a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $45.46.

View Our Latest Stock Report on YETI

YETI Price Performance

Shares of NYSE YETI traded down $0.16 during trading on Wednesday, hitting $41.22. 949,835 shares of the company were exchanged, compared to its average volume of 1,621,701. The company has a market cap of $3.50 billion, a price-to-earnings ratio of 17.91, a PEG ratio of 1.20 and a beta of 2.12. YETI Holdings, Inc. has a 1 year low of $33.41 and a 1 year high of $54.15. The firm's fifty day moving average price is $38.80 and its 200 day moving average price is $39.23. The company has a debt-to-equity ratio of 0.10, a current ratio of 2.58 and a quick ratio of 1.45.

YETI Company Profile

(

Free Report)

YETI Holdings, Inc designs, retails, and distributes products for the outdoor and recreation market under the YETI brand. It offers coolers and equipment, including hard and soft coolers, cargo, bags, outdoor living, and associated accessories, as well as backpacks, duffel bags, luggage, packing cubes, carryalls, camp chairs, blankets, dog beds, dog bowls, and gear cases under the LoadOut, Panga, Crossroads, Camino, Hondo Base, Trailhead, Lowlands, Boomer, and SideKick Dry brands.

Recommended Stories

Before you consider YETI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YETI wasn't on the list.

While YETI currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.