Amer Sports (NYSE:AS - Free Report) had its price target hoisted by The Goldman Sachs Group from $24.00 to $28.00 in a research report released on Tuesday,Benzinga reports. The Goldman Sachs Group currently has a buy rating on the stock.

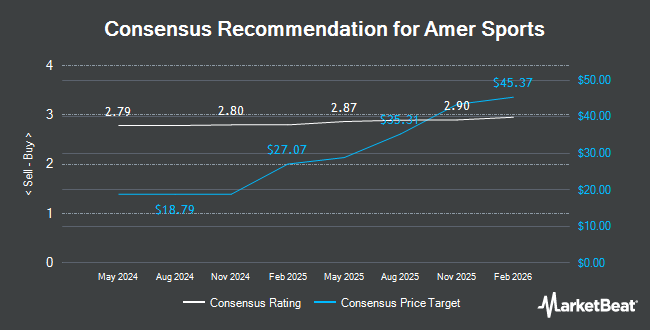

Other equities research analysts have also issued research reports about the company. Robert W. Baird upped their target price on Amer Sports from $24.00 to $30.00 and gave the company an "outperform" rating in a research note on Monday. Morgan Stanley boosted their price objective on shares of Amer Sports from $15.00 to $19.00 and gave the company an "equal weight" rating in a research report on Wednesday, November 20th. JPMorgan Chase & Co. raised their price objective on Amer Sports from $19.00 to $26.00 and gave the stock an "overweight" rating in a report on Wednesday, November 20th. Evercore ISI reissued an "outperform" rating and issued a $26.00 price target (up from $25.00) on shares of Amer Sports in a research note on Wednesday, November 20th. Finally, Wells Fargo & Company increased their price target on shares of Amer Sports from $19.00 to $20.00 and gave the stock an "equal weight" rating in a research note on Wednesday, November 20th. Four equities research analysts have rated the stock with a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Amer Sports has a consensus rating of "Moderate Buy" and a consensus price target of $22.79.

Get Our Latest Analysis on Amer Sports

Amer Sports Stock Performance

AS stock traded down $0.15 during trading on Tuesday, hitting $25.64. The company had a trading volume of 2,893,838 shares, compared to its average volume of 1,893,554. The company has a quick ratio of 0.77, a current ratio of 1.62 and a debt-to-equity ratio of 0.58. The firm has a 50-day moving average price of $20.58 and a 200-day moving average price of $15.87. Amer Sports has a 1-year low of $10.11 and a 1-year high of $26.85. The firm has a market cap of $14.01 billion and a PE ratio of -183.13.

Institutional Investors Weigh In On Amer Sports

A number of institutional investors have recently modified their holdings of the stock. Bank of New York Mellon Corp bought a new stake in Amer Sports in the second quarter worth approximately $3,164,000. Summit Securities Group LLC bought a new position in Amer Sports during the second quarter valued at about $297,000. Sabal Trust CO bought a new stake in shares of Amer Sports during the 2nd quarter worth about $881,000. Rhumbline Advisers acquired a new position in shares of Amer Sports during the 2nd quarter valued at about $1,142,000. Finally, Amalgamated Bank bought a new position in shares of Amer Sports in the 2nd quarter valued at approximately $83,000. Institutional investors and hedge funds own 40.25% of the company's stock.

About Amer Sports

(

Get Free Report)

Amer Sports, Inc designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, China, and the Asia Pacific. It operates through three segments: Technical Apparel, Outdoor Performance, and Ball & Racquet Sports.

See Also

Before you consider Amer Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amer Sports wasn't on the list.

While Amer Sports currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.