Ambac Financial Group (NYSE:AMBC - Get Free Report) is set to post its quarterly earnings results after the market closes on Tuesday, November 12th. Analysts expect Ambac Financial Group to post earnings of $0.14 per share for the quarter. Individual that are interested in registering for the company's earnings conference call can do so using this link.

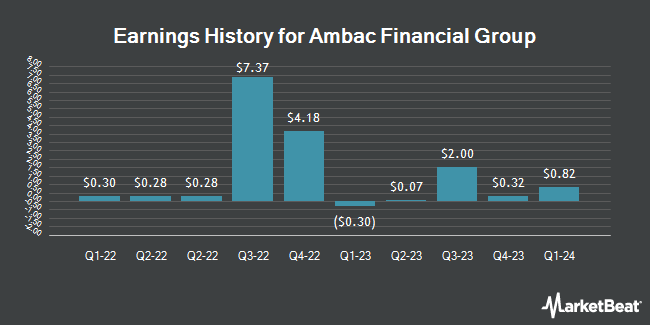

Ambac Financial Group (NYSE:AMBC - Get Free Report) last issued its quarterly earnings results on Monday, August 5th. The company reported $0.18 EPS for the quarter, missing analysts' consensus estimates of $0.19 by ($0.01). The business had revenue of $105.00 million for the quarter. Ambac Financial Group had a return on equity of 10.79% and a net margin of 19.27%. During the same quarter in the prior year, the business earned $0.07 EPS. On average, analysts expect Ambac Financial Group to post $1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Ambac Financial Group Stock Performance

Ambac Financial Group stock traded up $0.04 during mid-day trading on Tuesday, reaching $11.25. 581,705 shares of the company's stock were exchanged, compared to its average volume of 450,120. The business's fifty day simple moving average is $11.31 and its 200 day simple moving average is $12.94. The firm has a market capitalization of $533.70 million, a PE ratio of 7.10 and a beta of 1.22. Ambac Financial Group has a one year low of $10.12 and a one year high of $18.45. The company has a quick ratio of 0.62, a current ratio of 0.62 and a debt-to-equity ratio of 2.37.

Insider Buying and Selling

In other Ambac Financial Group news, Director Kristi Ann Matus bought 2,700 shares of Ambac Financial Group stock in a transaction that occurred on Thursday, September 26th. The stock was acquired at an average cost of $11.27 per share, for a total transaction of $30,429.00. Following the completion of the transaction, the director now directly owns 2,700 shares in the company, valued at $30,429. The purchase was disclosed in a legal filing with the SEC, which is available through this link. In other news, CFO David Trick acquired 3,700 shares of the business's stock in a transaction dated Wednesday, August 7th. The stock was purchased at an average cost of $10.76 per share, for a total transaction of $39,812.00. Following the acquisition, the chief financial officer now owns 156,082 shares of the company's stock, valued at $1,679,442.32. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. Also, Director Kristi Ann Matus acquired 2,700 shares of the business's stock in a transaction dated Thursday, September 26th. The stock was purchased at an average price of $11.27 per share, with a total value of $30,429.00. Following the completion of the acquisition, the director now directly owns 2,700 shares in the company, valued at approximately $30,429. The disclosure for this purchase can be found here. Insiders acquired a total of 37,500 shares of company stock worth $407,445 over the last ninety days. 5.00% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

Several analysts have issued reports on the company. Roth Capital upgraded Ambac Financial Group from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, September 18th. Roth Mkm upgraded Ambac Financial Group from a "neutral" rating to a "buy" rating and lifted their price target for the company from $13.00 to $15.00 in a research report on Wednesday, September 18th. Finally, StockNews.com cut Ambac Financial Group from a "hold" rating to a "sell" rating in a research report on Wednesday, August 14th.

Check Out Our Latest Research Report on Ambac Financial Group

Ambac Financial Group Company Profile

(

Get Free Report)

Ambac Financial Group, Inc operates as a financial services holding company. It operates three businesses: Specialty Property and Casualty Insurance, Insurance Distribution, and Legacy Financial Guarantee (LFG) Insurance. The Specialty Property and Casualty Insurance business provides specialty property and casualty program insurance with a focus commercial and personal liability risks.

Read More

Before you consider Ambac Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambac Financial Group wasn't on the list.

While Ambac Financial Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.