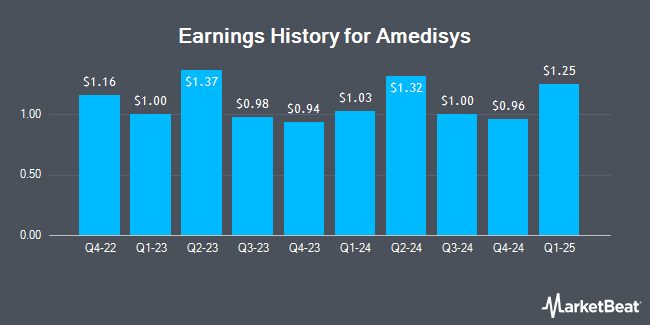

Amedisys (NASDAQ:AMED - Get Free Report) issued its quarterly earnings results on Wednesday. The health services provider reported $1.00 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.19 by ($0.19), Briefing.com reports. Amedisys had a return on equity of 12.39% and a net margin of 4.02%. The company had revenue of $587.67 million for the quarter, compared to analysts' expectations of $586.75 million. During the same quarter in the previous year, the business earned $0.98 EPS. The company's revenue for the quarter was up 5.7% on a year-over-year basis.

Amedisys Stock Performance

NASDAQ AMED traded down $0.93 on Thursday, hitting $96.78. The stock had a trading volume of 274,432 shares, compared to its average volume of 336,962. The company's 50-day moving average is $96.75 and its two-hundred day moving average is $95.77. The stock has a market cap of $3.17 billion, a price-to-earnings ratio of 34.90, a P/E/G ratio of 1.87 and a beta of 0.78. Amedisys has a one year low of $89.55 and a one year high of $98.95. The company has a quick ratio of 1.16, a current ratio of 1.16 and a debt-to-equity ratio of 0.30.

Analysts Set New Price Targets

A number of brokerages have commented on AMED. Deutsche Bank Aktiengesellschaft cut shares of Amedisys from a "buy" rating to a "hold" rating and set a $101.00 target price for the company. in a report on Monday, July 29th. Cantor Fitzgerald restated a "neutral" rating and issued a $101.00 price objective on shares of Amedisys in a research report on Thursday, July 25th. Four analysts have rated the stock with a hold rating and two have given a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $100.67.

Read Our Latest Research Report on Amedisys

Amedisys Company Profile

(

Get Free Report)

Amedisys, Inc, together with its subsidiaries, provides healthcare services in the United States. It operates through three segments: Home Health, Hospice, and High Acuity Care. The Home Health segment offers a range of services in the homes of individuals for the recovery of patients from surgery, chronic disability, or terminal illness, as well as prevents avoidable hospital readmissions through its skilled nurses; nursing services, rehabilitation therapists specialized in physical, speech, and occupational therapy; and social workers and aides for assisting its patients.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amedisys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amedisys wasn't on the list.

While Amedisys currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.