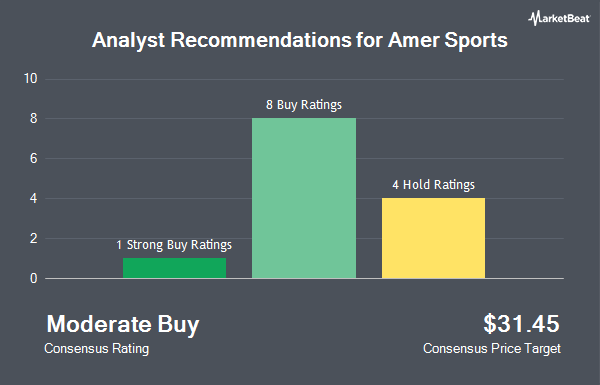

Shares of Amer Sports, Inc. (NYSE:AS - Get Free Report) have been assigned an average recommendation of "Moderate Buy" from the sixteen research firms that are currently covering the firm, MarketBeat.com reports. Five analysts have rated the stock with a hold recommendation, ten have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12 month target price among analysts that have covered the stock in the last year is $25.14.

A number of brokerages recently issued reports on AS. TD Cowen boosted their target price on shares of Amer Sports from $23.00 to $29.00 and gave the stock a "buy" rating in a research report on Monday, December 9th. Morgan Stanley upped their price objective on shares of Amer Sports from $15.00 to $19.00 and gave the company an "equal weight" rating in a research report on Wednesday, November 20th. UBS Group lifted their target price on Amer Sports from $27.00 to $37.00 and gave the stock a "buy" rating in a research report on Tuesday, December 17th. Hsbc Global Res downgraded Amer Sports from a "strong-buy" rating to a "hold" rating in a research report on Monday, December 16th. Finally, Wells Fargo & Company lifted their price objective on Amer Sports from $20.00 to $25.00 and gave the stock an "equal weight" rating in a report on Friday.

Check Out Our Latest Report on Amer Sports

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of AS. BNP Paribas Financial Markets lifted its position in Amer Sports by 734.8% during the 3rd quarter. BNP Paribas Financial Markets now owns 80,760 shares of the company's stock worth $1,288,000 after buying an additional 71,086 shares in the last quarter. Woodson Capital Management LP acquired a new position in shares of Amer Sports during the third quarter worth approximately $12,907,000. Shellback Capital LP grew its stake in shares of Amer Sports by 5.0% during the second quarter. Shellback Capital LP now owns 525,000 shares of the company's stock valued at $6,599,000 after purchasing an additional 25,000 shares during the last quarter. XTX Topco Ltd acquired a new stake in shares of Amer Sports in the third quarter valued at approximately $609,000. Finally, Creative Planning acquired a new position in Amer Sports during the 3rd quarter worth $656,000. 40.25% of the stock is owned by institutional investors and hedge funds.

Amer Sports Stock Performance

NYSE AS traded up $0.68 during trading on Friday, hitting $28.18. The company's stock had a trading volume of 1,871,834 shares, compared to its average volume of 1,930,344. Amer Sports has a 52 week low of $10.11 and a 52 week high of $29.43. The firm has a market cap of $15.40 billion and a P/E ratio of -201.27. The firm has a 50 day moving average price of $22.09 and a 200 day moving average price of $16.57. The company has a quick ratio of 0.77, a current ratio of 1.62 and a debt-to-equity ratio of 0.58.

Amer Sports Company Profile

(

Get Free ReportAmer Sports, Inc designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, China, and the Asia Pacific. It operates through three segments: Technical Apparel, Outdoor Performance, and Ball & Racquet Sports.

Further Reading

Before you consider Amer Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amer Sports wasn't on the list.

While Amer Sports currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.